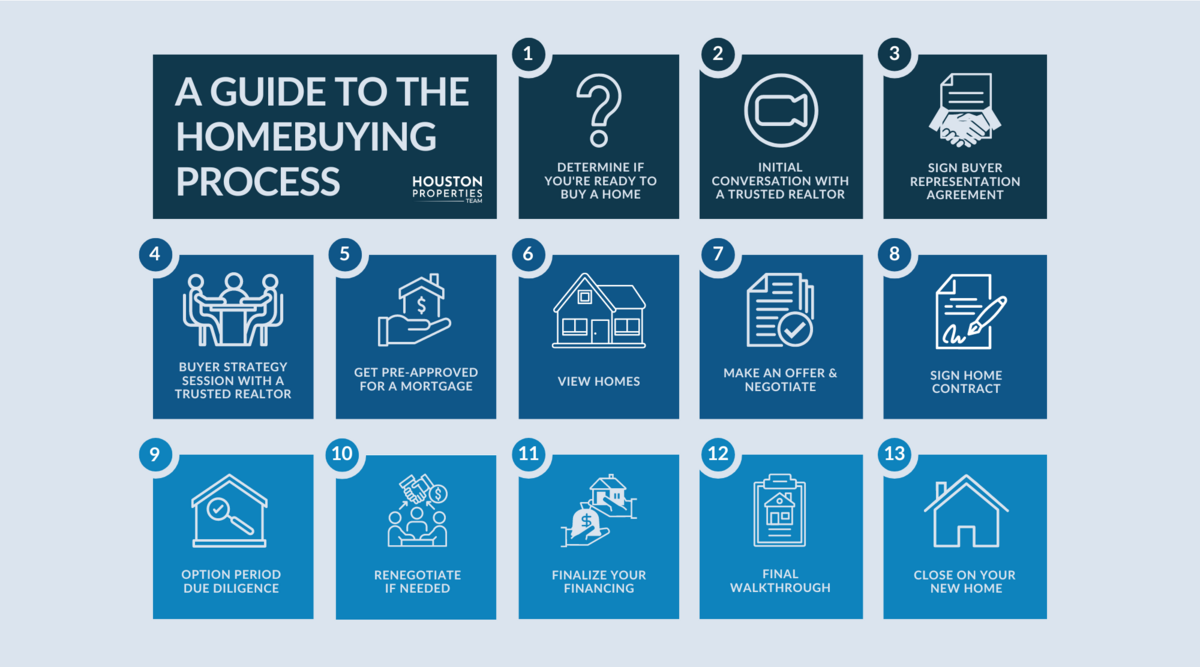

14 Steps to Buying a House: A Guide to the Home Buying Process in Houston

A complete, step-by-step breakdown on how to buy a house in Houston.

As a first-time home buyer, you probably have a lot of questions. In the first place, how do you buy a house? How do you start the home buying process? What are the income requirements to buy a house?

For many people, buying a house can be exceptionally challenging. Only 20% of all buyers reported having no difficulty with the home buying process.

Common challenges among home buyers include finding the right property at 56%, doing the paperwork at 15%, and understanding the process and steps at 13%.

But we want it to be as easy as possible for you, so we put together this guide to buying a home. Here, we'll not only give you a step-by-step breakdown of what happens — we'll also tell you how long is the home buying process, starting from your decision to buy a property up until when you finally get your keys.

Let’s start. Here are the steps to buying a house for the first time together with a home buying process timeline.

If you want to learn more about the home buying process in Houston, contact Paige Martin at [email protected], the #1 Individual Agent with Keller Martin in Houston and ranked #9 in the United States.

Table of Contents

- Decide if you’re ready to buy a home

- Check your credit score

- Estimate your budget

- Research first-time home buyer programs, loans, and grants

- Find a trusted real estate agent

- Find a mortgage broker and research your mortgage options

- Get pre-approved for a mortgage

- View homes

- Make an offer and negotiate

- Prepare the contract

- Get a home inspection, home appraisal, and title search

- Finalize your financing

- Do a final walkthrough and close on your new home

- FAQ

- The Best Houston Realtor to Help You Buy a Home

Decide if you’re ready to buy a home

My husband and I had Courtney as our realtor and we just bought our first home with her. She was awesome, made it really clear what the process would be like, made time for phone calls and house viewings almost every weekend if we needed. Once in the option and closing periods she made it very easy to keep on top of everything and was always available when we needed to ask questions. I would highly recommend working with Courtney and the Houston Properties Team. - Lucy Andrew

Timeline: 6 months to 1 year in advance

One of the first steps to buying a house in Houston is determining if you’re ready to buy in the first place. Homeownership is a significant financial and lifestyle choice that can greatly impact your future, and you need to think carefully if that’s what you really want, at least in the next four years (since that’s normally the length of time it takes to break even on your home purchase).

Is there a chance that you’ll be moving before the four years are up, whether it’s for a job, family matters, or a new relationship? Then maybe you’ll be better off renting instead.

