A Complete Guide To Houston Homestead Exemptions

Want to save on property taxes? Learn more about Houston Homestead Exemption Types, Requirements for Eligibility, and the Application Process.

Want to lower your property tax bill in Houston?

With average appraisal values in Harris County increasing by up to 21% in 2022, applying for a homestead exemption and filing a property tax protest can help reduce your tax burden.

Don't want high property taxes to eat away at your hard-earned income? Discover how Houston homestead exemptions and property tax protests work and learn how to take advantage of them.

Table of Contents

- What Is A Homestead Exemption?

- How Do You Qualify For Homestead Exemptions In Houston?

- What Are The Types Of Homestead Exemptions?

- How Can Temporary Moves Affect Homestead Exemptions?

- What Is Homestead Tax Ceiling?

- What Happens To A Homestead Exemption When A Home Is Sold Or Bought?

- How To Apply For A Homestead Exemption?

- When Should I Apply For A Homestead Exemption In Houston?

- What To Do If Your Homestead Exemption Is Denied?

- Best Houston Realtor To Help You With Your Property Taxes

- Sources

What Is A Homestead Exemption?

You can protect your primary residence against rising tax bills by filing for a homestead exemption.

A homestead exemption is a legal provision that offers homeowners a partial exemption on the appraised value of their primary residence. It reduces the amount of property taxes owed.

It removes a chunk of your property's value from taxation, depending on your eligibility. For instance, a $40,000 exemption for a $200,000 home means taxes are calculated as if it's worth only $160,000.

What do property taxes look like in the Houston, Texas area?

In 2022, the property tax rate in the City of Houston was 0.5336 per $100 of assessed value. Harris County’s property tax rate was at 0.3437.

On average, residential property taxes in Houston (Harris County) run a little over 2.5% per year.

What are the benefits of a homestead exemption?

Homestead exemptions reduce your primary residence’s taxable value. This effectively lowers your property taxes. It can protect you from creditors in the event of bankruptcy or the death of a spouse.

How Do You Qualify For Homestead Exemptions In Houston?

- You must occupy the property as your primary residence.

- Only one homestead exemption is allowed per individual or family.

- Your property must be within the state or county offering the exemption.

Eligibility may also depend on requirements outlined by the state or local government offering the exemption. These are:

- Property must be the owner's primary residence as of January 1 of the tax year;

- Owner must have owned and occupied the property as their principal residence as of that date;

- The owner must also be an individual (not a corporation or partnership); and

- Must not claim a homestead exemption on any other property.

The type of home that qualifies for a homestead exemption varies by state and local government. Homestead exemptions are available to owners of:

- Single-family homes;

- Townhouses; and

- Condominiums.

The amount of the exemption may differ depending on the type of property and its assessed value.

In some states, homestead exemptions automatically apply to eligible properties. In Texas, homeowners are required to apply for their homestead exemptions.

What Are The Types Of Homestead Exemptions?

There are many types of homestead exemptions. The types of exemption available vary depending on the state or local government offering the exemption.

Here is an overview of different types of homestead exemptions in Houston:

School Taxes

For school district taxes, you will receive at least a $25,000 homestead exemption on the value of your home.County Taxes

A 20% optional homestead exemption is given to all homeowners in Harris County. If the value of your home is $100,000, applying the exemption will decrease its taxable value for Harris County taxes from $100,000 to $80,000.Optional Exemptions

It's possible for any taxing unit (e.g., school district, city, county, or special district) to provide an exemption for your home up to 20% of its value. However, regardless of the percentage, the amount of an optional exemption cannot be less than $5,000.

If your home is valued at $20,000 and your city offers a 20% optional exemption, your exemption will be $5,000 even though 20% of $20,000 is only $4,000.

This percentage exemption will be added to any other homestead exemption you qualify for.

Knowing the different types of homestead exemptions available to you can help you take advantage of potential tax savings!

How Can Temporary Moves Affect Homestead Exemptions?

If you're planning to temporarily move out of your home, keep in mind that it could have an impact on your homestead exemption.

Here's what you need to do to maintain your homestead exemption while on a temporary move:

- You must intend to return to your primary residence;

- Do not establish a new homestead at your temporary location; and

- Adhere to the period allowed by your state or local government.

A temporary move may sometimes qualify for an exemption extension. This allows you to continue to receive the homestead exemption while you are away.

This requires you to continue to own and maintain your primary residence. The temporary move should have a qualifying reason such as military service or medical treatment.

What Is Homestead Tax Ceiling?

The homestead tax ceiling limits the increase in your property taxes every year.

Homeowners over the age of 65 or those who are disabled can apply for this tax ceiling after qualifying for the general homestead exemption.

To apply for this, you need to provide proof of age or disability. This should be filed with the county appraisal district.

This provides you protection from huge increases in property taxes. It also limits the increase in your taxes even if the value of your property increases. This should be reapplied every year.

Review Houston's requirements and procedures to take advantage of your potential tax savings!

What Happens To A Homestead Exemption When A Home Is Sold Or Bought?

The homestead exemption is non-transferable to the new owner when a home is sold. The new owner must apply for their own homestead exemption.

If you inherit a home with a homestead exemption, you may be able to keep the exemption if you meet certain eligibility requirements.

- You must be related to the previous owner; and

- You must continue to use the home as your primary residence.

How To Apply For A Homestead Exemption?

Getting a homestead exemption is an effective way to reduce your property tax bills, and it's a straightforward process to apply for it.

