Houston Real Estate Market Update: Coronavirus & Oil Price War Edition

Current statistics on the coronavirus on real estate in the Houston housing market and current Q&A with experts.

BACKGROUND

- Watching the real estate market based on recent closings is like driving a car through the rear-view mirror.

- In the best case, recent sales give you a reflection of what was going on 30-45 days ago.

- In a situation like the Coronavirus outbreak and oil price crash, you should NOT be "looking in a rear-view mirror".

SUMMARY

- See 6 of the 20 leading indicators we watch for how the market is trending.

- See our list of FAQ we're getting from clients and reporters consulting us about the situation.

- This article is part of a series see our last likely impact of the Coronavirus impact on the Houston market based on past crises.

TAKEAWAYS

- Historically, most people don’t respond quickly to major crises.

- Sellers who price ahead of the market typically get the best deal (versus waiting 6-18 months) in the short term.

- Buyers who focus on quality properties and pay fair prices usually get the best deal over a 5-10 year timeframe.

The trends presented below are for the entire city of Houston. HOWEVER, data is trending very differently based on area and price point. Contact [email protected] for a custom set of trends for your neighborhood.

Table of Contents

- DATA: Houston Active Listings

- DATA: New Active Listings

- DATA: New Homes Under Contract

- DATA: Price Reductions

- DATA: Total Real Estate Showings

- FAQ: State Of The Houston Real Estate Market

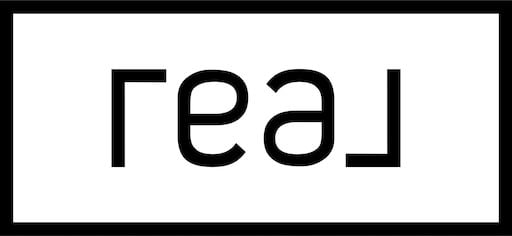

DATA: Houston Active Listings

Real estate is hyper local – for personal recommendations on a selling strategy, please contact [email protected].

The above graph shows the central Houston active listings through yesterday.

More homes on the market favors buyers.

Less homes on the market favors sellers.

Historically, March through August are Houston's busiest months.

The data post the original COVID lockdown shows that buyers have returned to the market faster than sellers.

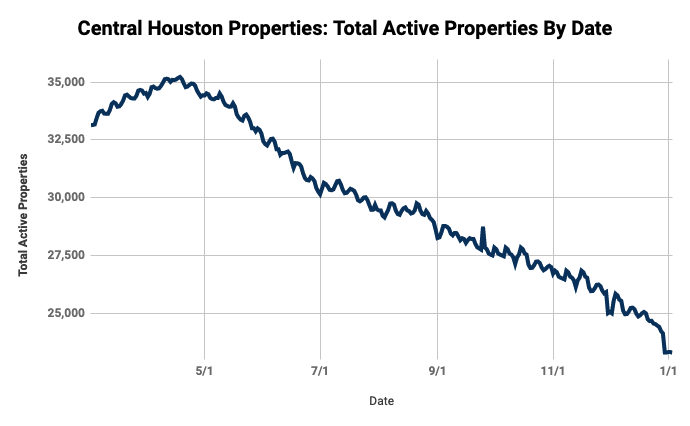

DATA: New Active Listings

Contact [email protected] for recommendations on how to find the best deals.

The graph above displays the number of new listings added to the Central Houston market.

The rate of change on new listings has been slower than the rate of change of homes going under contract (reducing the total inventory on the market).

Currently, this behavior favors sellers (assuming they're priced appropriately).