Renting offers greater flexibility, making it an attractive choice for people who frequently relocate or have uncertain living arrangements due to work or personal reasons. You can easily move out at the end of your lease without the hassle of selling a property.

If, on the other hand, you crave stability and a sense of belonging to a community then homeownership might indeed be right for you. You’ll have the freedom to personalize and invest in your property, creating a long-term home for yourself and your family.

However, your readiness to buy a home isn’t solely based on your commitment to staying put in the same place for several years. It’s also about the responsibilities that come with homeownership, and whether you’d be willing to take them on.

Unlike renting, you alone will be responsible for the maintenance, repairs, and upkeep of the property. A study by home services website Angi said that homeowners spent an average of $2,467 on home maintenance in 2022, while property insurance firm Hippo put the number at nearly $6,000. Are you prepared to spend that much money on your maintenance alone?

You must also evaluate whether you’re financially ready to be a homeowner. We’ll go into more details on that later, but there are certain requirements that lenders look for, and that you should consider before you run headlong into the home buying process in Houston.

So, what are the requirements to buy a house for the first time?

- A credit score of at least 620

- Downpayment of 3% to 20% of the home’s purchase price

- Stable income and employment history

- Debt-to-income (DTI) ratio that’s 43% or lower

Buying a house for the first time is an exciting milestone in one's life. However, it also involves fulfilling these requirements so that the home buying process goes as smoothly as possible.

Let’s look at the next steps of the process in this home buying guide in Houston.

Check your credit score

I highly recommend the Houston Properties team for anyone in need of a knowledgeable and professional realtor in the Houston area. The team at Houston Properties is dedicated to finding their clients the perfect home or property, and they go above and beyond to ensure a smooth and successful transaction. With their extensive knowledge of the Houston real estate market and their commitment to excellent customer service, the Houston Properties team is the go-to choice for anyone looking to buy or sell a home in the Houston area. - Jesse Manley

Timeline: 3 to 6 months

Your credit score is a crucial factor when it comes to buying a house. It’s a numerical representation of your creditworthiness and financial history, which lenders use to assess the risk of lending you money for a mortgage.

“Not understanding your credit score and its implications is one of the first-time home buyer mistakes, since your credit health directly impacts your ability to secure a mortgage and the terms you'll be offered,” observes Courtney Williams, an award-winning and top-producing Realtor with the Houston Properties Team.

Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Generally, they are categorized as follows:

- Excellent: 800 - 850

- Very Good: 740 - 799

- Good: 670 - 739

- Fair: 580 - 669

- Poor: 300 - 579

A higher credit score significantly increases your chances of mortgage approval. “Lenders view borrowers with good credit scores as less risky, making them more likely to offer you favorable loan terms and lower interest rates,” says Courtney.

On the other hand, a lower credit score may limit your mortgage options or require you to pay higher interest rates to compensate for the perceived risk.

You can repair a low credit score though, either by checking for errors and filing a dispute or by trying to get accurate negative information removed. On average, it takes about 3 to 6 months for your credit to be repaired.

In terms of downpayment, while your credit score is not the sole factor in determining the down payment amount, it can influence the lender's requirements. A higher credit score may allow you to qualify for a lower down payment, such as 3% to 5% of the home's purchase price.

Different mortgage programs also have varying credit score requirements. For example, government-backed loans, such as FHA loans, may be more lenient with credit score criteria, making them accessible to borrowers with fair or good credit. Conventional loans, however, usually have stricter credit score requirements.

Estimate your budget

Being a first time buyer is scary and no matter how much we prepared it still felt like it wasn’t enough. Holly was so kind, patient and helpful every step of the way. She knew our budget and never showed us a house over it. She helped us find a lender, gave us references for people who could get us quotes for repairs/remodels and walked us through everything. Literally anything we needed she helped us with. It was such a smooth process even with the buyer in a different country. - Carissa Drury

Timeline: 1+ days

Now that you understand the significance of your credit score in the home buying process, the next step is to estimate your budget. This will help you determine how much money do you need to buy a house for the first time. Here's how to do it:

First, calculate your total monthly income. This includes your salary, bonuses, commissions, and any other sources of income.

If you have a steady paycheck, this calculation is relatively straightforward. However, if your income fluctuates or includes irregular payments, consider averaging your earnings over the past several months.

Next, create a comprehensive list of your current monthly expenses. Include everything from rent, utilities, groceries, transportation, student loans, credit card payments, and any other outstanding debts.

Then, subtract your total monthly expenses from your total monthly income. This will give you a clear understanding of your disposable income — the amount of money available to you that you can allocate toward housing costs.

Once you have calculated your disposable income, assess how much you’re willing to allocate toward your monthly mortgage payment. A general rule of thumb is to spend no more than 28% of your gross monthly income on your mortgage. So if you’re earning $7,500 a month before taxes, then you should keep your monthly mortgage payments under $2,100.

Keep in mind that this is a general guideline, and your specific financial situation and personal preferences should ultimately dictate your housing budget.

Also, when estimating your budget for buying a house, it's important to consider additional costs like include property taxes, homeowner's insurance, and ongoing maintenance.

