5 Home Investment Themes Every Homebuyer Must Know by Heart

Take note of this guide that will make you see what properties will give you and your family realizable long-term wealth from the moment you invest in a real estate property in Houston.

While the "average" Houston home has appreciated, there have been areas, neighborhoods & individual properties that have beaten the market by 500% or more.

As we guide our clients in both helping them generate long-term wealth from their investment and living their best life, we wanted to quantify the successes (and failures) from the Houston housing market.

From analyzing 512,056 Houston home sales over two decades, we identified five home characteristics that have a systematic and statistically significant POSITIVE impact on a home's resale value. We will help you see what a good property investment in Houston really is.

We dubbed these the "5 Successful Investment Themes."

Properties with any of these factors on average:

Re-sell for higher values than their peers.

Benefitted from higher demand.

Benefitted from having multiple types of bidding (residents, builders, investors).

Sell faster.

Sell for closer to the list price.

In Part #1 of the series, we identified the 9 Kisses of Death For Resale - Avoid These When Buying a Houston Home.

In this article, we focus on the 5 Successful Houston Real Estate Investment Themes that will help you identify the best neighborhoods to invest in Houston.

From analyzing 512,056 Houston home sales over two decades, we identified five home characteristics that have a systematic and statistically significant POSITIVE impact on a home's resale value. We dubbed these the "5 Successful Investment Themes."

Table of Contents

- Houston Real Estate Has Been A Great Investment

- Success Themes Generated Over 45% 10-Year Appreciation Rates

- Houston Home Sales Comparing Impact Of Resale Benefits And Challenges

- Success Theme #1: Avoid 9 Kisses of Death For Resale

- Success Theme #2: Buy Large Lots (Own Land)

