Houston Housing Market Forecast: Current Data & 2021 Predictions

Concerned about a housing market crash? Worried about missing out on a boom?

UPDATE: We have just released our updated review and Houston Real Estate Market Forecast for 2022.

SUMMARY:

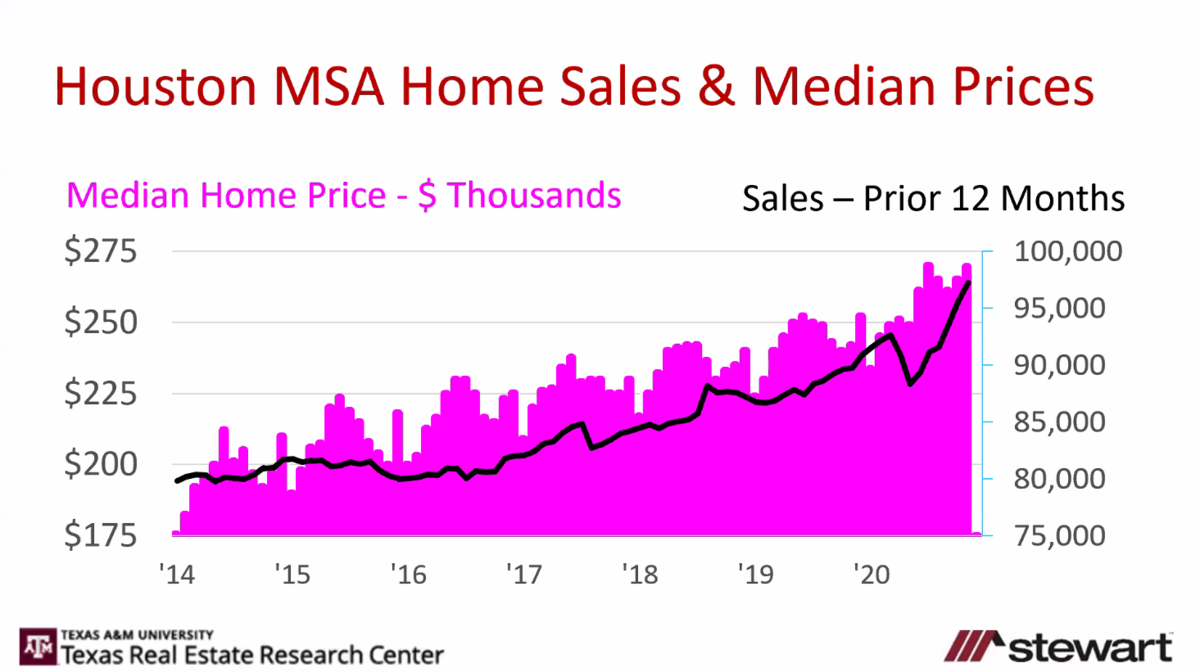

- Coming off a record year, the Houston real estate market started 2021 in a seller’s market.

- The average household finances are in the best shape they’ve ever been in. Ever.

- COVID-19 and subsequent government actions have dumped gasoline on wealth inequality in ways that we don’t fully understand yet. This is creating a “tale of two cities” both locally and nationally.

- Since the COVID-19 lockdown, homes have a higher “intrinsic value” to people as they spend more time in their abode (implying that many families will allocate a higher percentage of their total net worth to making their home their haven).

- We believe this will create a strong appreciation for homes and neighborhoods that are in demand in our HGTV / COVID-19 world (details below).

- We also believe that this will stagnate neighborhoods and specific property types that have fallen out of favor (also details below).

