Should I Sell My Current Houston House Before I Buy a New One?

Looking To Buy A House In Houston? Read This First

Timing is crucial in any real estate transaction. Choosing between buying a home before selling and selling your old house before buying is challenging. Two scenarios may happen:

If you sell first before buying a new house, you will need temporary housing. Paying for rent is not financially reasonable.

Or if you buy a new house before selling, you end up with two mortgages.

Depending on market conditions, each option has different pros and cons. We'll explain how the market affects your decision, and Shannon Poindexter, a top Realtor with the Houston Properties Team, will provide advice on navigating today's real estate market.

A good Realtor should guide you on where the market is headed and what you need to do; Contact us if you need sound advice regarding your situation.

Related Resources:

- What To Avoid When Selling A Home In Houston?

- What's The Cost Of Living In Houston?

- Neighborhoods In Houston With The Best Land Value Appreciation

"Our experience working with the Houston Properties Team is exceptional. From day one, we felt as though we had a personal team handling the sale of our home. They consistently provided us with reports and advice on how to proceed. All their efforts not only lead to a successful and lucrative close but also eliminated a great deal of the anxiety and pressure.” – Arpita Niranjan

Table of Contents

- Understanding The Houston Market

- Selling Your House First

- Buying Your New House First

- Buy And Sell At The Same Time

- Choose What Best Fits Your Needs

Understanding The Houston Market

"The Houston Properties Team is fantastic!!! I use to live in a townhome community. My neighbor’s home came on the market two weeks before we listed. My home sold and theirs is still sitting on the market (now a month after our closing!) Their marketing program works. I’d highly recommend them to anyone who wants to sell their home.” – Brian Donaldson Shell International Exploration & Production

The current real estate market condition should dictate whether you must sell or buy first. Always consider where the market is now and where the sales trends are headed.

If You're In A Buyer's Market

When inventory exceeds demand, properties often spend more days on the market. This puts pressure on the owner to lower the price or provide concessions to entice a buyer. In such a market, selling your house first is recommended because selling fast may be challenging. This allows you to take your time when buying.

If You're In A Seller's Market

There is little inventory and strong buyer demand, generally accompanied by intense competition. While you're likely to sell your property fast — potentially above asking, with few to no contingencies and a rapid closing — you could have trouble locating the next one. Wait until you've discovered a new house before listing to prevent a second move into a temporary home.

How To Know What Kind Of Market You're In:

Because of COVID-19, the Houston housing market was in a strong seller's market with few inventories and active buyers. People scrambled to look for a large house with more outdoor space as work-from-home options became prevalent. Inventory problems started due to supply chain issues, restricted building supply, and a scarce workforce. Furthermore, historically low mortgage rates enticed purchasers.

Over the last two years, house prices have reached new highs as supplies have lagged behind demand.

The market is gradually shifting in 2022. According to NAR, home prices will rise 5.7% this year due to persistent labor shortages, increased cost of materials, higher mortgages, rising interest rates, and inflation. However, the market should begin to level down before the end of the year.

Shannon stated, "prices have remained stable while inventories and interest rates have risen." According to her, the robust market has resulted in a "shift in communication" between buyers and sellers. "Buyers now have more choices. They're not going to offer more than the asking amount, and they're not going to waive appraisals." Shannon continued.

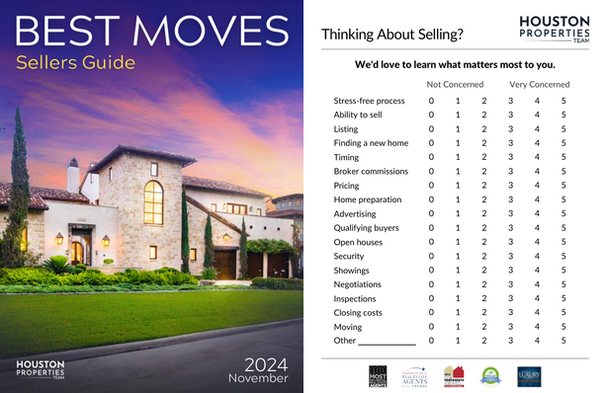

After reviewing the experts' forecasts for the market's direction, consult with trusted and knowledgeable agents. Houston Properties Team, the #1 boutique real estate in Houston, provides a wide array of data covering research about the best Houston neighborhoods, Houston's market trends, the best Houston schools, and the average household income required to live in Houston neighborhoods.