- Success Theme #3: Buy Zoned To Top Ranked Schools

- Success Theme #4: "Buy Ugly" & Renovate

- Success Theme #5: Buy Close To Major Job Centers

- The Best Houston Realtor to Sell Your Home

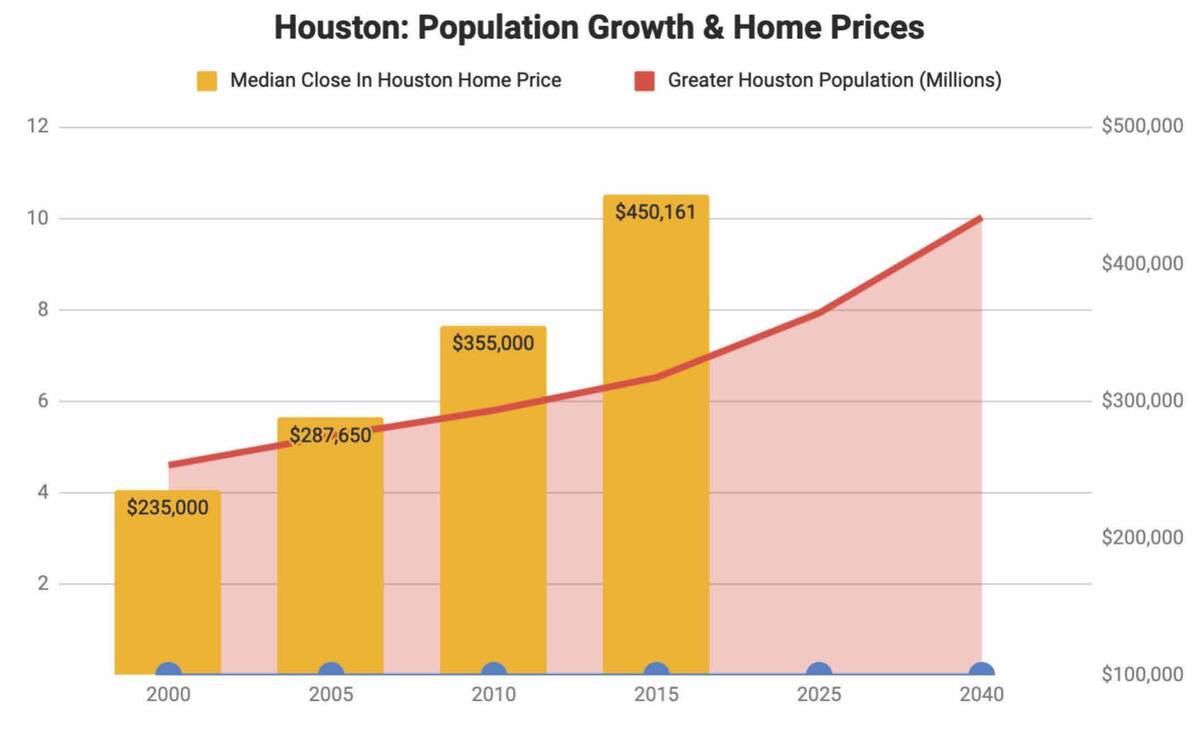

Houston Real Estate Has Been A Great Investment

The #1 predictor of real estate prices is job growth. Houston has created more jobs than any other major US metro area over the last year.

Job growth is the number one factor that drives real estate prices. And in the past few years, Houston has consistently created more jobs than other major U.S. areas.

This past spring, Houston hit its lowest unemployment rate at 3.1%. Most of the job growth is coming from industries like Health Care, Construction, Administrative Support, and Waste Management industries.

A study from Houston MetroNext projects that Greater Houston's population will surpass 10 million by the year 2040, up from roughly 7 million today.

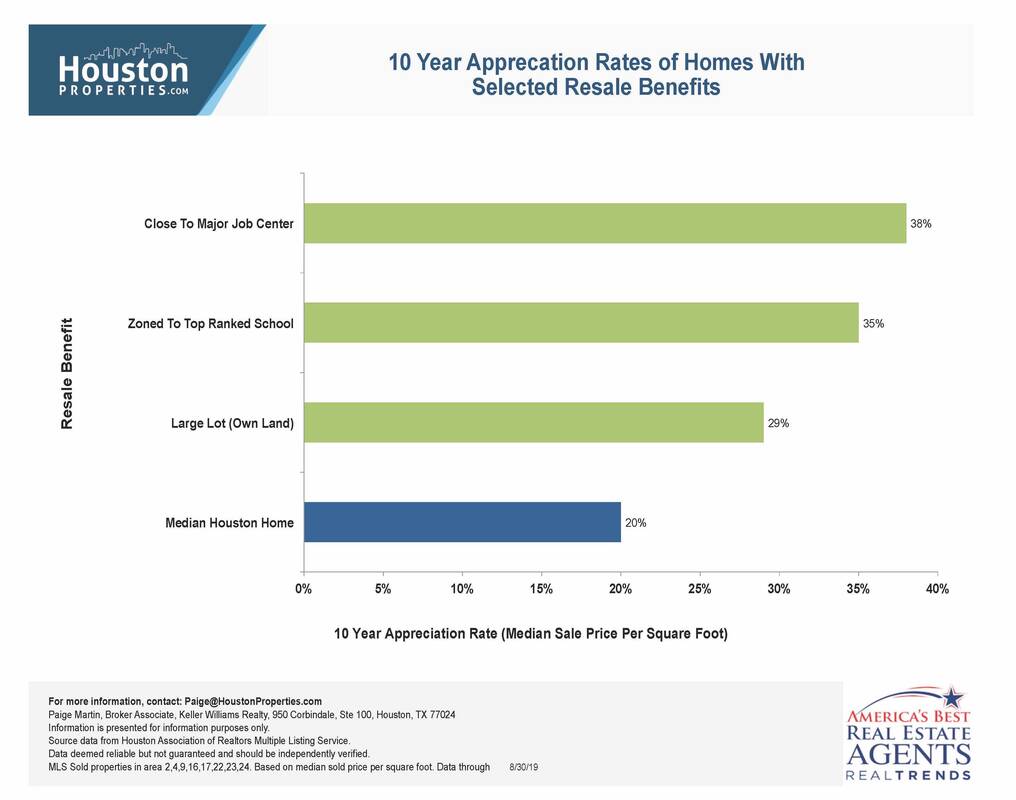

Success Themes Generated Over 45% 10-Year Appreciation Rates

Contact us today for a custom list of properties zoned to top-ranked schools, close to major job centers, and with above-average lot sizes.