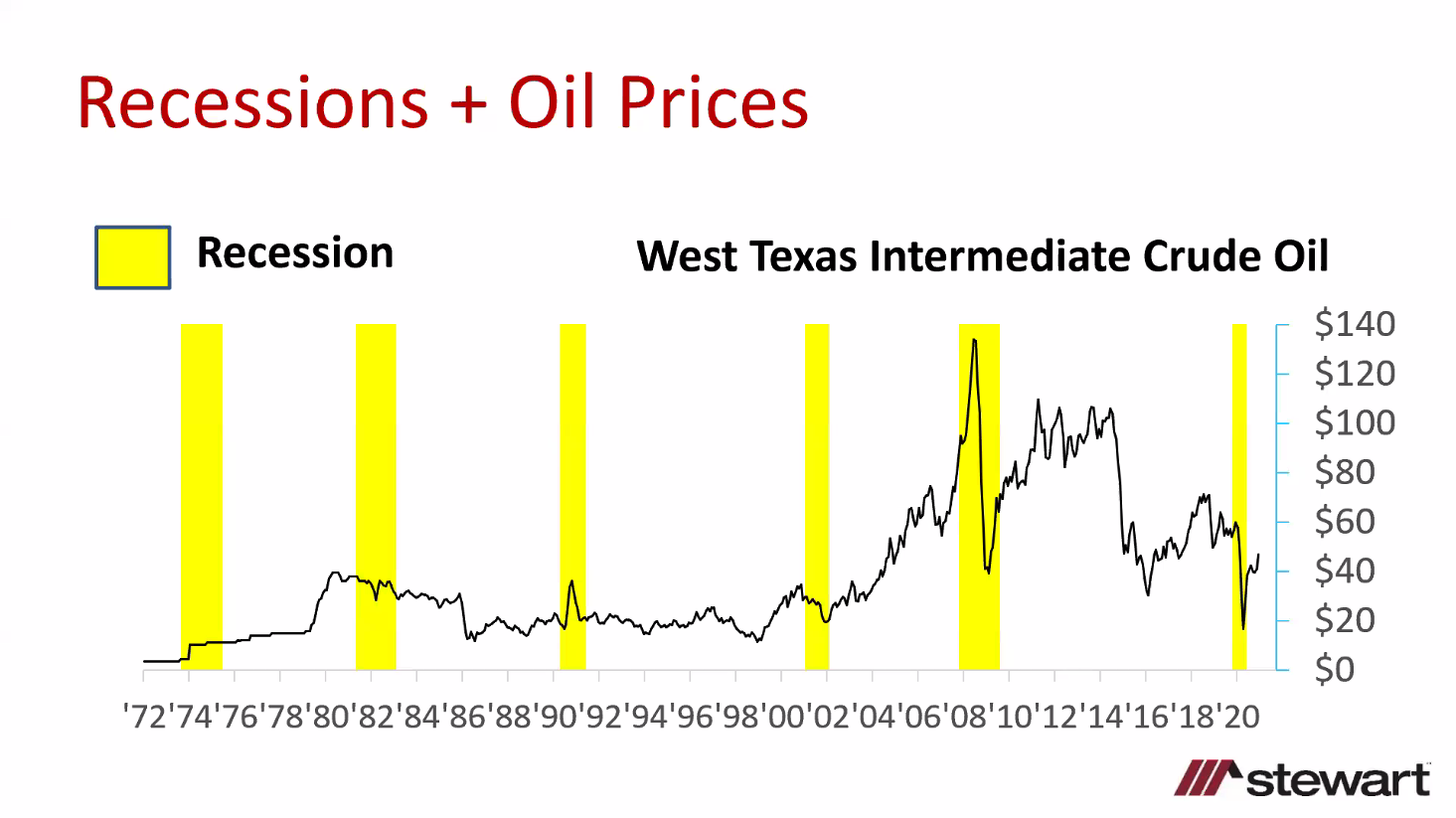

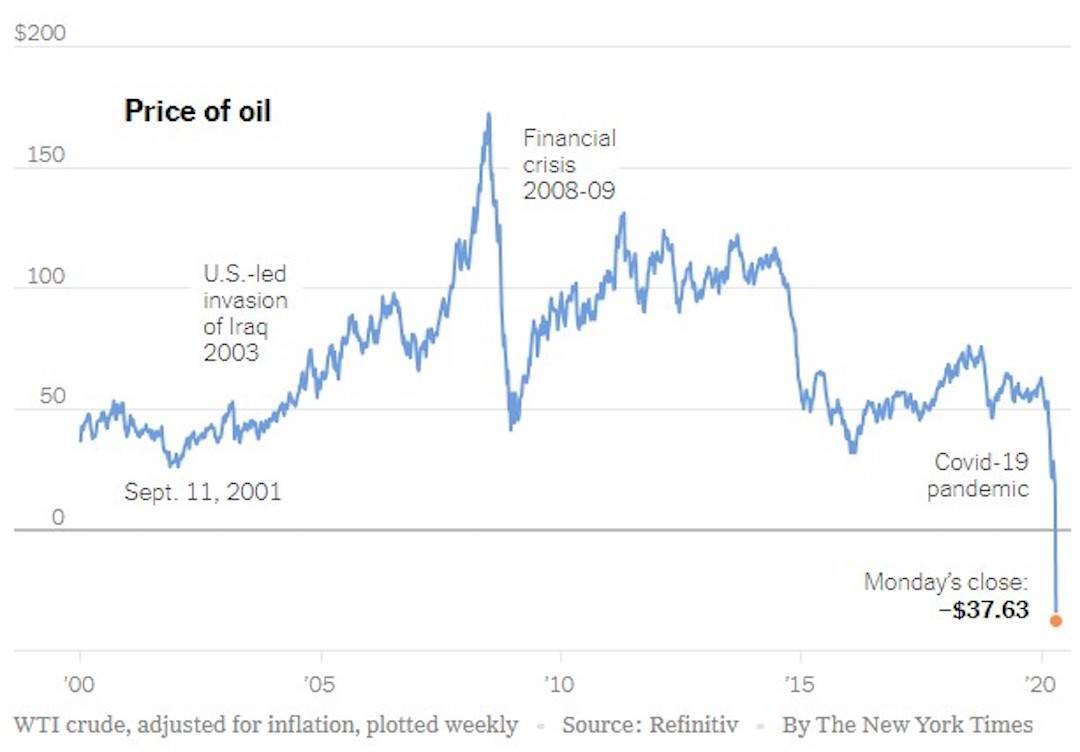

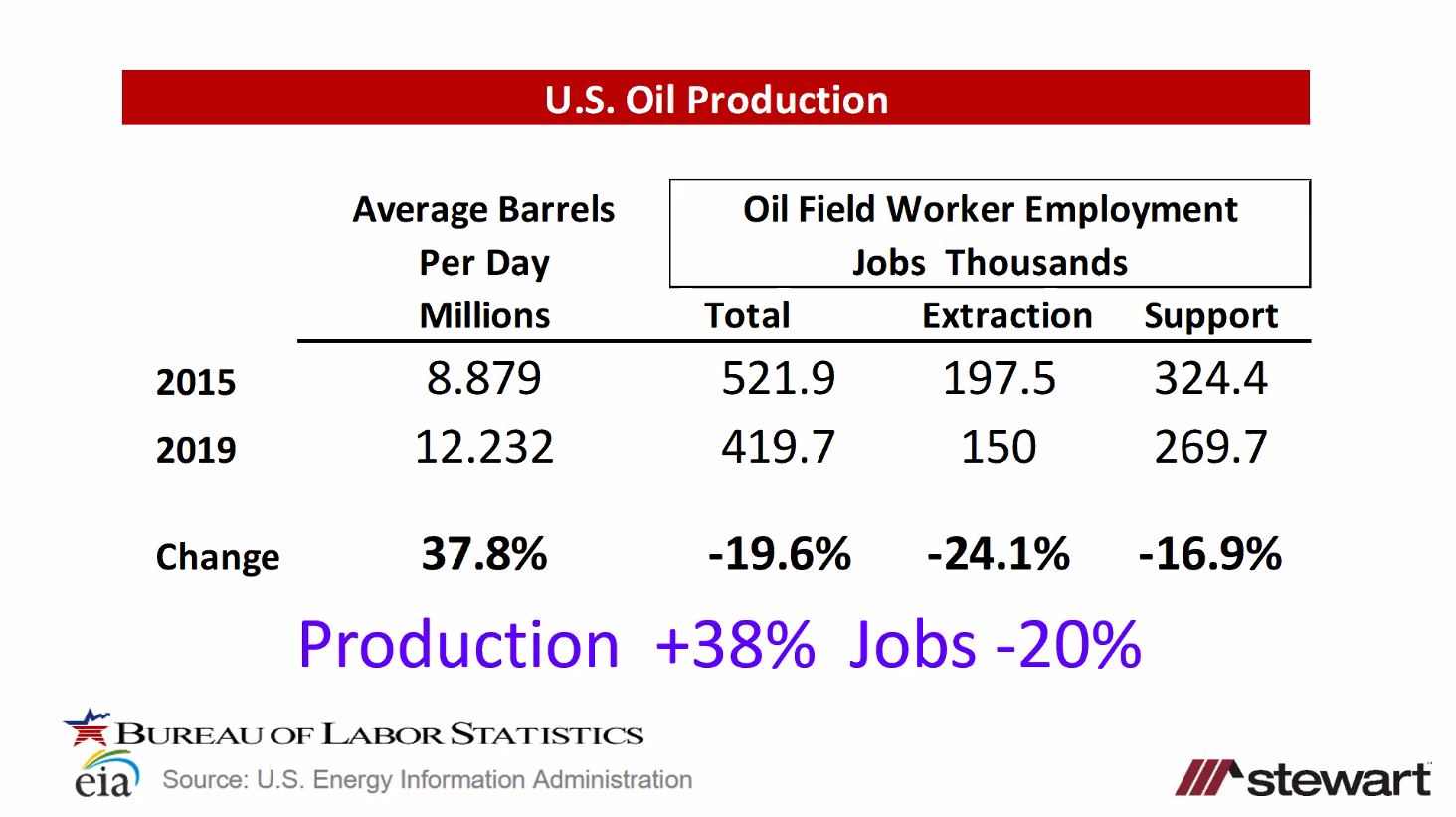

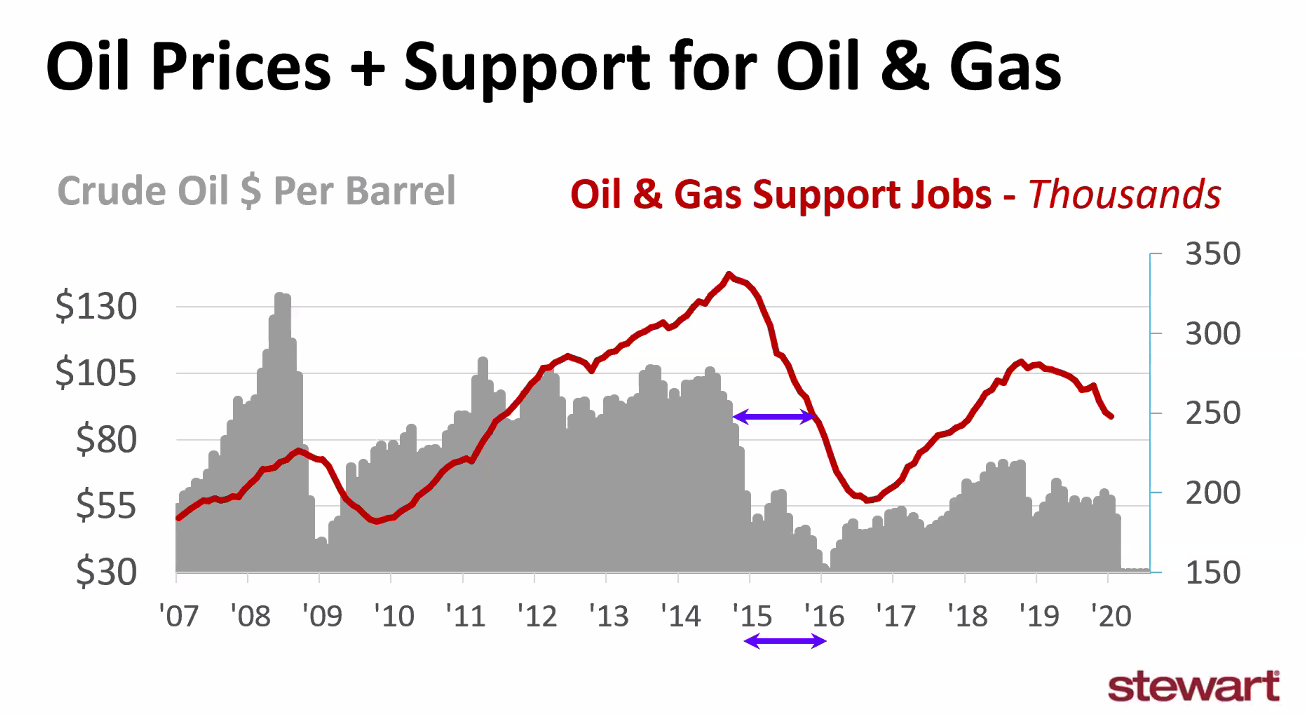

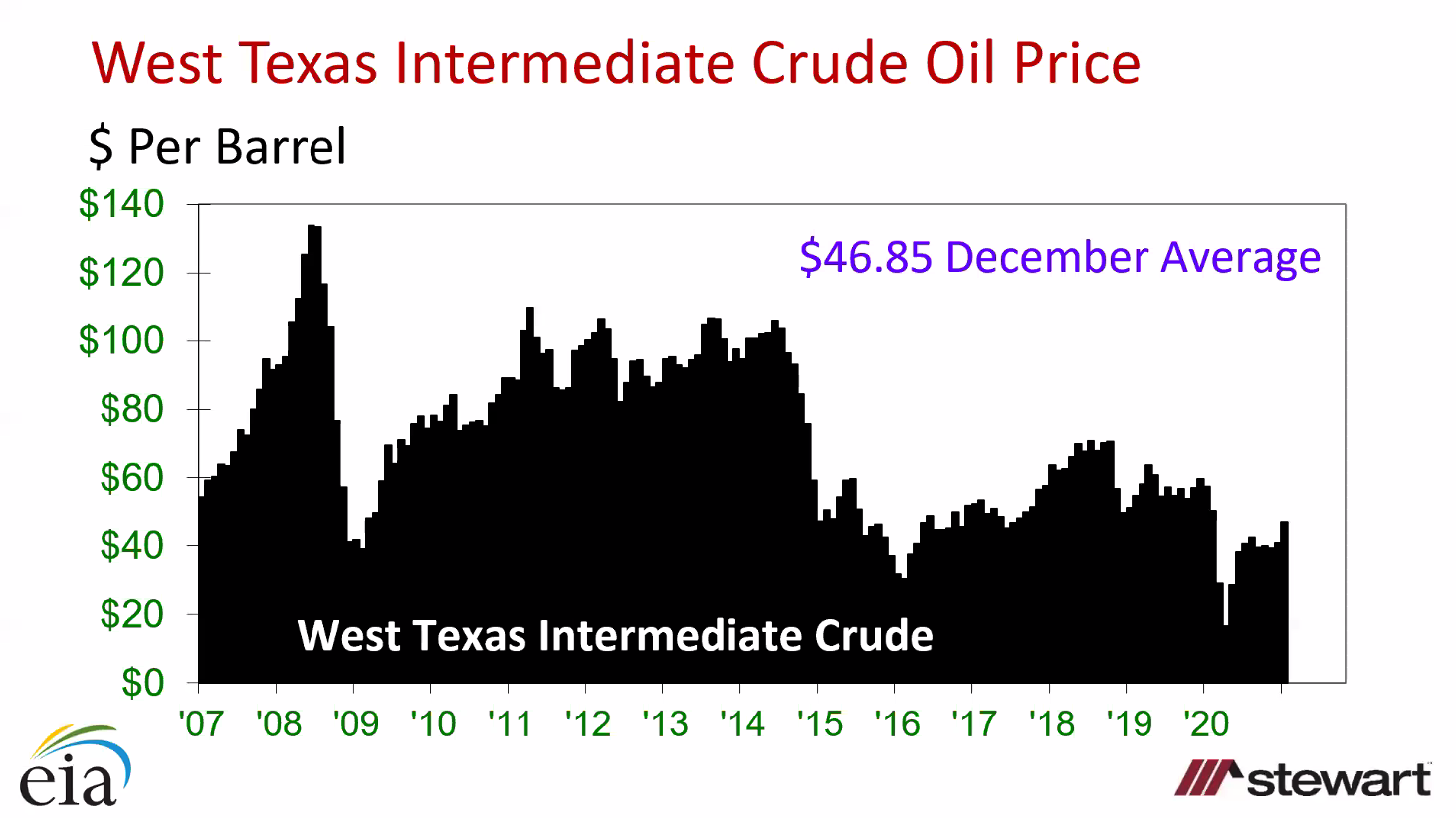

- Main Concern: the impact of the oil price crash on Houston jobs (about 1/3 of Houston’s jobs are tied to the energy industry).

- Secondary Concern: the disparity in wealth (details below) will likely propel some neighborhoods to record highs while stagnating others, given that Houston is one of the most economically segregated cities in the US.