To simplify the budgeting process, you can use online tools such as a Buying a House Calculator. These calculators allow you to input your income, expenses, and other financial details to get a clearer picture of how much you can afford to spend on a home.

Research first-time home buyer programs, loans, and grants

Paige helped me navigate a dynamic seller's market to successfully purchase my first home. She is an expert in Houston real estate, extremely responsive, and well regarded among her peers. She was there every step of the way, and took the time to explain the process and answer my questions. She's not afraid to give you straight answers and keep you grounded in the process, most importantly making sure I didn't overpay for the property. Paige worked until midnight to submit my bid the first day the house was on the market in a multiple offer situation. She far exceeded my expectations - I'd highly recommend her to anyone looking to buy or sell a home. - Rachel White

Timeline: 1+ days

“If you’re a first-time home buyer, there are various first-time home buyer programs, loans, and grants that can help you achieve your dreams of homeownership,” Paige Martin, founder and team lead of the Houston Properties Team, advises.

Also, if you’re wondering how to buy a house with no money or how to buy a house with low income, then these options might be worth researching in more detail.

There are downpayment assistance programs, which are grants or loans that have low interest rates or no interest at all, and many are exclusive to first-time home buyers.

In Texas, for example, the Texas State Affordable Housing Corporation (TSAHC) can “provide you with a mortgage loan and funding to use for your down payment. You can choose to receive the down payment assistance as a grant (which does not have to be repaid) or a deferred forgivable second lien loan (which only has to be repaid if you sell or refinance within three years).”

TSAHC also states that if you’re a first-time home buyer in Texas then you might also be eligible for a Mortgage Credit Certificate (MCC) which is essentially a tax credit for low-income borrowers. You can take the Eligibility Quiz on TSAHC’s website to know whether you qualify for an MCC.

Then there are government-backed loans like FHA loans, USDA loans, and VA loans that can help you buy a house even if you have poor credit or you can only afford a low downpayment.

You might be wondering as well about the first-time home buyers $7,500 government grant that was part of the Housing and Economic Recovery Act of 2008. Unfortunately, that has already ended in 2010.

However, there are other first-time home buyer grants that are available to you, which include:

- The Good Neighbor Next Door program offered by the Department of Housing and Urban Development (HUD), which gives a whopping 50% discount off select HUD properties

- The HomePath Ready Buyer Program that allows you to buy a foreclosed property with just a 3% downpayment, and helps you with closing costs as well

- The National Homebuyers Fund that sponsors downpayment and closing costs of up to 5% of your home’s purchase price (this is not limited to first-time home buyers)

- The Chase Homebuyer Grant that provides grants of $2,500 or $5,000 to lower interest rates and that can be used as well for fees associated with mortgage or downpayment costs

- Bank of America’s America’s Home Grant, which provides up to $7,500 in lender credits for closing costs

- Bank of America’s Down Payment Grant, which provides up to $10,000 in downpayment help

Find a trusted real estate agent

Lisa was the absolute best realtor we could have asked for! Moving and buying a home can be stressful enough, let alone from 2,000 miles away. Lisa helped answer our questions every step of the way, and most important, was extremely knowledgeable about current market trends, pricing, etc. I am so thankful to have had Lisa as our realtor in helping us buy our first home! She also continues to even follow up and help us with any questions we have post close, which we are so thankful for. I cannot recommend her enough! - Jason Roberts

Timeline: 1-2 weeks

One of the things you need to buy a house for the first time is a trusted real agent. “Finding one is essential because a reliable and experienced agent will not only guide you on how to go about buying a house, they will also help you navigate the complexities of the real estate market and make the home buying experience less daunting for you,” Paige acknowledges.

In fact, 86% of all buyers purchased their home through an agent. When choosing an agent to work with, working with an experienced agent was the most important factor for buyers, followed by one who is honest and trustworthy, according to the National Association of Realtors.

You can start your search for one by seeking recommendations from people you trust, such as friends, family members, or colleagues who have recently purchased a home. Personal referrals often provide valuable insights into an agent’s professionalism, communication style, and ability to meet clients' needs.

It will also be in your best interests to look for an agent who specializes in the local market. Real estate is highly localized, and market dynamics can vary significantly from one neighborhood to another. It's essential to find an agent who specializes in the area where you plan to buy a home.

If you’re buying a property in Houston, for example, the Houston Properties Team has in-depth knowledge of Houston’s housing market, property values, school districts, and community amenities, and we can provide you with valuable information so you can make informed decisions.

We will also guide you throughout the entire process of home buying and ensure that we cover all the necessary steps and complete all the required documents for a seamless purchase.

This is why we were able to close over $1 billion real estate sales in the last few years — people come to us because we are experts at what we do.

We also care more. We advocate for you and make sure that you find the right home for your needs, avoid any future issues, and get the best deals in your transactions.

But don’t just take our word for it. See what hundreds of our clients are saying about our team of top Houston Realtors and the level of service we provide.