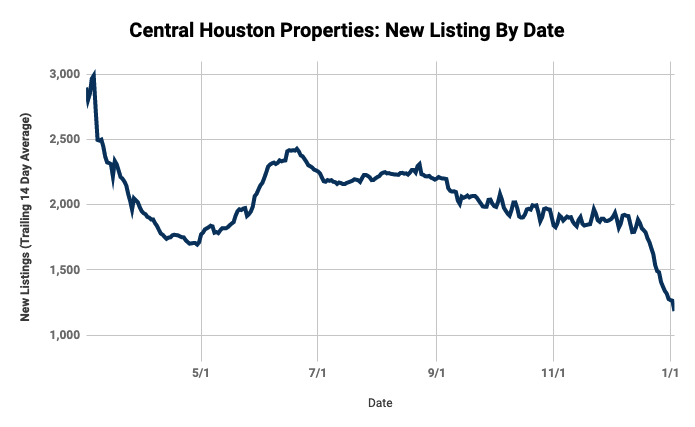

DATA: New Homes Under Contract

Contact [email protected] for a personalized update on your neighborhood.

Please see the number of homes in Central Houston that have gone under contract (Pending Status) each day since March 2nd.

Not surprisingly, during the heart of the lockdown, new contracts slowed.

Real estate was always deemed "an essential service" - so our activity fell less than other parts of the country.

However, since the re-opening, buyers have returned to the market in droves.

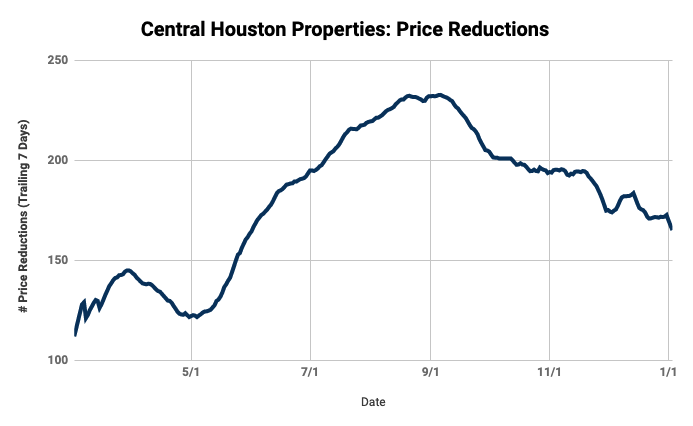

DATA: Price Reductions

Contact [email protected] for a customized approach to your home-buying or selling needs.

The above graph shows the number of active listings that incurred price reductions daily since March 2nd.

Notably, the largest increase in price reductions have come from properties who have been on the market for the longest period of time.

Please see this guide for Why Is My Houston Home Not Selling?

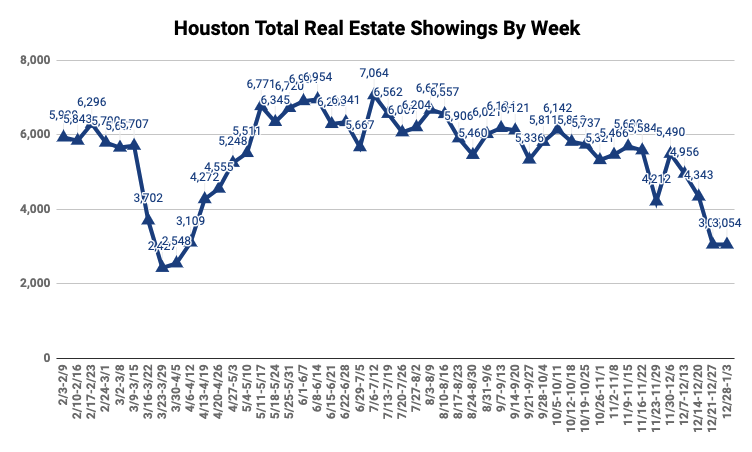

DATA: Total Real Estate Showings

Contact [email protected] for up to date showing activity in your neighborhood.

The top graph above showcases the weekly number of showings since early February.

This data is provided by all public showings as recorded in the city of Houston through Showing Time (the central showing service)

FAQ: State Of The Houston Real Estate Market

"Regardless of the economic and political climate, our approach has been the same: 'Every situation is unique'. We use data to create custom solutions for our clients and have candid conversations on what they can do given the situation."

The stock market fluctuations, pandemic scare, and oil price war is raising a lot of uncertainty and panic around the Houston housing market.