Buyers consistently ask us, "How do I make money in Houston real estate?"

The answer is simple:

1) Don't buy a bad house. (Read - 9 Kisses of Death of Resale - How to Avoid Buying a Bad House

2) Buy land in a good location.

From our analysis, a "good location" where to buy real estate in Houston, is primarily defined as:

1) Zoned to top-ranked schools.

2) Close to one of Houston's four major job centers.

As an example of the current Houston residential real estate market, if you bought an average Houston house, your $300,000 investment turned into $360,000 over a 10-year time period.

Since most people finance their home with a 20% down payment (using the values above) their $60,000 down payment turned into $120,000 of equity.

Best Home Investment in Houston

However, as an example of the best home investment in Houston, like those in Houston Heights real estate market, if you bought a home zoned to a top-ranked school (definitions & methodology below), your down payment turned into $165,000 of equity (a 35% improvement).

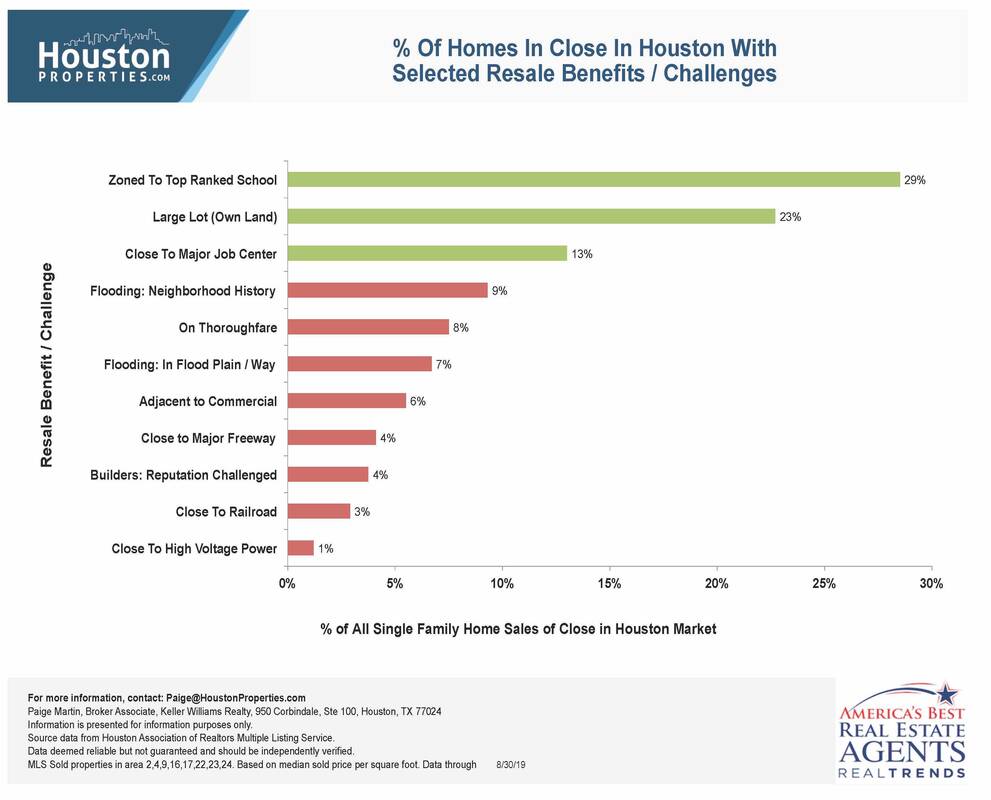

Houston Home Sales Comparing Impact Of Resale Benefits And Challenges

High-quality homes sell in nearly every market. Disadvantaged homes sell more slowly or at larger discounts. The Houston real estate market is hyper-local -- contact us for tips on how to navigate it.