Selling Your House First

"The Houston Properties Team make real estate transactions a lot less complicated for sellers – they take care of everything AND they get the highest prices and the shortest closings. Paige went the extra mile in helping us and has been diligent in giving us reliable and intelligent recommendations. You're the best Paige and congrats on being the #1 Keller Williams agent in the entire state of Texas!" – Kathryn (Google Review)

Review your finances: Are you financially able to buy a new property without selling yours first?

Selling your house first provides certain advantages, such as determining your budget for the new home. But there's a risk that you may need to relocate to a temporary home until you find your dream house.

Pros

- Buying with a budget: You are aware of your finances when buying a new home.

- Financing is simple: You can use the money as a substantial deposit.

- Reduced pressure: You can easily bargain the highest price possible for your present house.

- Benefiting from the market shifts: You could take advantage of a desirable area by selling today. Economist predicts that the Houston housing market will continue to rise in 2022.

Cons

- Living in temporary housing: Rent has risen along with everything else. The rental industry is stronger than the housing market. With little inventory, landlords can set their prices.

- Moving twice: Moving again is costly and tiring, especially if you have to pay for storage.

- Risking the market: Market prices may climb, causing you to pay more for your new house than you planned.

How To Make It Work

Transition via rent back

If your house sells before you're able to find a new one, you can choose a "rent back," also known as a holdover, sale-leaseback, or "possession after closing." wherein you rent your house from the new buyer for a certain length of time, generally no more than 60 days. Their loans will have a 1.25% additional interest rate than a mortgage since their property is now considered an investment. It will enable the seller to refrain from making a second move.

This ideal approach and a "flip" on the more frequent buyer contingency. Shannon adds, "when the market evolves, fewer purchasers are willing to do this since more availability means more possibilities." On the other hand, she continues, "enabling a lease-back might give a buyer an advantage in a competitive market."

In this case, the buyer receives some cash back, and the seller gets the sale money for a new home.

The seller renting it back takes exceptional care of the property because it was their home.

Extend the closing period

The second most popular choice is to prolong the closure period. It will enable the seller to stay in residence for a set time. It is a riskier alternative since the buyer can cancel the agreement while the house is under contract. Shannon points out that the seller also doesn't have any funds from the sale to use toward a new home.

Find temporary housing

Other possibilities for sellers include living with relatives, renting elsewhere, or house-sitting. Maybe they have a vacation property where they can stay temporarily. Shannon suggests looking into short-term rentals.

Buying Your New House First

“Paige and her team are knowledgeable, attentive, responsive, and patient. The HoustonProperties.com team put us into our first dream home, and due to that experience, we’ve returned to them time and again for our real estate needs. While the team’s focus is on completing your deal, their endgame is to ensure your needs are preserved and satisfied.” - Peter McGillivray & Jillian Jopling

It's financially risky to find the right home before selling your current home. Lending institutions may instruct you to make a down payment and pay for two mortgages. A 'bridge loan,' a short-term loan explicitly designed to close the gap between selling one house and buying another, can be available if you have a high credit score and a low debt-to-income ratio. It will help you overcome that daunting debt and avoid the problem of coming up with a down payment. It usually works best in a seller's market, when your house will sell rapidly if adequately priced.

Pros

- Securing the perfect home: The ideal home for you is within your reach.

- Avoiding moving twice: You'll have peace of mind with fewer expenses since you won't rent.

- Having time to make improvements: Buying a new house will give you time to make significant changes, such as an extension or rebuild, or simple changes, like painting.

- Benefiting from market shift: If market values climb, you will make more money on your property sale.

Cons

- Paying two mortgages: It might be financially challenging and lead to stress.

- Taking on high-interest loans: We'll explain these below.

- Feeling pressure to sell: There might be some fear in paying two mortgages, so you'll settle for a lower price to sell quickly.

- Risking the market: If market values decline, you may pay more for your new house than your previous one.

How To Make It Work

Make A Contingent Offer

You can make a contingent offer if you've located your ideal home but can't afford to pay for it until your current property is sold. The contingency offer implies that you will get into a contract on the new house if and when your existing property sells. Keep in mind that sellers do not like this sort of offer. In a seller's market, where competition is high, sellers might reject your bid because they do not want to wait to see whether you can sell your property before purchasing theirs.

Apply For A HELOC

The advantage of having a property is that it may be used as collateral for loans. You can use a House Equity Line of Credit (HELOC) to borrow up to eighty-five percent of the value of your existing property, less the amount you owe to make a down payment and mortgage payments on a new home.