What’s shocking is (through the end of 2020) about 23% of Houston neighborhoods in specific areas are still selling at LOWER PRICES than before Hurricane Harvey hit in 2017. This highlights the importance of Avoiding the 9 Most Common Mistakes Buyers Make.

In this analysis, we also show you current data along with key lessons from both the 2015 oil price crash and the 2008 great recession.

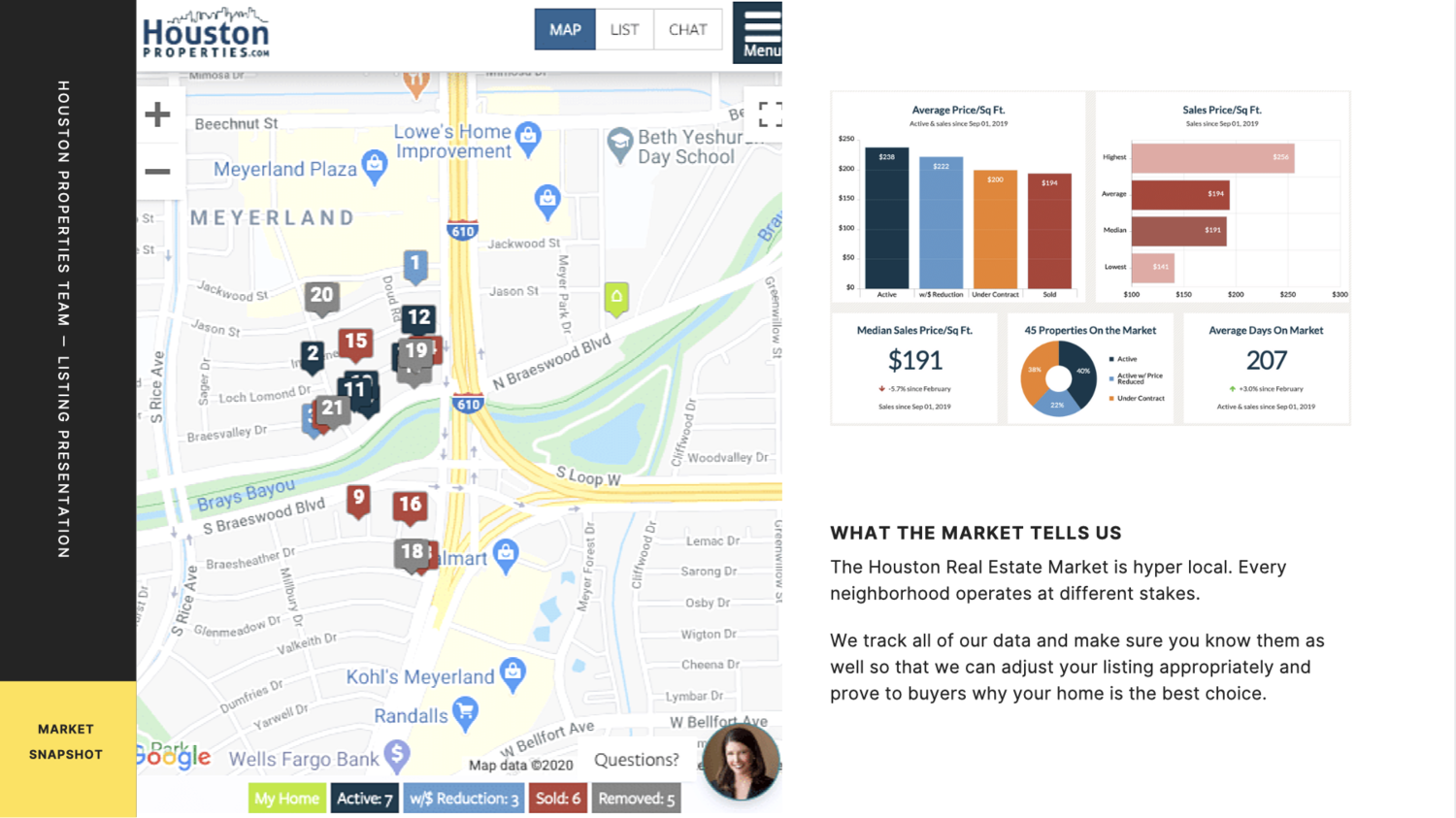

Remember: real estate is hyper-local! The data below covers the “average Houston home.” Many neighborhoods are trending differently.