Simply put: not all homes are created equal.

High-quality homes sell in nearly every Houston Texas real estate market. Disadvantaged homes sell more slowly or at larger discounts.

This is anecdotal data, but it supports the Houston real estate market trends we see above: In the aftermath of the 2007/2008 financial crisis, we saw a flight to quality in nearly every asset class—including Houston Cottage Oak real estate.

Several of the key factors that influenced the price and speed that residential investment property Houston sold in the downturn include:

Railways. Homes near railroads tend to sell at larger discounts.

Highways. Homes near highways tend to sell at larger discounts.

On major thoroughfares. Homes on a major thoroughfare tend to sell at larger discounts.

Floor plan. Homes built with a bad or awkward floor plan tend to sell slower or at larger discounts.

Quality of construction. While this can be subjective (or determined by a good inspector during the option period) homes built by “known problematic builders” are sold at material discounts.

These are the same trends we're seeing now, post-Hurricane Harvey. We see no reason for it to change any time soon.

Success Theme #1: Avoid 9 Kisses of Death For Resale

If you're looking to make a good Houston real estate purchase, step #1 - avoid making these 9 mistakes.

From studying 512,056 Houston home sales over two decades, we identified nine home characteristics that have a systematic and statistically significant NEGATIVE impact on a home's resale value.

We dubbed these "the Nine Kisses Of Death for resale" - a.k.a what you should avoid making a good Houston real estate investment.

Properties with any of these factors on average:

Re-sold for lower values than their peers.

Suffered from a smaller buyer pool (some buyers are unwilling to deal with any of these issues).

Stayed on the market longer.

Required a larger discount off the list price to sell.

Created additional costs and/or hassles for residents

Click here to read details on the 9 Kisses of Death of Resale - How to Avoid Buying a Bad House.

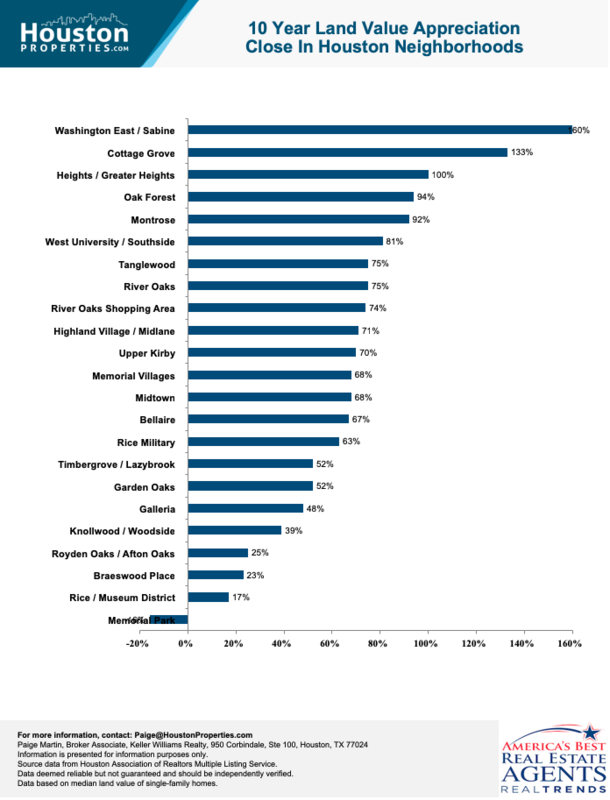

Success Theme #2: Buy Large Lots (Own Land)

Looking at the data, investing in land in Houston has been a very good way to store wealth. Contact us for a list of homes with sizable lots located in areas with strong long-term land value appreciation.

Impact: Appreciated 29% Over 10 Years

Effects: 23% Of the Market

To determine the count of "large lot homes" we used the definition that a lot was 50% larger than the median lot size for the area (e.g. for MLS area 9, the median SFH lot size is 5,000 square feet. To qualify as a "large lot home" the property needed a lot size in excess of 7,500 sq ft)

This highlights the fact that over longer periods of time, home appreciation rates in Houston increase, particularly, land appreciates, and structures depreciate.