Find a mortgage broker and research your mortgage options

I highly recommend Courtney from the Houston Properties Team. Her knowledge of the market and her exceptional service were key in making the home-buying process smooth and stress-free. My wife and I are new to the Houston area and buying a home during a very low inventory period for houses looked difficult. Fortunately, Courtney was fantastic during our home buying experience - providing lists of must-see locations for areas such as EaDo, the Heights, Rice Military, Oak Forest and our eventual new home neighborhood Spring Branch. Courtney was persistently available; willing to quickly hop on a calls, providing comprehensive information booklets compiled by the Houston Properties Team about the current and future value of the homes we toured. Best of all, after a couple of home tours, Courtney really locked into the style of home in the neighborhood we wanted quickly and was ready once the right home was available for us to get the right place! We are so happy with our new home! We even got to meet the more of the Houston Properties Team when we went to our first Astros Game downtown! - Jonathan Siler

Timeline: 1-2 weeks

A mortgage broker is a licensed financial professional who acts as an intermediary between you (the borrower) and lenders during the process of getting a home loan. How do they do this? They’ll compare mortgage products from various lenders and guide you through the application and approval process. They’ll also work to secure the best terms and rates for you.

The first step to finding the best broker for you is to research the ones in your area. You may ask for recommendations from friends, family, or your real estate agent, or you can conduct searches online.

Your real estate agent in particular can be a valuable resource for finding a reputable mortgage broker. The Houston Properties Team, for example, has established relationships with trusted brokers and we can provide you with recommendations based on our past experiences.

Once you have a list of potential brokers, you'll want to interview them to assess their expertise, communication style, and understanding of your financial goals. Ask them about their experience with first-time home buyers, the loan products that they offer, and their fees.

Together with your mortgage broker, the next thing you need to do is decide on the best type of loan for you.

Conventional Loans

These loans are the most common type of mortgage, with 62% of all buyers using them to finance their homes. It’s a popular option because of low downpayments (you can get one for as little as 3% downpayment) but you have to take note that if you don't put down 20% or more, the lender will require you to pay private mortgage insurance (PMI).

These types of loans are not backed by the federal government but by private mortgage lenders like banks and credit unions. It must also conform to the limits set by the Federal Housing Finance Agency (FHFA), but there are jumbo conventional loans that exceed these limits.

FHA Loans

Unlike conventional loans, they are backed by the government, specifically by the Federal Housing Administration (FHA). It means the government protects lenders against defaults on payments, making it easier for these loans to have low credit score requirements (500 if you have a 10% down payment, or 580 if you have a 3.5% down payment).

Downpayments can be as low as 3.5%, but they require borrowers to pay PMI in addition to the monthly payment.

VA Loans

These loans are available through the Department of Veterans Affairs for service members, veterans, reservists or National Guard members, and surviving spouses.

If you’re one of them, you can purchase a home with a competitive interest rate and no downpayment and PMI. Not only that, but closing costs are also limited and can be paid by the seller, plus there is no prepayment penalty if you pay off the loan early.

USDA Loans

These loans are guaranteed by the USDA Rural Development Guaranteed Housing Loan Program, a part of the Department of Agriculture, and help low- to moderate-income home buyers purchase homes in rural and suburban areas.

They have lower rates than conventional loans, don’t require borrowers to pay for PMI, and can be gotten for zero downpayment, but you’ll have to meet certain requirements first.

Get pre-approved for a mortgage

Paige Martin and her Houston Properties Team make real estate transactions a lot less complicated for her clients - they take care of everything. She went the extra mile in helping us and has been diligent in giving us reliable and intelligent recommendations. You're the best Paige and congrats on being the #1 Keller Williams agent in the entire state of Texas! - Kathryn Ruff

Timeline: 3-10 days

Once you have found a reputable mortgage broker, the next step is to get pre-approved for a mortgage, which is necessary in the process of buying a house. A pre-approval provides you with an estimate of what you can borrow and how much you can afford.

“It also strengthens your position as a serious buyer when you finally make an offer on a property,” she continues.

The pre-approval process takes 7-10 days on average, although it can be as short as 3 business days if you already have all the documentation that the lender requires. Common documents include:

- Government-issued photo ID

- Social security card

- Pay stubs

- Employment history and contact information of employers

- W-2s and tax returns

- Bank statements

- Statements of investment accounts and other financial assets

- Gift letters

- List of monthly debts like rent or mortgage, car loans, student loans, credit cards, etc.

- Credit report

- Retail information and landlord references

After gathering the required documents, the lender will review your financial information, credit history, and debt-to-income ratio to assess your eligibility for a mortgage and determine the amount you may qualify for.

Then, after the lender completes their evaluation, you will receive a pre-approval letter indicating the maximum amount you are approved to borrow.

“This pre-approval letter is a valuable asset when making an offer on a home, as it shows sellers that you are a serious and qualified buyer,” Lisa reminds us. “Sellers are more likely to consider offers from pre-approved buyers as they have already demonstrated their financial ability to secure financing for the purchase.”

