Understanding Houston Property Taxes

Are You Overpaying Your Property Taxes? Here's How to File a Protest and Save Money.

Given that Texas has the seventh-highest property tax rates in the country, the cost of property ownership can be a serious burden for many homeowners.

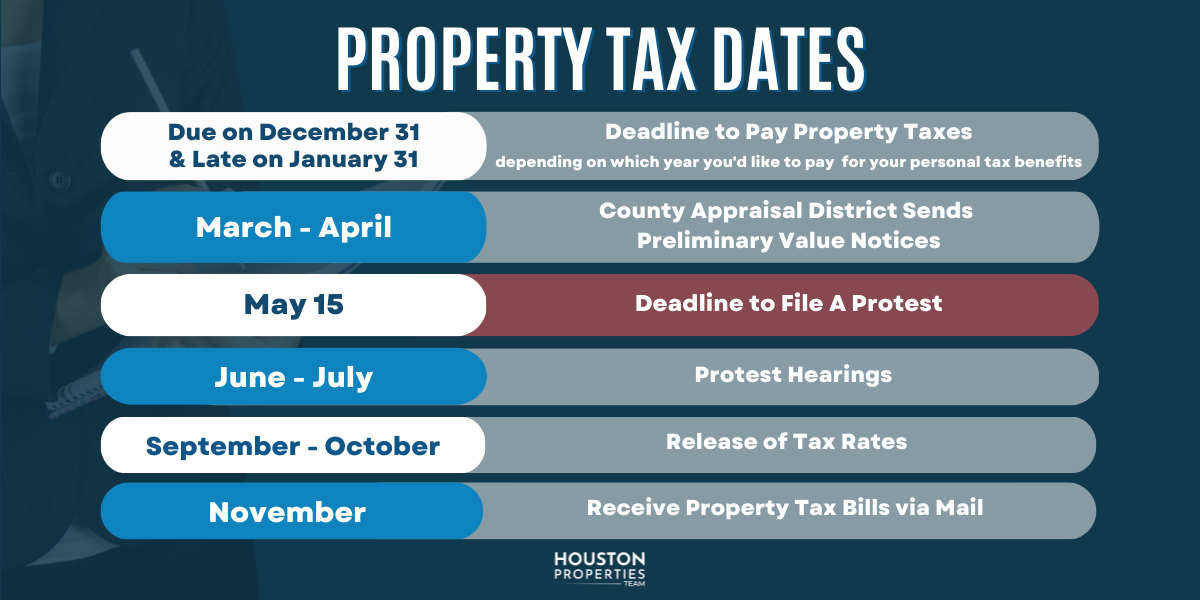

With the May 15th deadline coming up, it's important to understand how property taxes work and how to file for a protest. Here's a quick overview of the property tax process in Houston.

"Buying a house in Houston with the Houston Properties Team was just the start of our relationship. They helped me build friendships, relationships, and support as a new resident in Houston. They went above and beyond to help make our lives better even after our move." – Brandon, Google Review

Table of Contents

- How Do Texas Property Taxes Work?

- How Do I Reduce My Property Taxes?

- Top 4 Property Tax Misconceptions

- Is It Worth Protesting Property Taxes in Houston?

- The Best Houston Realtor to Sell Your Home

How Do Texas Property Taxes Work?

If you have more questions about property values, homestead exemptions, and tax appraisals, please contact Paige Martin at [email protected], ranked Houston’s #1 Boutique Team Powered by Keller Williams.

Property taxes are the primary source of local government revenue in Texas. These funds support various essential services that enable schools, cities, and counties to operate smoothly for residents. Here's how the process works and how you can best protect your property from overly-aggressive tax values.

There are two key components within your property taxes: Property Tax Values and Property Tax Rates.

1. Tax Values

An appraisal district in each county determines the year’s tax and market value of all taxable property at the beginning of each year. Your tax appraisal value is typically set between January and April.

If your property (primary residence) is subject to a homestead exemption, the tax value of your home cannot increase more than 10% each year, per state law. Depending on market conditions (or your protest), it can also decrease, but will often require a property-owner-initiated action to challenge the values to a lower amount.

In addition, the taxing authority will track the market value of the property. This may or may not be the accurate market value (and often is not); however, should a transfer of the property occur, the taxing authorities will adjust the tax value of the home to match its current market value, as determined by them, to ensure that the property is taxed at the appropriate rate.

As a home buyer, it's important to watch both of these values because, upon purchasing, the taxing authorities will likely bump up the tax value of your home to their tracked market value or higher.