Below are a series of questions we've been getting from our clients. We've also added reporter inquiries we've answered the past few weeks.

Disclaimer: The answers were written on March 18. Given the volatility of the situation, some of the data (and in turn, the answers) may change dramatically any given day. We will try to update this as often as possible.

Q: What should buyers and sellers do right now?

A: Currently, most of the market is in a state of shock or denial (the first two of the seven stages of grief).

For buyers, the most forward-looking ones are focused on a flight to quality.

They want to ensure that they buy a good house that fits within the main long term investment themes and they are trying to ensure they don’t overpay.

Historically, homes in good areas, zoned to good schools that own land have bounced back from the bottom of any market (Hurricane Harvey, 2015 Oil & Gas Crash or 2008 Great Recession) in about 12-20 months.

Sellers are a mixed bag.

Many sellers have a more rosy view of the future than buyers do (and if the government pumps $3+ trillion into the broad market, we’ll likely see a fast recovery).

We’re advocating that for sellers who want to sell within the next 12-18 months that they price attractively now to get ahead of what may or may not be coming so they can move on with their goals.

Ultimately the answers will depend largely on the individual goals of each buyer and seller. If you're a seller who needs to sell fast, you need to get ahead of the curve (before prices go way down and the market becomes really competitive) and move now. If you're a buyer who can afford to wait it out, you will have plenty of opportunities to find good deals.

Q: Are there any major shifts in the way buyers are approaching the market?

A: Currently, only about 10-15% of buyers we are working with are changing their home buying strategy. Obviously, this number can go up or down significantly based upon whatever response the government offers next and the direction and volume the stock market changes tomorrow.

In parts of the city, we’re still seeing multiple offers. As far as Houston real estate market predictions go, buyer activity is unlikely to change any time soon unless we enter a full quarantine.

Since the typical real estate purchase process takes about 4-6 months (including being under contract for ~30-45 days), any data showing any market impact won’t begin to show up for at least 3 months.

Historically, it has taken 18 months before there is a material impact on the real estate market (e.g. after the 2008 crash, average home prices still increased for ~12 months).

Q: What's been the general reaction to the coronavirus scare in our market?

A: So far, the reaction in Houston has been a lot of conversations, a lot of general market concern and fear, but that has not yet translated into reduced real estate volumes. Please see the number of homes in Central Houston that have gone under contract (Pending Status) each day over the last two weeks. So far, the impact of lower oil & gas prices and the Coronavirus pandemic have not removed buyers from the market. We expect this to change dramatically over the next few days. Sellers and buyers who can get ahead of that "shift" are putting themselves in a good position to hit their personal goals.

Q: Are people taking listings off due to the uncertainties around the market?

A: Please see the graph of the total number of active properties in the Central Houston area.

Total listings are consistent both with the last few weeks and this time last year.

What we have seen in previous market shocks like this is that people go through the seven stages of grief:

- Shock

- Denial

- Anger

- Bargaining

- Depression

- Testing

- Acceptance

Typically, buyers move through these stages faster than sellers (which makes sense as sellers typically have "more to lose now.")

Most sellers in the first six phases don't make a lot of adjustments (removing their home from the market or adjusting the price), and it takes them getting through phase seven to make an update.

Q: Are closings/contract signings being delayed?

A: Not yet.

Currently, the biggest delay we’re seeing is around homes that are under the Option Period (the time when the buyer has the unrestricted right to walk away).

Some buyers are starting to re-trade deals. Some sellers are amenable, as they recognize the world has changed in the past 2-3 weeks. Other sellers are not, and believe that this will “blow over.”

Q: How are you addressing the fears and panic expressed by your buyers?

A: To help calm client fears we’ve been using data. In addition, we’ve spent quite a lot of time talking through our client’s primary motivations and the pro’s and con’s of every situation. We recognize that our clients have different goals and we present them with unique solutions based on their situation.

We’ve completed an analysis of the data from prior shocks (2001 Tech Bust, 2008 Great Recession, 2015 Oil & Gas Crash, Ebola Epidemic, etc). In our analysis we found several key success themes.