Keep in mind that a mortgage pre-approval is not a guarantee of a loan, and it is based on the information provided at the time of the application. Thus, it's essential to keep your financial situation stable and avoid making significant changes to your credit or financial status during the home buying process.

Knowing how to get pre-approved for a mortgage is an important step when learning how to buy a house for the first time. It provides you with a clear budget, enhances your bargaining power, and sets you on a solid path toward homeownership.

View homes

My husband and I worked with Lisa, and we had a great experience finding our first time home, which we love. Lisa really took interest in getting to know us as a couple and what we were looking for in a home. She was honest about the pros and cons of each home we toured or had interest in. We even had to put our search on hold as my husband was supposed to relocate out of Houston for work. It took over a year for us to find a home, and during the whole time, Lisa was available for us, patient, and we did not ever feel pressured to buy. Lisa provided us with objective data and her expert opinion during the process. She also helped us with negotiations. It was as stress free as a big purchase could be! Highly recommend the team and Lisa in particular. - Monica Aceve

Timeline: 12+ weeks

With your mortgage pre-approval in hand, it's time to begin the next and most exciting phase of the home buying process — home viewings!

Knowing how to buy a house in Houston means knowing how to explore different neighborhoods, assess properties that align with your budget, and ultimately find your dream home.

But wait — before you go house shopping, you have to clarify your priorities and preferences for your future home first. Create a list of must-haves, such as the number of bedrooms and bathrooms, specific features like a backyard or a garage, and any other non-negotiable elements you want in your home.

Having a clear list will help you and your realtor narrow down potential properties that meet your criteria, which will save you time and will help you focus your search on homes that best suit your needs.

Once you have this list, you can now schedule viewings of homes that match your criteria. If you’re buying in Houston, our team’s knowledge of the best neighborhoods in Houston to buy a house is invaluable in finding areas that fit your specific lifestyle, budget, and preferences.

Now, as you visit properties, consider factors such as proximity to schools, your workplace, and amenities such as parks and shopping centers. Take note as well of the safety and ambiance of the neighborhoods you’re looking at.

You should also take detailed notes and pictures to help you remember the unique features of each property. These notes will be valuable when you are comparing homes later on.

Most importantly, pay special attention to the condition of the property, any necessary repairs or renovations, and whether the layout of the house meets your needs.

As you view different houses, be patient and keep in mind that finding the perfect home may take time. It may take you 8 weeks on average, but it can be as short as 1 week or as long as 4 months.

Make an offer and negotiate

The first time we met with Paige Martin, we immediately knew we were working with the best. They really took the pain out of the real estate experience by guiding us throughout the process. The thought of negotiations used to be so stressful, but with Paige and the Houston Properties Team, I know that my interests were well-represented. If you want a client-first real estate agent who works far beyond what is expected of them, this is your team! - Peg M.

Timeline: 2-5 days

After carefully viewing homes and finding the one that you like the most, it's time to make an offer.

But before you do, you need to conduct some market research first. If you’re in Houston, you need to know how much is a house in Houston and you need to understand the current real estate trends in the area.

Here at Houston Properties, we pull a comparable analysis for our clients to make sure you’re paying a fair and competitive price for the home you’re interested in.

“After that, we’ll help you craft an offer that reflects what the property is worth,” she continues, “while being mindful of your budget and the maximum amount you are willing to pay.”

Now, once you submit the offer, the negotiation process will start. Three things can happen here. The seller can either:

- Accept the offer - Congratulations! This means you can move on to the next step, which is to sign the contract and pay your earnest money deposit.

- Reject the offer - If this happens, you can either submit another offer or move on to another property.

- Submit a counteroffer - The seller can change the terms of the sale or even the purchase price of the home. If this is the case, you can accept the counteroffer, submit one of your own, or even outrightly reject it.

Your real estate agent’s negotiation skills will be instrumental in securing a favorable deal for you at this stage. They will work on your behalf to help you find common ground with the seller and advocate for your best interests.

It’s important that you communicate clearly and openly with your agent throughout this entire process. Ask them to keep you informed about any updates, counteroffers, or changes to the deal. Rely on their experience to navigate any challenges that may arise, and leverage their knowledge of the local market to help you make informed decisions.

Prepare the contract

Shannon Poindexter was fantastic! The first time we met her she said we would buy one of the first five homes we saw with her because the Houston Properties Team buyer program was so strong. I had my doubts and thought she was kidding, but she was right. Shannon and her team did a great job vetting homes, avoiding problems and helping us definite what we wanted and we bought the 3rd home. She saved us a lot of time and effort, and we couldn't be happier with the results! - Sarah Becker

Timeline: 1-3 days

Once you and the seller have reached an agreement, it’s time to prepare the contract. It’s a detailed document that outlines the terms and conditions of the home purchase, including the purchase price you and the seller have agreed upon, contingencies, closing date, and other crucial details.

After the contract is signed the option period begins, which is the number of days that you can get out of the contract for any reason. You may have changed your mind about the house, or you discovered any red flags or major issues during the home inspection. Whatever it is, you have the first 10 days to terminate the contract and walk away from the deal.