2. The Tax Rate

The governing bodies of the various local government jurisdictions (counties, school districts, cities, municipal utility districts, college districts, hospital districts, etc.) that rely on property taxes to serve their residents, set an annual tax rate. This rate is set between the summer and fall (usually released by October).

Your tax bill is then established based on the taxable value (not market value) of your property (considering any property exemptions for which you may qualify) and the established tax rate for that year.

How Do I Reduce My Property Taxes?

"The Houston Properties Team make real estate transactions a lot less complicated for sellers – they take care of everything AND they get the highest prices and the shortest closings. Paige went the extra mile in helping us and has been diligent in giving us reliable and intelligent recommendations. You're the best Paige and congrats on being the #1 Keller Williams agent in the entire state of Texas!" – Kathryn (Google Review)

Property owners have two primary options for reducing their taxes.

First, if you qualify for a homestead exemption (for your primary residence) or any additional exemptions, be sure to file those as quickly as you can so they are factored into your final tax bill (which arrives at the end of the year).

The second option is to file a protest, and here are the two ways to do it:

1. You can file a protest in accordance with the County Assessment District that governs your property. The procedures vary from county to county, but in all cases, you'll need to justify why you think your home's value is worth less. Many homeowners rely on their real estate agents to assist with neighborhood comparables and suggestions on how to best present their case.

a) For Harris County Homeowners

b) For Brazoria County Homeowners

c) For Fort Bend County Homeowners

d) For Galveston County Homeowners

e) For Montgomery County Homeowners

2. You may hire a property tax consultant to guide you through the process. These consultants typically work on a contingency basis, with them receiving a portion of the tax savings they achieve. Some also work with small retainers. If you would like resources for this service, we have a curated list of protesters who have achieved results beyond what the homeowners were able to achieve for themselves, making the relationship financially beneficial to the property owner.

What is the deadline for property tax protest in Houston?

Don't forget, May 15 (or 30 days after receiving the notice of value, whichever is later) is the deadline to file a 'Notice of Protest' with your appraisal district. You can either submit the form provided in the late April / early May notice or file it online through the appraisal district's website.

Note: County appraisal districts offer e-protest portals, but this may not be your best option. We recommend evaluating all of the protest options to determine the best way to reduce your taxes.

Top 4 Property Tax Misconceptions

People often ask, "When do I file for a property tax protest?" Without the right information, it's easy to miss the protest season and end up paying more in property taxes.

Here's a list of common misconceptions about property taxes:

1. "I've successfully filed for a homestead exemption, so I don't need to protest."

It's best to protest your property taxes every year, even if you have a homestead exemption with a homestead cap. If the property value decreases and you fail to protest, you may inadvertently accept the capped amount.

2. "My notice shows a property tax value that is lower than the market value, that's the lowest it can go."

If a property's value stays the same with the county or the value does not go up more than $1,000, the appraisal district does not have to send a notice of value. This is important to note as your property's value may still actually be lower. The only way to check would be by filing a protest.

3. "I have the over-65 exemption so there's no need to protest."

While the over-65 exemption may freeze some taxes, such as school taxes, it doesn't freeze everything. Other taxes can still go up for various reasons. It's important to protest every year to avoid allowing the county to keep the value at an elevated level that may hurt the rest of your neighborhood.

4. "My neighbor has a lower price per square foot, the county should lower my property's tax value."

The county appraisal district does not consider the price per square foot when assessing property values. They use other data points to determine the value.

Is It Worth Protesting Property Taxes in Houston?

Houston homeowners can protest their taxes themselves or hire a professional to do it.

However, there are several important benefits to protesting your property taxes.

1. Protection against errors.

The Assessment Review Board (ARB) is tasked with the critical role of reviewing property tax assessments and rectifying any mistakes. By protesting annually, you can ensure that the ARB reviews your property tax assessment for accuracy and corrects any errors.

2. Potential savings on property taxes.

Even if you think your property value assessment is correct, challenging it through a protest can potentially lower your taxes and lead to potential savings on your tax bill.

3. Encouraging fair assessments.

However, by protesting each year, you can help ensure that the assessment process is more fairly applied to all homes and that property owners' values are respected.

We're happy to provide recommendations for trusted professionals or a home valuation to help you better argue your case. Text or call us at 713-425-4194!

The Best Houston Realtor to Sell Your Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Her recent awards include:

– 2022: #1 Group by Closed Listing Volume, Keller Williams Memorial

– 2022: #1 Group by Closed Units, Keller Williams Memorial

– 2022: #1 Group by Closed Overall Volume, Keller Williams Memorial

– 2022: #1 Group by Closed Listing Units, Keller Williams Memorial

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtor in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtor in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, and civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent expert in your area

- competitive advantage by simply having more resources, more ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.