Calculate your loan-to-value ratio to see if you'll qualify before meeting with a lender (LTV). LTV is a percentage rating determined by your property's current worth, mortgage debt, and credit score. Many simple online calculators are available to evaluate your LTV and the amount you're qualified to borrow through a HELOC.

Bridge Loan

Although uncommon, bridge loans can help you fund the purchase of your new house by borrowing against the value of your present property. Because the loans are generally for six to twelve months, they do not fall under the conventional "ability to repay" guidelines.

While approval is primarily dependent on the valuation and equity of your home, you must still have excellent credit and enough earnings to pay two mortgages. Bridge loans are famously expensive, with higher interest rates (rates vary, but anticipate them to be at least 2%-3% more) and additional costs. They are also challenging to get from institutional lenders; therefore, you will likely need to turn to a private lender.

Rent Your Old Home

Once you've stayed in your new home, you can rent out your old one to pay off your mortgage. Shannon notes that not everyone can afford a second mortgage to buy a new property, but this may be a reasonable alternative if you are able.

It's best to consult with an attorney and your insurance broker to ensure that you and your property are covered and to identify all necessary processes and approvals. Furthermore, be upfront with renters about your plans and expectations for viewings and open houses, such as scheduling, who is responsible for cleaning, and if tenants are required to leave.

In Houston, you need at least 24 to 48-hour notice before showings, and it usually takes 30 and 60 days before evicting a tenant. It's essential to consult an attorney to be familiar with Houston's rules and the tenure of your contract.

Note that tenants may inflict significant damage to your home, and being a landlord isn't for everyone.

Short-term Rent

Rather than a long-term rental, you could make your house open for a short-term rental by offering it on Airbnb, Vrbo, or other holiday rental websites. Airbnb hosts in Houston made a whopping $21,763 in annual earnings in 2021. Although, if you leave the neighborhood, this choice gets more complicated. Short-term rental rules are evolving, so verify with your local legislation and attorney before listing.

Buy And Sell At The Same Time

"Every single member of the Houston Properties Team was a delight to work with. They are always available, attentive, and active in the pursuit of the right buyer. Their advice was spot-on and helped us sell our home in just 5 days. Best of all, when it really mattered, they bent over backward to ensure an easy closing. We cannot thank them enough. If you want a smart team with a solid understanding of the market on your side, I recommend you hire the Houston Properties Team – they won't let you down.” – Linda Chang

Preferably, you'd like to time the purchase of your new house with the sale of your current one. Using the same Realtor for both transactions can boost your chances of success by simplifying communication — a huge help when attempting to coordinate schedules or having a contingent sale. You could even negotiate a commission reduction.

Work With A Top Agent

"What distinguishes a good agent is providing an answer for the customer," adds Shannon. That includes more than just pricing. Shannon and the Houston Properties Team have gained business due to our solutions, such as introducing a virtual tour at the peak of COVID-19 that allowed potential purchasers to inspect the home without physically visiting it. "You must research the market and understand what is happening with buyers and sellers," Shannon stated.

Finding someone experienced as both a buyer's and a seller's agent can be challenging. If you want a hassle-free transaction as a buyer and seller, Contact us, and we'll provide in-depth data and insights to assist you with your home buying and selling needs.

Find The Right Lender

Shannon suggests partnering with a local lender since these smaller businesses know the regional market and care more about your loan finishing on time.

"It's fine to evaluate fees and rates to some extent," she adds, "but I would not make that my key deciding point." Shannon completed it by stating, "it's more about completing on time, having a good back office, and having a local underwriter."

Houston Properties Team can refer you to a reputable lender with which we have already transacted.

Choose What Best Fits Your Needs

"The Houston Properties Team under the leadership of Paige Martin is one of the most successful real estate teams in Texas. Paige and her team take the pain out of the real estate experience through hard work, proprietary systems and processes, and a deep understanding of the hyper-local Houston real estate market. She's ranked #5 in Keller Williams worldwide and #1 in Houston with good reason." – Sandy (Google Review)

In a seller's market, selling your house before finding a new one might provide the following benefits:

- Due to little availability and great demand, there's a possibility that you can negotiate for a better price.

- You'll be aware of your budget for a new home.

- You can use the money from selling your current home to acquire a new one.

However, if you can't locate a new house fast, you may have to move again and store your furniture - and get stuck in a short-term rental.

Whatever road you choose, bear in mind that you have alternatives. Your goal is to leave behind a house that no longer meets your requirements to move into one that does.