There’s also the matter of the earnest money that you will need to pay three days after signing the contract. It’s a deposit that demonstrates your intention to proceed with the purchase of the home and is typically held in an escrow account until the closing.

Now, during the period leading up to the closing, it’s important to stay informed about the contract deadlines and contingencies. For example, if the contract includes a home inspection contingency, you need to be aware of the timeframe within which you can request repairs or negotiate with the seller based on the inspection results.

If all contingencies are met, and the deal proceeds as planned, the earnest money will be applied towards your down payment and closing costs. In the event that the contract falls through due to a valid contingency, the earnest money is typically returned to you.

Get a home inspection, home appraisal, and title search

Paige Martin is Houston's best realtor. Buying a home can be a nightmare for first-time buyers. Paige and her team made everything simple, they guided us every step of the way. We will definitely hire her again. - Tonda Grist

Timeline: 1-2 weeks

A home inspection is a critical step in the process of buying a home since it’s a professional evaluation of the condition and overall state of the property you’re buying. It’s conducted by a certified home inspector, and its purpose is to provide you with an objective and comprehensive report on the home’s condition before you buy it.

During an inspection, the home inspector will take a look at the interior and exterior of the property. According to the American Society of Home Inspectors (ASHI), this is the complete list of what they evaluate:

- Heating system

- Central air conditioning system (temperature permitting)

- Interior plumbing and electrical systems

- Roof and rain gutters

- Attic, including visible insulation

- Walls

- Ceilings

- Floors

- Windows and doors

- Foundation

- Basement

- Structural components

After the inspection is completed, the inspector will provide you with a detailed report, often including photographs, outlining their findings. The inspection itself usually takes only a few hours, while the report may take a day to arrive (although you as the buyer are normally given 5-15 business days to complete the inspection).

A home appraisal, on the other hand, is used to determine if you’re paying a fair price for the home. Unlike an inspection which focuses on the condition of the property, the appraisal is focused on the property's value and is often required by the lender to determine the loan amount.

The key aspects of a home appraisal include:

- Fair market value

- Property assessment

- Comparable sales

- Neighborhood analysis

The onsite appraisal generally takes 30 minutes to a few hours, while the appraisal report itself may take 1 to 2 weeks.

Lastly, a title search, which can take 1-2 weeks, is a critical process that involves investigating the historical records and public documents related to the property to determine its ownership history and verify if there are any claims, liens, or encumbrances that could affect its title.

Its purpose is to establish a clear and marketable title, to ensure that the seller has legal ownership of the property and can transfer that ownership to you without any unforeseen issues.

During a title search, the title company or real estate attorney will conduct a comprehensive examination of public records, which may include:

Reviewing the chain of ownership, starting from the property's original grant or patent, to ensure a proper transfer of title from one owner to the next (deeds and conveyances)

Checking for any outstanding liens, mortgages, judgments, or other encumbrances that could affect the property's title (liens and encumbrances)

Identifying any easements or restrictions on the property that may impact its use or development (easements and restrictions)

Verifying the status of property taxes, assessments, and any other outstanding financial obligations related to the property (taxes and assessments)

Searching for any lawsuits or legal actions that may affect the property's title (court records)

Finalize your financing

Kim is great! As first time home buyers, she was able to make the process smooth and stress free. She was very knowledgeable and answered all of our questions quickly. She gave good information on the various Houston neighborhoods and aspects about properties that make them good investments. Kim would definitely be our realtor of choice for any house we purchase! - Sarah Byrnes

Timeline: 21 days

Before you close on your new home, you need to finalize your loan first. “Maintaining open communication with your mortgage broker and lender is crucial during this stage,” says Kim Vargas, a top-producing Houston Realtor and a senior partner on the Houston Properties Team.

“Stay in touch with them to address any last-minute questions that they may have and to ensure that the loan process is progressing as expected,” she advises.

During all this, the lender may also request additional documents to verify your financial standing and eligibility for the loan. These documents may include recent pay stubs, bank statements, tax returns, and other financial information. Be prompt in providing the requested documents to avoid delays in the loan approval process.

Remember to maintain financial discipline during this phase. “Avoid making significant financial changes, such as taking on new debt, making large purchases, or changing jobs, as these actions can affect your loan approval,” Kim warns. Keep your credit in good standing by paying bills on time and avoiding excessive credit card use.

Also, review your credit reports regularly and most importantly, dispute any errors or inaccuracies. This is because a strong credit score can lead to more favorable loan terms and interest rates for you.

At least three business days before you close on your mortgage loan you'll receive a Closing Disclosure (CD) from the lender. It’s a form that details the loan terms, your monthly mortgage payments, and how much you will pay in closing costs (usually fees processing the loan, title search, title insurance, appraisal, and other related expenses). It’s important that you review the CD carefully and coordinate with your financial institution to ensure you have the necessary funds available for closing.

On the day of the closing, make sure to have your funds ready in the form of a certified check or wire transfer to cover the closing costs. Your lender or closing agent will provide instructions on how to handle the payment.