Get a free home valuation for your house and trends in your neighborhood.

If you’re considering buying or selling, our advice for you will depend on your neighborhood, price point, and personal goals.

KEY RESOURCES:

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected]. Paige Martin is the #1 Individual Agent with Keller Williams in the State of Texas and team lead of The Houston Properties Team.

Table of Contents

- Household Finances - The Best (Ever)

- Why Markets Boomed In a Year of Human Misery

- There’s No Free Lunch

- The Tale of Two Cities

- How Is My Neighborhood Doing?

- What To Do As A Homeowner?

- Buyers Beware?

- I May Need To Sell. How Does This Affect Me?

- Job Losses In Houston: Areas And Industries At Risk

- Oil & Gas Having A Bigger Impact?

- Sources, Methodology & Disclosures

- Top Ranked Realtors: Paige Martin & The Houston Properties Team

Household Finances - The Best (Ever)

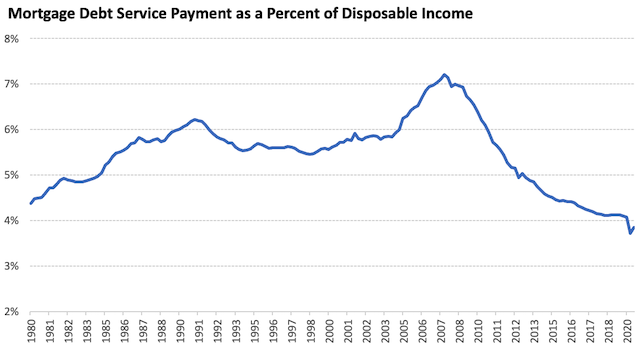

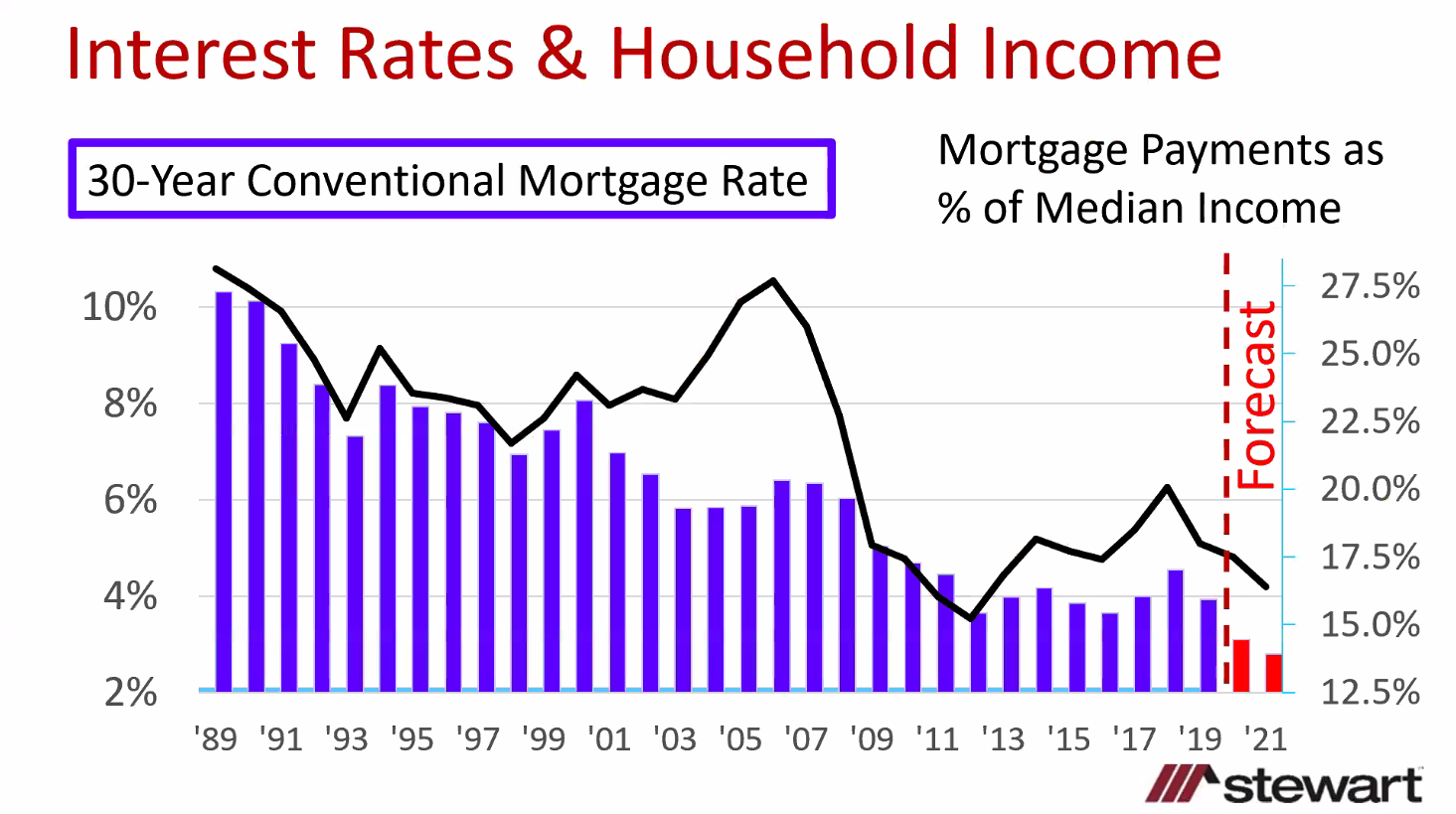

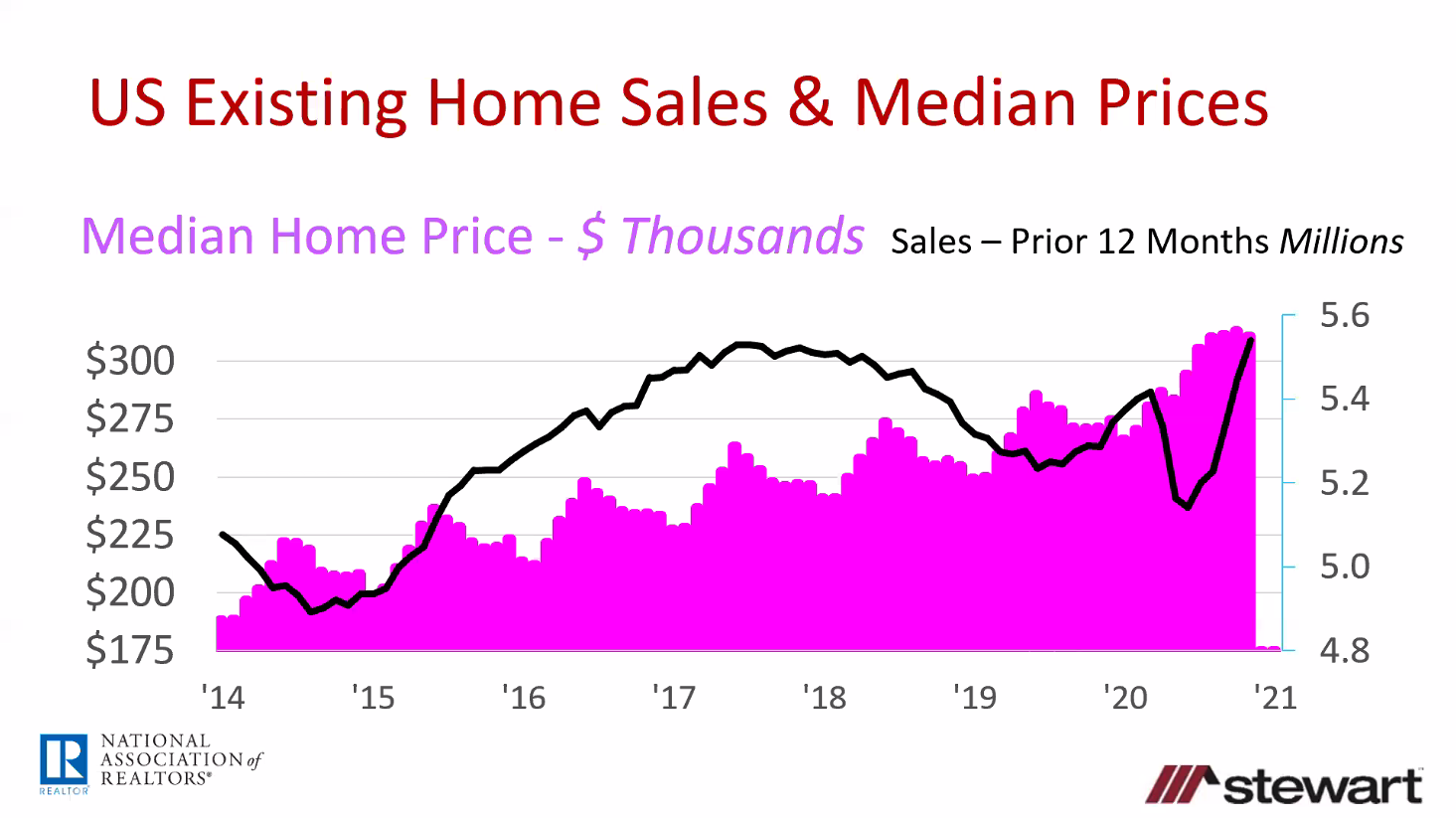

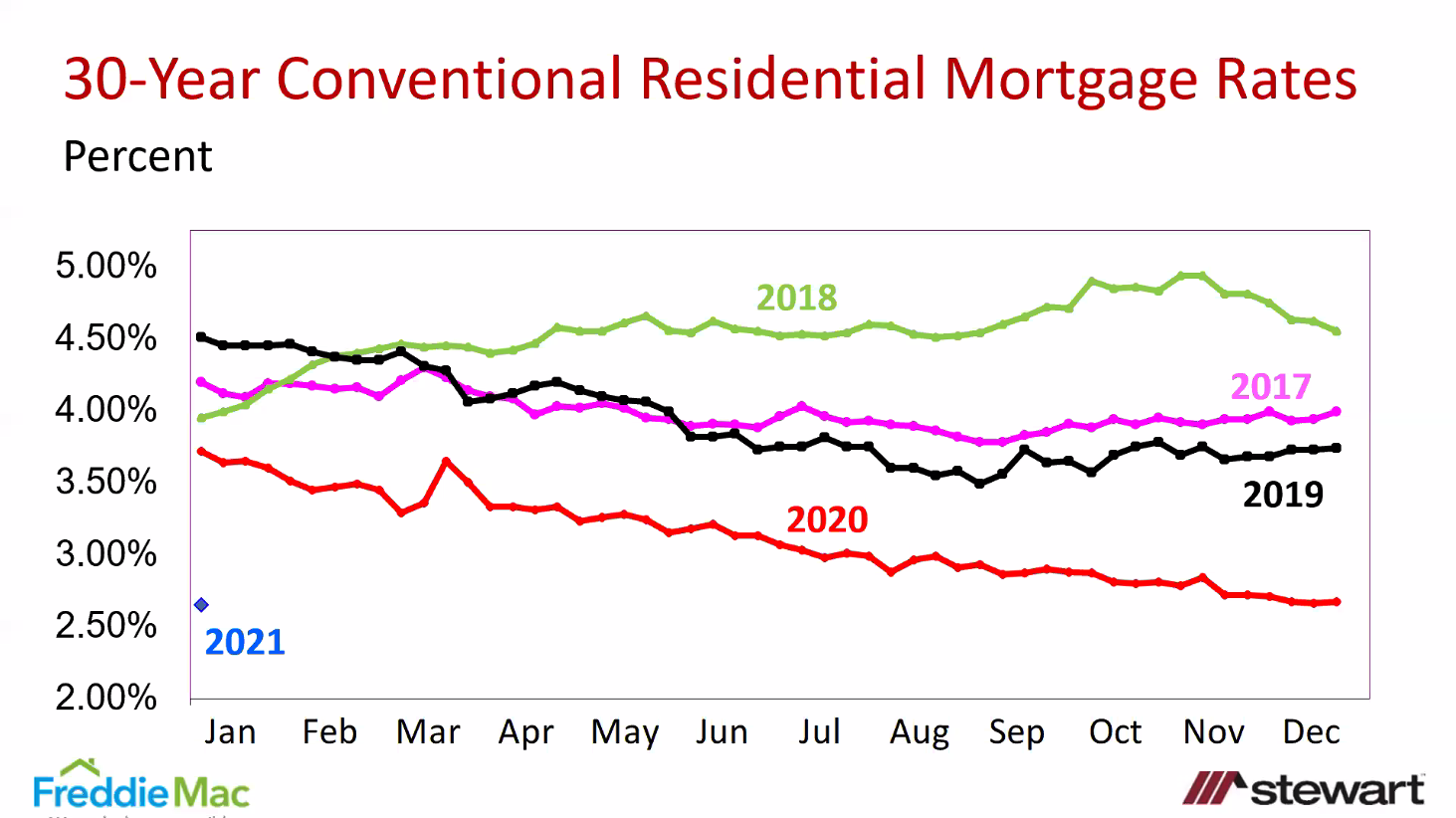

Today's monthly payments on a $500,000 mortgage are about the same as a $210,000 mortgage from the mid-1990s or a $300,000 mortgage from 2007.

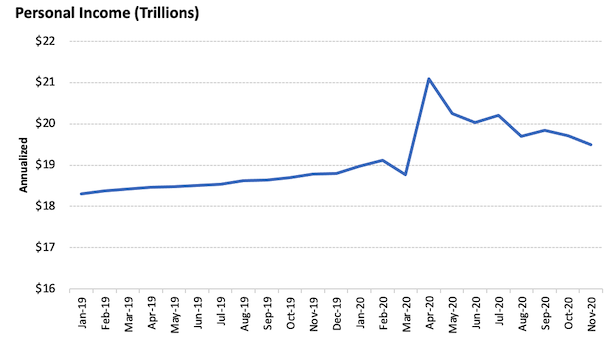

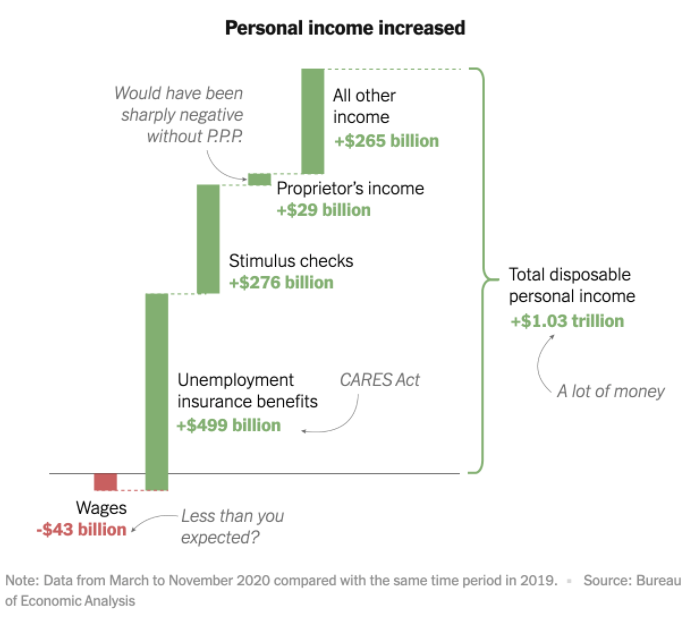

2020 was the best year in American history for personal income.