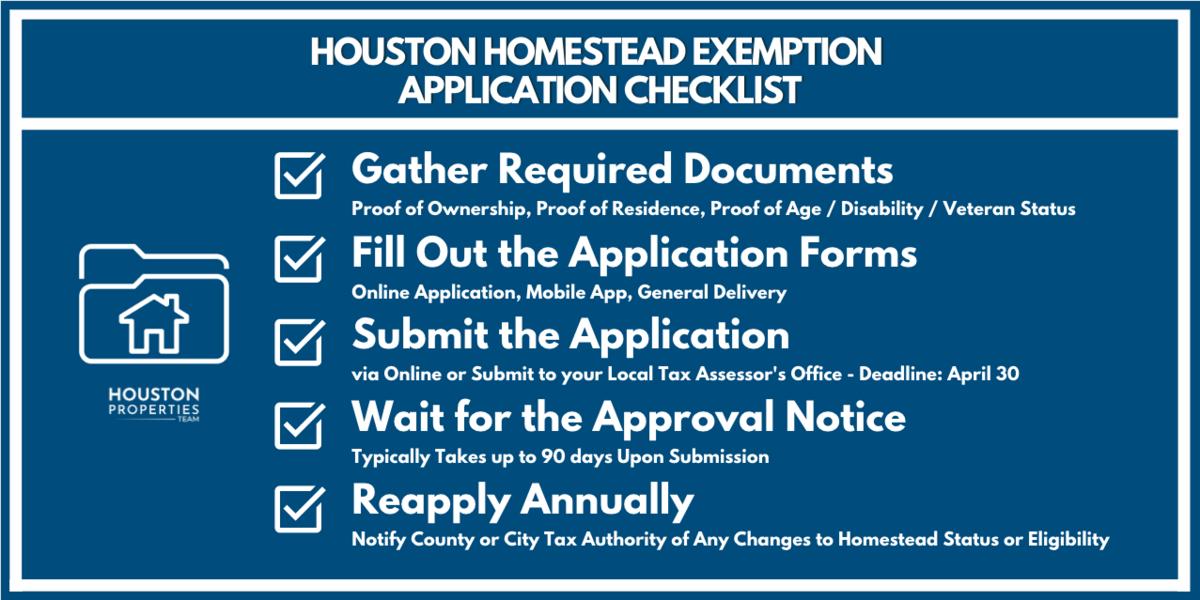

Here's a step-by-step guide on how to apply:

STEP 1: Gather Required Documents

The specific requirements for documentation can vary depending on the jurisdiction, but here are some examples of documents that could be used to provide proof of the following:

Proof of Ownership

- Deed to the property

- Property tax bill

- Mortgage statement

- Title insurance policy

Proof of Residency

- Utility bill (electricity, gas, water, etc.)

- Voter registration card

- Driver's license or state ID card

- Lease agreement

- Homeowner's insurance policy

Proof of Age/Disability/Veteran Status

- Birth certificate or passport

- Social Security Administration award letter

- Disability award letter

- VA disability compensation letter

- DD Form 214 (Certificate of Release or Discharge from Active Duty)

STEP 2: Complete the Homestead Exemption Application

Complete the homestead exemption form provided by your local tax assessor's office. The application may be available online or in person.

Harris County

Homeowners in Harris County can apply in three ways:

Online Application. Apply using the Form 11.13 with a scanned copy of your Texas Driver's License.

Mobile App. You can also file your exemption using their mobile app in Android or in iOS with a photo of your Texas Driver's License.

General Delivery. Print and fill out the Form 50-114 and mail or deliver it to the Harris County Appraisal District at 13013 Northwest Freeway Houston, Texas 77040-6305, with a copy of your Texas Driver's License.

STEP 3: Submit the Application

You can submit your completed application and documentation to your local tax assessor's office. Some states may require the application to be submitted before a specific date. In Houston, this is usually April 30th of the tax year.

STEP 4: Wait for Approval

After submitting the application, you will need to wait for approval from your local tax assessor's office.

Approval typically takes up to 90 days. You will receive a written notice of approval or denial in the mail to inform you of the status of your homestead exemption application

STEP 5: Reapply Annually

It's important to remember that you must reapply for the homestead exemption yearly.

In Houston, you are generally not required to provide updated documentation or complete a new application when you reapply.

But you must notify the appropriate county or city tax authority if there are any changes to your homestead status or eligibility.

When Should I Apply For A Homestead Exemption In Houston?

Applications need to be postmarked from January 1 until April 30 to be eligible for the exemption for that tax year.

It's important to note that there may be exceptions to these dates. Exceptions are given to newly constructed homes or to homeowners who have recently moved.

Homeowners granted a homestead exemption in the previous year will receive a renewal application in the mail. Complete and return this to the Appraisal District before April 30 to maintain your exemption.

What To Do If Your Homestead Exemption Is Denied?

When you apply for a homestead exemption, the Chief Appraiser of the county appraisal district will either approve or deny it after reviewing your documents.

If your claim is wrongly denied, you can file a property tax protest with the Appraisal Review Board (ARB) in your county, which operates independently from the appraisal district. The ARB settles conflicts between property owners and the appraisal district, covering homestead exemption denials and property value appraisals.

A homestead exemption can lower your property tax bill, and Property Tax Protest can help reduce your taxes with no upfront cost and no fee if there's no reduction.

Best Houston Realtor To Help You With Your Property Taxes

We're happy to guide you through the application process and help secure your property's future. Text or call us at 713-425-4194.

Sources

Navigating Houston homestead exemptions can be overwhelming. We provide comprehensive guides to help you take full advantage of reducing your property taxes. Our team of top Houston Realtors to ensure you find the perfect home.

- Comptroller Texas Website

- Harris Central Appraisal District Website

- Property Tax Protest Website