Do a final walkthrough and close on your new home

Great service. Paige and team led me efficiently through a search, offer, inspection, close and has follow-up with helpful advice and info. I appreciate this much. I highly recommend Houston Properties! - Michael Scott

Timeline: 1-2 days

The final walkthrough normally takes place a day or two before — or even the day of — the closing date. It’s your opportunity to physically inspect the property one last time to ensure that it meets your expectations. Take your time during this inspection and pay close attention to every detail. Here’s what to look out for during your final walk:

Exterior

- Check the exterior of the house for any visible damage to the siding, roof, or foundation.

- Inspect the landscaping and yard for any changes or damage.

- Verify that all outdoor fixtures, such as lights and doorbells, are functioning properly.

Interior

- Test all light fixtures, switches, and outlets to ensure they are working.

- Open and close all doors and windows to check for proper operation.

- Inspect the walls, ceilings, and floors for any new damage or changes since your last visit.

- Check for leaks or water damage around sinks, toilets, and showers.

- Ensure that all appliances included in the sale are in working order.

Safety Features

- Test smoke detectors and carbon monoxide detectors to ensure they are operational.

- Verify that any safety railings on stairs or balconies are secure.

Repairs and Agreements

- Ensure that any repairs or agreed-upon changes have been completed as per the contract.

- Check for any items the seller agreed to leave behind, such as fixtures or appliances.

Once everything is set, it's time to close on your new home. Now, the closing normally takes place at the office of a title company, escrow agent, or real estate attorney. During this meeting, you’ll review and sign various documents related to the home purchase. You will also need to pay the remaining balance due on the home, which includes the down payment and closing costs. Your lender will provide a detailed breakdown of these costs beforehand, so you can come prepared with the necessary funds.

You may have the option to wire the funds to the closing agent or bring a certified check to cover the closing costs. You need to ensure that you have the correct amount and that you’re prepared to pay any additional fees or adjustments as needed.

Once all the documents are signed and the funds have been disbursed, you'll receive the keys to your new home, and the property is officially yours! Take a moment to celebrate this significant milestone in your life and savor the joy of homeownership.

FAQ

I recommend Paige Martin and the Houston Properties Team to anyone looking for an honest, smart, and patient representation. Paige has a stellar reputation as one of the best real estate agents in Houston - I often see her being interviewed and featured by publications like Wall Street Journal, HBJ, and the Chronicle. We look forward to working with them again! - Malia Mejia

What is the hardest step of buying a house?

The hardest step of buying a house is often finding the right property that meets all the buyer's requirements, fits within their budget, and is located in a desirable neighborhood. This step requires careful consideration, research, and patience to find the perfect home that aligns with the buyer's needs and preferences.

What are the three Cs of home buying?

The three Cs of home buying are Credit, Collateral, and Capacity. These factors are crucial considerations for lenders when assessing a borrower's eligibility for a mortgage. Credit refers to the borrower's creditworthiness, Collateral is the property being purchased, and Capacity is the borrower's ability to repay the loan.

What is the longest part of the house buying process?

The longest part of the house buying process is the time from finding the right property to closing the deal. This period involves various steps, such as home search, negotiation, inspections, and mortgage approval, which can take several weeks (or even months!), depending on individual circumstances and market conditions.

What's the best age to buy a house?

The best age to buy a house is around 36 years old since that’s the typical age of the first-time home buyer according to the National Association of Realtors. Generally, people at this age have a stable income, good credit, and enough savings for a down payment and other associated costs.

Can I afford a 300k house on a $70 K salary?

Yes, you can afford a 300K house on a $70K salary, assuming a 30-year fixed interest rate of 6.0% with a 0.97% annual property tax rate, a $30,000 down payment, and a $600 annual homeowners insurance premium, according to The Mortgage Reports.

Is 400k too much for a house?

400K is within the nationwide median sale price of $410,200. However, whether it’s too much for you depends on various factors, including location, the local housing market, size, and features of the property, as well as the buyer's financial situation and budget. That price may be reasonable for some buyers but could be too expensive for others.

What is the 30 percent rule for mortgages?

The 30 percent rule for mortgages suggests that your housing expenses should not exceed 30 percent of your gross monthly income. This rule is used as a general guideline to ensure that your mortgage payments are manageable and leave enough room for other essential expenses and savings.

Why does closing on a home take so long?

Closing on a home can take time due to various factors, including the complexity of the real estate transaction, thorough inspections and appraisals, securing the financing, title searches, resolving any legal or title issues, and coordinating between multiple parties involved, such as lenders, agents, and attorneys. Delays can also occur due to unforeseen circumstances.

How much money do you need before you buy a house?

The amount of money needed before buying a house varies based on factors such as the purchase price, down payment percentage, closing costs, and potential reserves. Generally, buyers should have enough for a down payment (often 3-20% of the home price), closing costs (2-5% of the home price), and an emergency fund.

What is the first thing to do when you buy a house?

The first thing to do when you buy a house is to change the locks on all exterior doors to ensure security. Also, update your address with relevant parties, such as the post office, banks, and utilities. Lastly, conduct a thorough inspection of the property and plan any necessary repairs or improvements.