Much of the growth was from stimulus payments and higher unemployment benefits. However, average American private wages, salaries, and average hourly earnings are back at new highs.

These averages are highly skewed toward knowledge workers who have the ability to work remotely (more on this below).

From March to November of 2020, Americans made $1 trillion more than they did from March to November of 2019.

A very fair question is: Will this continue, or is this a one-time thing?

I’ll save the details for another article, but I think you want to ask yourself: "Now that the American population knows the government has the ability to provide trillions of dollars of stimulus money in any given year, do you think they’ll elect politicians who choose to say 'No More'?"

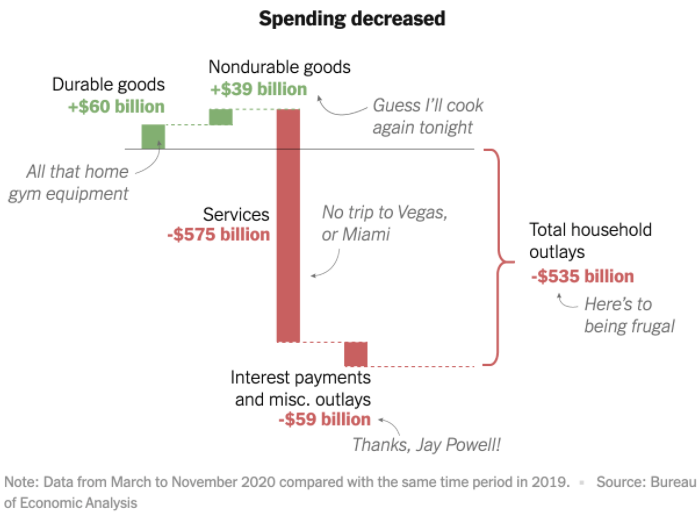

What do you do when you get a giant stimulus check and you can’t use it?

You can’t travel because everything’s locked down. Or go shopping because the malls are closed. Or dine out as restaurants are closed.

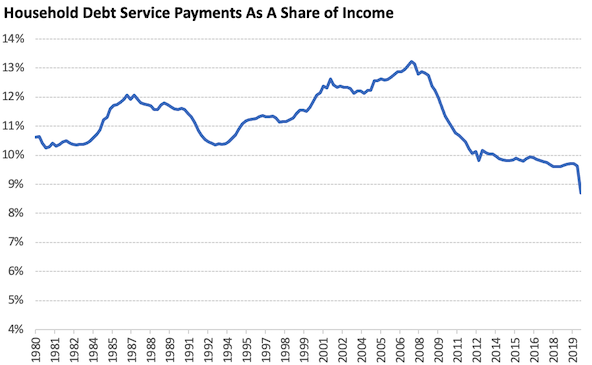

Millions of Americans used it to pay off their debt.

Credit card debt balances declined by over $100 billion last year.