Two of the largest were:

- Don’t panic and rush to a bad decision.

- Focus on quality.

From our studies of over 500,000 Houston home sales, here are the major success themes to make a good investment:

- Located in quality neighborhoods that have good proximity to major job centers;

- Large lots (the primary value is the land value);

- Not located on a busy thoroughfare, near a highway or near a railroad;

- A street location with some kind of premier feature (by a cul-de-sac, on a street with a tree-filled median, etc.);

With a home that is liveable and can be rented. Typically, new construction homes come with a higher purchase premium and “true fixer-uppers” require too much investment.

Regardless of the economic and political climate, our approach has been the same: Every situation is unique. We use data to create custom solutions for our clients, present this to them, and have candid conversations on what they should do given the situation.

Q: How does the recent events (pandemic, stock market crash, oil price war) compare to the panic around the Houston floods in the past?

A: The flooding in Houston created a far worse sense of panic (especially for people who had flooded homes and needed to evacuate). The flooding in Houston was also more disruptive as tens of thousands of Houstonians gave of them time and resources to help flood victims.

Currently, the Coronavirus pandemic hasn’t “hit home” as most people don’t know anyone who has yet been affected.

More concerning, however, is the fact that oil prices have crashed to levels not seen for 5+ years. The implication of this crash is that nearly all oil and gas companies are operating at a loss and will need to make sizable personnel cuts.

While most of these cuts haven’t happened yet, a good number of individuals in the industry are concerned for their jobs.

We're already having conversations with our clients in the industry. Given the volatility of the situation, the urgency of the response is critical.

Q: What is the state of the luxury market today? How does it compare to last year and before the recent developments?

A: The state of the overall real estate market today is not very different than it was 30 days ago.

In the central Houston area, the luxury market (as defined by properties over $1M) saw record pricing, sales price per square foot and transaction volumes in 2019.

The two primary drivers of growth in the luxury market were 1) Job growth, 2) record levels of wealth in the stock market. Specifically, the Houston MSA added over 80,000 jobs in 2019 (including a large number of doctors, lawyers, professionals and executives). In addition, the Greater Houston Partnership was forecasting additional job growth for 2020 notably in the health care, financial and professional service industries.

Above you can find the current trends (through yesterday) on showings, active listings, price reductions and homes going under contract.

Within the luxury market (Houston homes over $1M) the public data from the largest showing service reports that there have been 886 showings from March 1 through March 18, 2020.

This compares to 943 showings from March 1 through March 18, 2019 - a drop of about 6%.

Q: Going forward, what are you keeping an eye on in terms of factors that may impact the luxury segment?

A: Watching the real estate market based on recent closings is like driving a car through the rear-view mirror.

In the best case, recent sales give you a reflection of what was going on 30-45 days ago.

In addition to comparable sales, we’re watching about 20 different, leading indicators.

Notably, we’re watching data around showings, offers, homes going under contract, homes coming back on the market, withdrawals, price reductions and trends daily.

Our team is also having hundreds of conversations daily with buyers, sellers, other agents, vendors to get a pulse on how people are feeling during this difficult time.

Q: How are you finding new ways to market your listings given the pandemic scare and potential full lockdown?

A: We’ve recently implemented a new “Houston Properties Team Guaranteed Clean” showing program for our listings.

With this program, we accompany all showings, meet prospective buyers at the door with masks, gloves, disposable shoe covers to help guarantee safe peace of mind from transmitted germs for both the buyers and sellers.

We're also building virtual walkthroughs of our listings. We expect more people to opt for virtual showings until the situation improves.

Q: How are low-interest rates affecting the market?

A: With interest rates at an all-time low, homes are more affordable. Buyers are factoring this into their purchasing decisions as many are evaluating home options based on their monthly mortgage rates.

We have also been seeing a number of people reaching out because they’ve seen low rates being advertised and they’re looking for investment opportunities. This is something we're advising potential sellers to look at as well - if we can get ahead of the curve, these opportunities will be out there.