What is a good credit score to buy a house?

A good credit score to buy a house is typically around 700 or higher. However, lenders' requirements can vary, and some may approve mortgage loans for borrowers with scores in the mid-to-high 600s. The higher your credit score, the more favorable interest rates and loan terms you may qualify for.

Is $10,000 dollars enough to buy a house?

$10,000 is unlikely to be enough to buy a house on its own. It may, however, serve as part of a down payment, depending on the property's price and the down payment percentage required by lenders. Additional funds for closing costs and other expenses are usually needed to complete the purchase.

What is the 20% rule when buying a house?

The 20% rule when buying a house refers to the practice of making a down payment of at least 20% of the home's purchase price. By putting down 20% or more, buyers can avoid private mortgage insurance (PMI) and potentially secure better mortgage terms and lower monthly payments.

What are the 3 most important things when buying a house?

The three most important things when buying a house are (1) obtaining pre-approval for a mortgage, (2) conducting a thorough inspection to assess the property's condition, and (3) considering the location and neighborhood to ensure it meets your lifestyle and future needs.

What is the trick to buying a house?

The trick to buying a house is to be well-prepared and informed. Start by assessing your finances, obtaining pre-approval for a mortgage, and researching the market. Engage a trusted real estate agent and conduct thorough inspections. Remain patient, flexible, and open to negotiations while making a well-informed decision that aligns with your long-term goals.

How much income should I show to buy a house?

The income needed to buy a house depends on various factors, such as the home's price, down payment percentage, and monthly debt obligations. As a general guideline, most lenders recommend that your total housing expenses, including mortgage, taxes, and insurance, should not exceed 28-30% of your gross monthly income.

How much is a downpayment on a 500k house?

A down payment on a $500,000 house varies based on the percentage required by the lender. For example, a 20% down payment would be $100,000, while a 10% down payment would be $50,000. Buyers can also explore options with lower down payments, such as FHA loans with as little as 3.5% down.

What are the mistakes to avoid while buying a house?

The mistakes to avoid while buying a house include:

- Overextending your budget.

- Skipping the home inspection

- Ignoring the neighborhood

- Failing to shop around for mortgage rates

- Rushing the process

What matters most when buying a house?

When buying a house, several factors matter most: financial readiness, the location of the home and the neighborhood it’s in, the condition of the property, and its long-term suitability for you.

Is it better to put 20 down or pay PMI?

The decision to put 20% down or pay private mortgage insurance (PMI) depends on individual circumstances. A 20% down payment avoids PMI and may lead to better mortgage terms. Paying PMI, on the other hand, allows for a smaller upfront payment but adds to monthly expenses.

What are the disadvantages of a large down payment?

The disadvantages of a large down payment include:

- Reduced liquidity - Tying up a significant amount of cash in the home.

- Opportunity cost - Missing out on potential investments with higher returns.

- Less financial flexibility - Less available funds for emergencies or other financial goals.

What is the lowest acceptable down payment on a house?

The lowest acceptable down payment on a house depends on the type of mortgage and the lender's requirements. Some government-backed loans, like FHA loans, accept as little as 3.5% down. Conventional loans may require 5% to 10% down, while certain programs offer 0% down for eligible buyers.

How much income do you need to buy a $650,000 house?

The income needed to buy a $650,000 house depends on factors like the down payment and debt-to-income ratio. As a general guideline, a 20% down payment would require an income of approximately $130,000 per year to comfortably afford the mortgage and meet the lender's requirements.

How long does it take to buy a house?

The time it takes to buy a house varies. On average, the process can take around 30 to 60 days, but it depends on factors like market conditions, the complexity of the transaction, mortgage approval, and negotiations. Delays can also occur due to inspections, appraisals, and unforeseen issues.

What is the minimum income to buy a house in Texas?

The median price of a home in Texas, specifically in Houston, is $350,000. With that price and a 30-year fixed mortgage interest rate of 6.84% (the average in Houston), you’d need $98,568 as your annual income to buy a house in Houston, Texas, according to finance website NerdWallet.

What is the average income in Houston?

The average household income in Houston is $90,511 per year according to real estate marketplace Point2 Homes. However, it should be noted that income levels can vary widely depending on factors like profession, education, and location within the city.

The Best Houston Realtor to Help You Buy a Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 billion in Houston residential real estate sales.

Recent awards include:

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtors in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtors in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, and civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury Realtors, has a well-defined structure based on the individual strengths of each member.

We find the team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- The ability to be in two or three places at one time; a member can handle showings, while another answer calls

- Collective time and experience of members

- Targeted advice and marketing of agent expert in your area

- Competitive advantage by simply having more resources, more ideas, and more perspectives

- A “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- More people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- Efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- Multiple marketing channels using members’ networks

- Constant attention: guaranteed focus on your home and your transaction

- Lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- Flexibility in negotiation and marketing

- Better management of document flow

- Increased foot traffic through more timely and effective showing schedule coordination; and

- Increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.