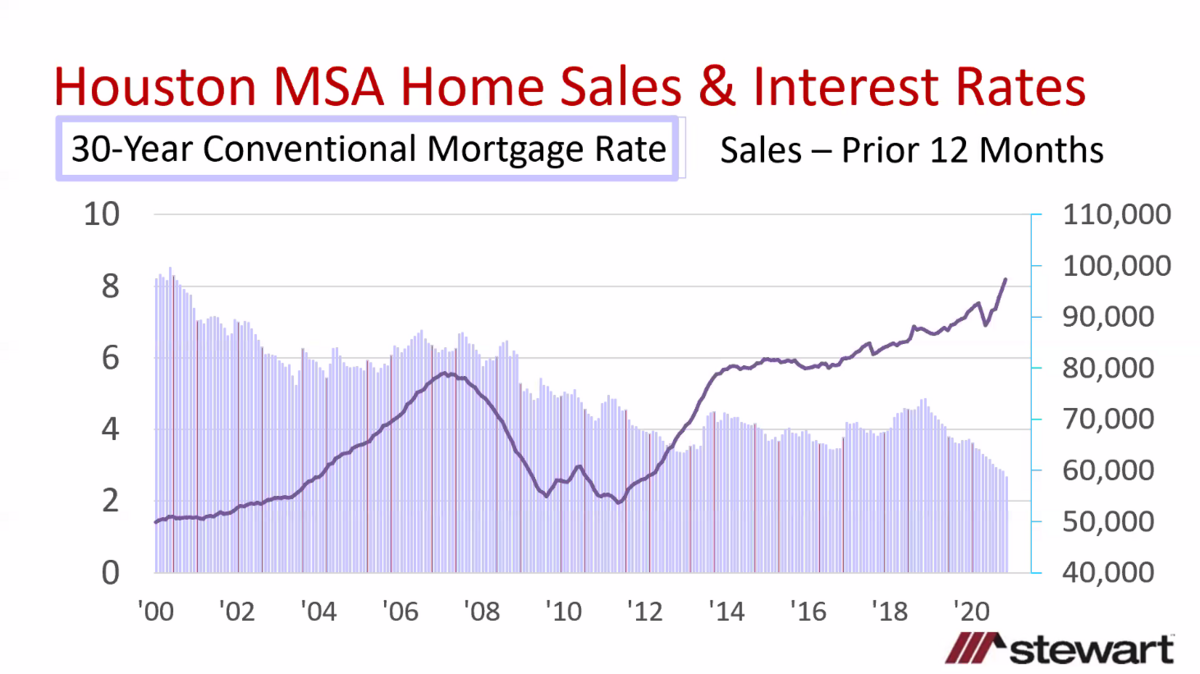

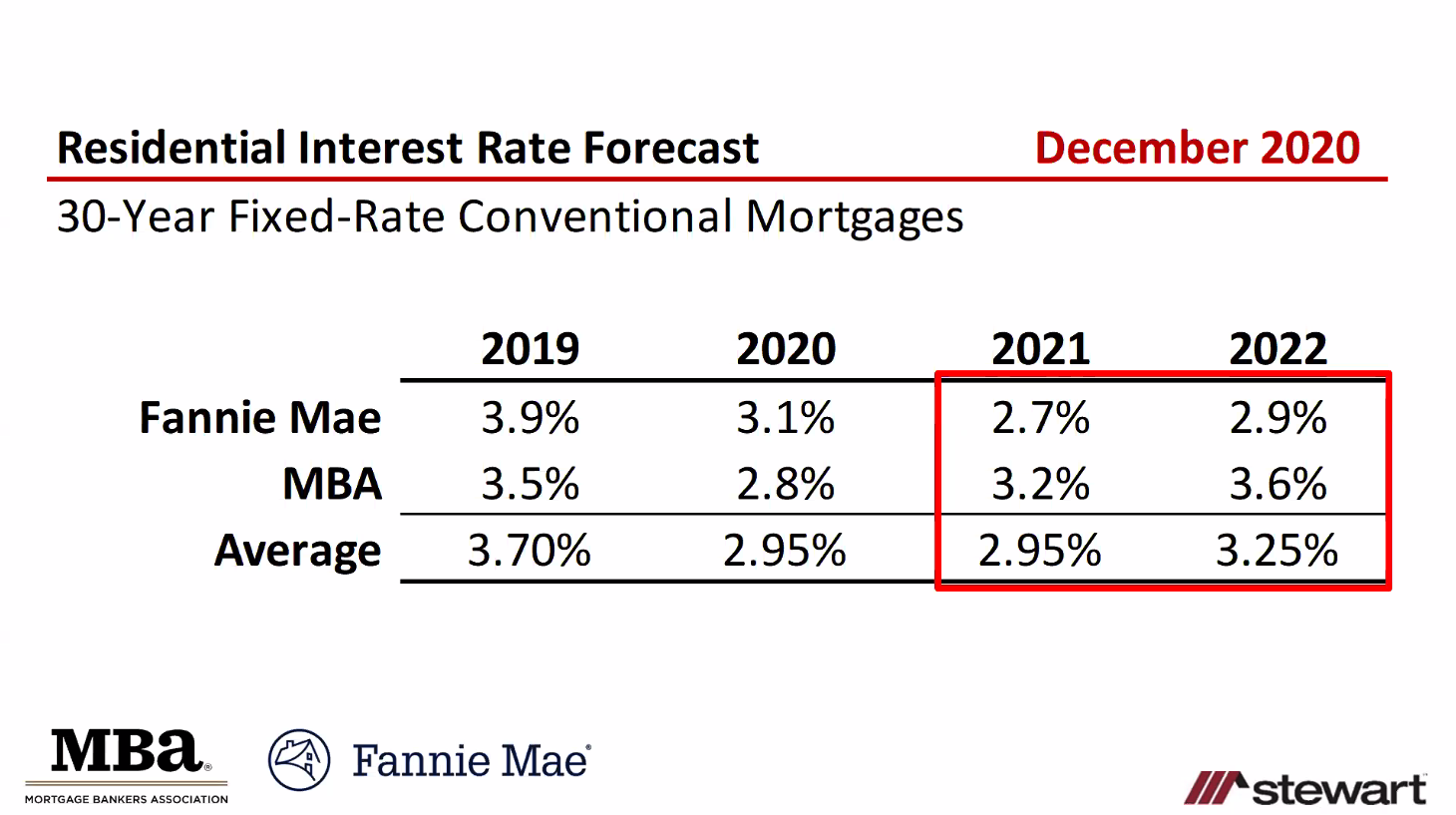

In addition, mortgage rates are at an all-time low. Some companies are offering 30-year fixed-rate mortgages for less than 2.3%.

Put another way, the monthly payments on a $500,000 mortgage are about the same as a $210,000 mortgage from the mid-1990s or a $300,000 mortgage from 2007.

For certain parts of the economy, usually in the upper-income brackets, they didn’t carry a lot of debt and they couldn’t go out to spend their money.

So, what did they do? Many increased their savings . . .

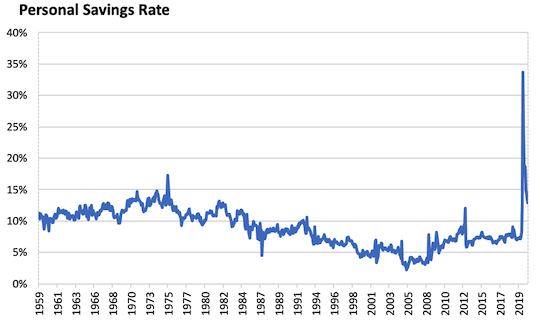

The personal savings rate averaged 7% from about 1995 - 2020.

Then COVID-19 hit, and the savings rate went to 34%.

It’s since dropped to 14%, but that’s still higher than any point in the last 50 years.

Said another way, American households have $1 trillion more in checking accounts than they did before COVID-19.

For comparison, they held about $800 billion in checking accounts a year ago.

Why Markets Boomed In a Year of Human Misery

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected].

First off, we had a huge increase in income.

Again - remember this is "on average, based on math."

So, if a corporate executive gets a $100,000 bonus for steering a company through a hard year, and four $25,000-per-year restaurant workers lose their jobs; the new impact on total compensation is zero. This is even though (in human terms) there’s a great deal of pain, shared unevenly.

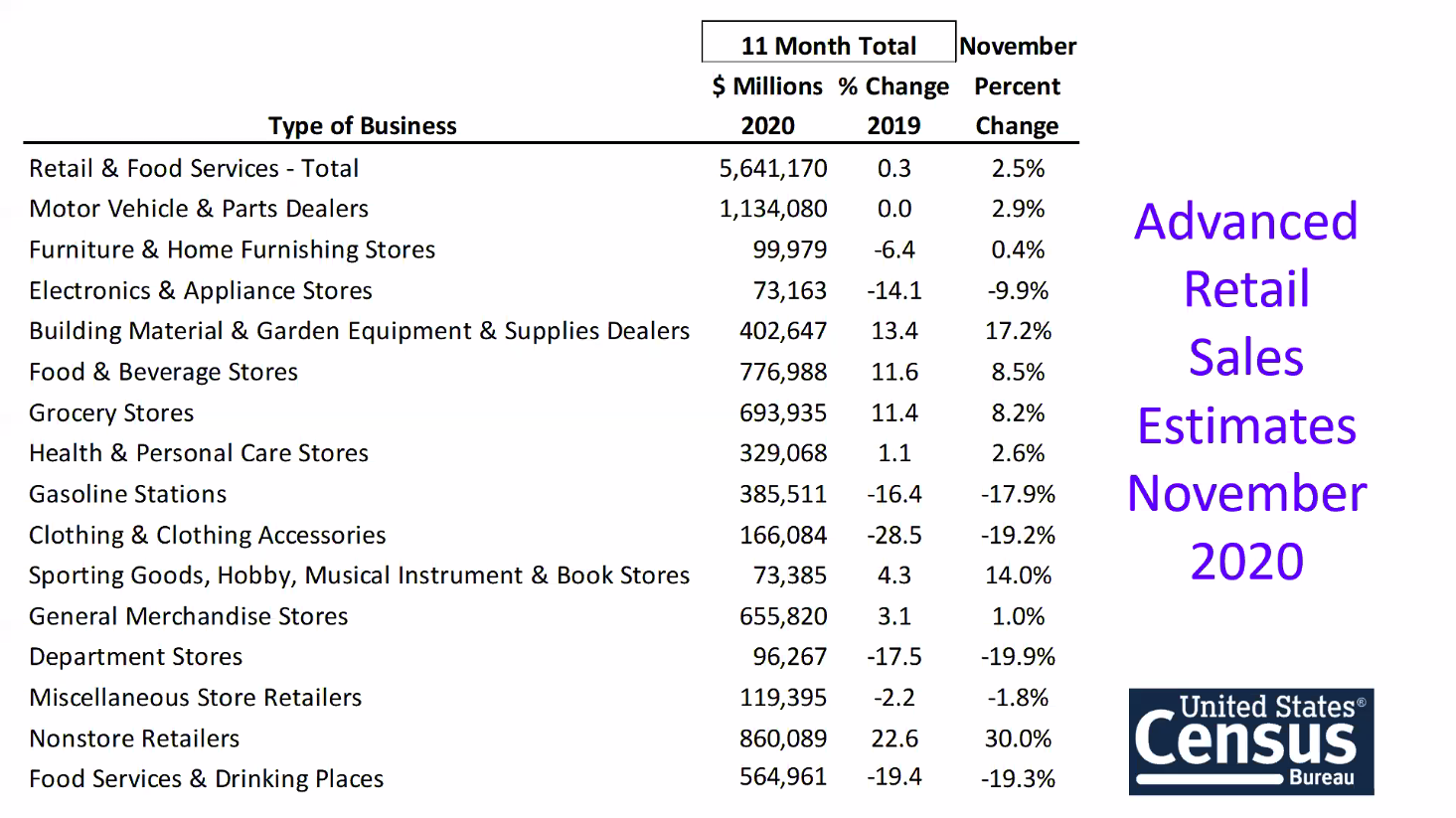

Second, we had a huge drop in spending.

Again - remember this is "on average, based on math."

That corporate executive above couldn’t spend his $100,000 bonus (because they couldn’t travel, shop at malls, or dine out), so he puts it in the bank because they didn’t need it for living. On the other hand, the four restaurant workers would still need to spend monthly payments for rent, food, transportation, and insurance. Again, no change from an “average math perspective” but it glosses over the human impact.