Buying a home where the majority of the value of the purchase price "is the land" will likely maximize your long-term returns in residential real estate investing in Houston.

Best Neighborhoods to Invest in Houston

What to know about real estate investing. Click here to learn more about the Best Houston Neighborhoods in Land Value Appreciation.

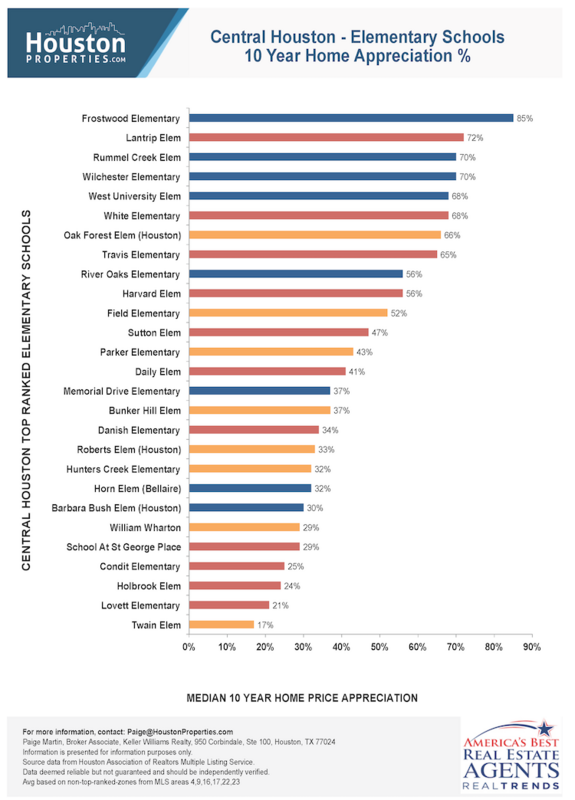

Success Theme #3: Buy Zoned To Top Ranked Schools

We analyzed 641,342 Houston home sales since 2000, zoned to 275 different public elementary, middle & high schools. Contact us for a custom list of homes zoned to specific top-ranked Houston schools.

Impact: Appreciated 35% Over 10 Years

Effects: 29% Of the Market

Definition: Defined as owning a lot that zoned to an elementary school with an 8, 9, or 10 ranking from GreatSchools.

The results show that these homes were, on average:

More expensive

Appreciate at faster rates

Not only did buyers show a willingness to “pay higher” for these areas, but more new construction pushed up median home prices in the area.

Good Property Investment in Houston

Homes zoned to top-ranked schools account for 29% of all single-family home sales of the close-in hottest real estate markets in Houston. The median appreciation in 10 years for these properties has reached 35%, resulting in higher Houston home resale prices.

Click here to see a list of Houston's Best Schools and Its Impact On Home Values.

Success Theme #4: "Buy Ugly" & Renovate

A house on its own is a depreciating asset. Typically it's the lot that determines future value. The lot will maintain its value (or likely appreciate) relative to the house.

Thanks to the popularity of HGTV and shows like Fixer Upper, many buyers are looking for properties that are beautiful, bright, white, airy, and have an open floor plan, whenever they are choosing the best Houston investment properties.

How is the real estate market in Houston Texas? In many cases, these buyers who wonder how to choose the best Houston real estate investment, either cannot see past the home's facade or don't want to invest the time or money to manage contractors and a renovation project.

Disclaimer: The Houston MLS lets us track about 200 different property factors. Three of the factors listed above come directly from the data.

When we reviewed the analysis with our team (the #1 boutique real estate team in Houston with over $500 million of residential property sales), our top-ranked Realtors unanimously mentioned this factor that they felt needed to be on the list but we didn't have a statistically significant method to pull data from the last 20 years.

If you find an old and "ugly" Houston Montrose house or a Houston Southside home, but it is in a prime location, don’t just skip it yet. Think about how to maximize property investment. Imagine what a new coat of paint, a sturdy front fence, and pretty landscaping can do.

A Houston real estate market forecast would now see that ugly duckling turn into a beautiful swan. Your inexpensive renovations can increase a home’s value by tens of thousands of dollars. This has been one of the proven ways how to succeed in real estate investment in Houston.

Buying ugly can give you the following benefits:

Better Deal

Quicker Negotiations

Future Home Valuation

Just make sure you avoid houses with structural issues; major roof, gutter, and window damages; issues with HVAC systems; and termite damage. If you're wondering how to increase your resale value, just steer clear of these structural woes.

Suppose that you have narrowed your choices to two homes that stand side by side in a great neighborhood. One needs repairs and updates but has a huge lot. The other is in tip-top shape but sits on a lot half the size. The prices of the two homes are similar.

Which do you choose? This is one aspect of house hunting that surprises many people. In most cases, the beat-up house is a better investment.

Why? Your house is a depreciating asset. The lot will maintain its value (or likely appreciate) relative to the house. If you bulldozed both houses, the larger lot would sell for more. So, if you can, choose a bigger, better-shaped, or better-situated lot over a nicer house.

The Houston real estate market after Imeldacreated a less attractive house. It can always be updated, added on to, or replaced altogether while the lot can't be changed.

A Houston real estate market analysis shows that location isn't entirely subjective—in fact, it's based on a fairly static set of criteria. So, when you set out to shop for a new home, make sure the neighborhood isn't just desirable to you.

Success Theme #5: Buy Close To Major Job Centers

Houstonians consider Traffic (36%) as the biggest problem facing The Bayou City, outranking Crime (15%), Economy (11%), and Flooding (7%).

Impact: Appreciated 38% Over 10 Years

Effects: 13% Of the Market

Definition:

Located within 15 minutes or less commute to one of Houston's four major job centers: Downtown, Galleria, Medical Center, or Energy Corridor.

Background

The #1 predictor of real estate prices is job growth.

The easiest way to ensure your property is connected to job growth is to be located near the four areas of the city that are growing jobs.

Houston Overview

The Houston metropolitan statistical area (MSA) has a population of approximately 7 million people and is the fifth most populous area in the country.

Houston has historically been among the fastest-growing areas in the US and has been adding about 900,000 people every 7- 10 years. (For illustration, Houston adds the population of Pittsburg every 2-4 years.)

Thanks to the increase in population, combined with limited mass transit and a more "Laissez-faire" government planning policy, traffic is often cited as one of the most common complaints.

A large number of buyers are willing to pay higher land values and home values in the best areas to invest in real estate in Houston to not have to deal with a commute.

Houston Economy

Greater Houston has one of the strongest economies of any region of the US and is home to 21 Fortune 500 companies, ranking fourth among all MSAs.

Our regional GDP is approximately $500 billion dollars per year. If Houston were a country, our economy would be about the same size as Thailand, Austria, or Norway.

Houston has four central job hubs.

Downtown Houston

Downtown is Houston's largest business district. The approximately 2 square mile district is home to nine Fortune 500 corporations, 50 million square feet of office space, and is the workplace of 150,000 employees.

View Downtown Houston Lofts For Sale

The Medical Center

The Texas Medical Center is the largest medical complex in the world. The area also has one of the highest concentrations of clinical facilities for patient care, basic science, and translational research.

View Medical Center Homes For Sale

Galleria

Located west of Loop 610, the Galleria is one of Houston’s main business and retail centers. Vibrant and eclectic, the neighborhood is a bustling mix of offices, posh boutiques, restaurants, and upscale homes.

Energy Corridor

The Energy Corridor is home to corporate or regional headquarters for firms like BP, Citgo, ConocoPhillips, Dow Chemical, ExxonMobil Chemical, and Foster Wheeler. The neighborhood offers a great commute for the 80,000+ individuals working in this area.

View Energy Corridor Homes For Sale

The Best Houston Realtor to Sell Your Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Recent awards include:

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtor in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtor in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, and civic and community boards. She was appointed by the mayor of Houston to be on the Downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent expert in your area

- competitive advantage by simply having more resources, more ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.