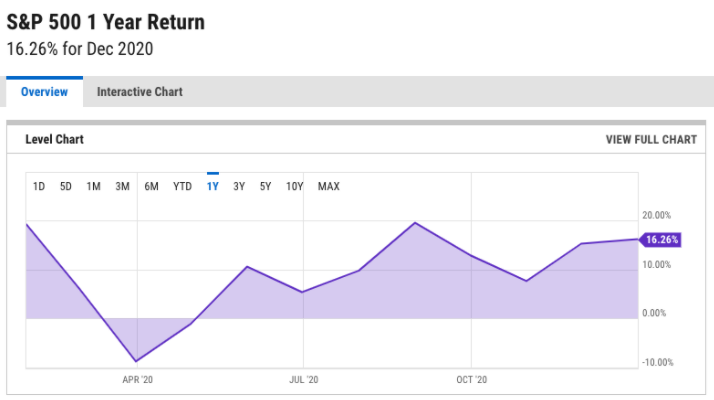

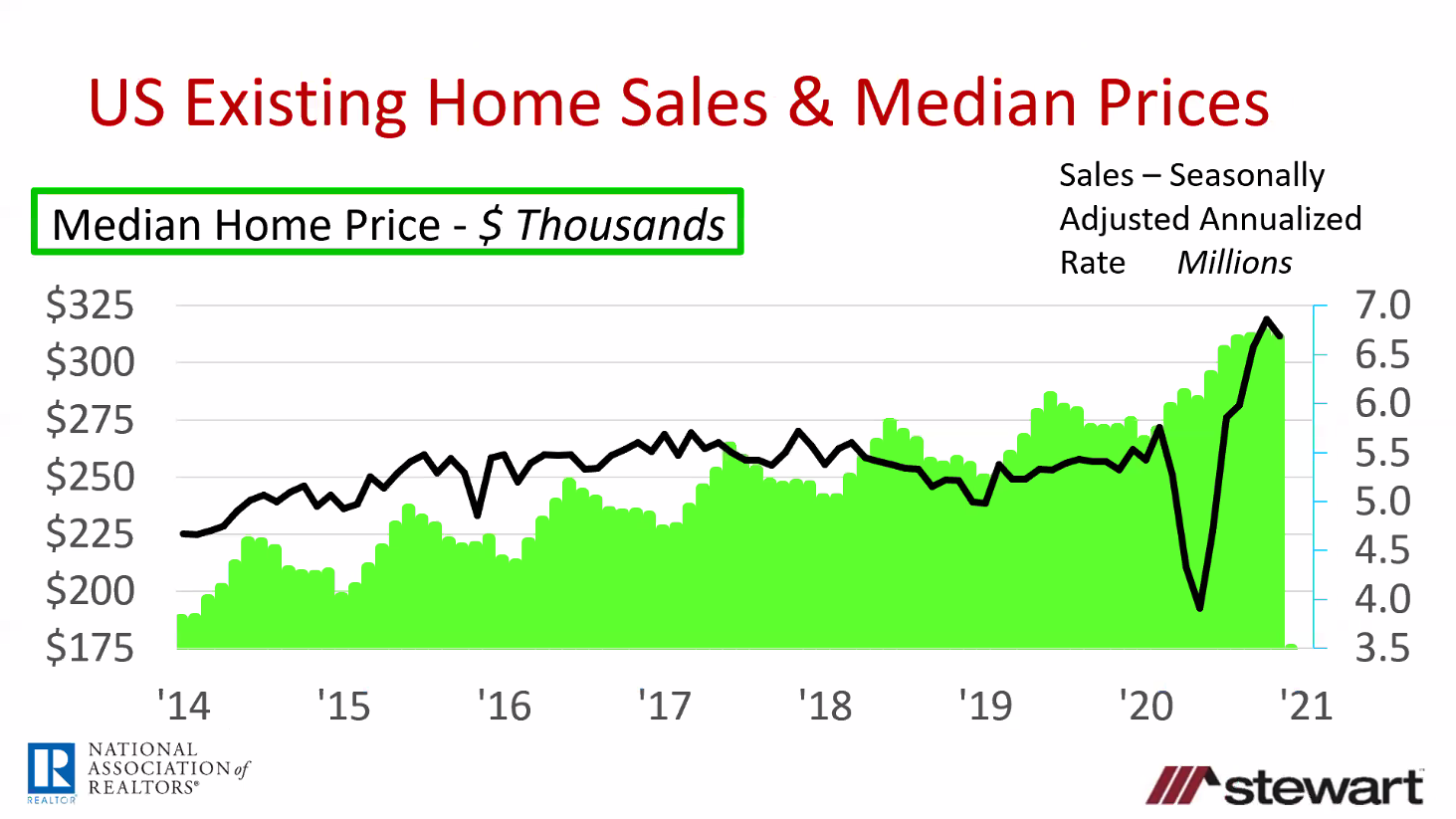

And for that group of people who had extra savings? Many of them invested their funds in the stock market (which was up 16%) and real estate (up to over 8% on average) last year.

There’s No Free Lunch

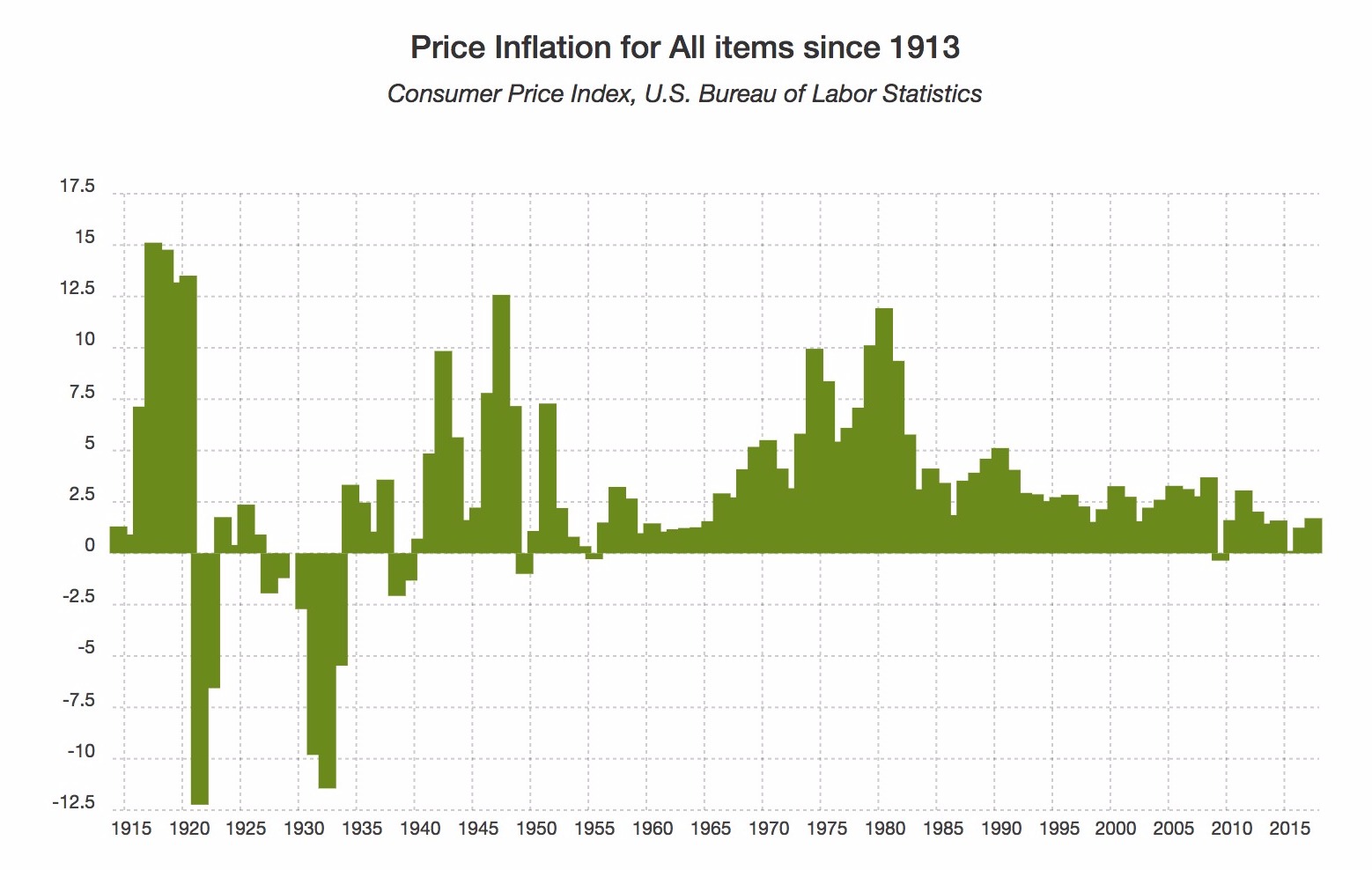

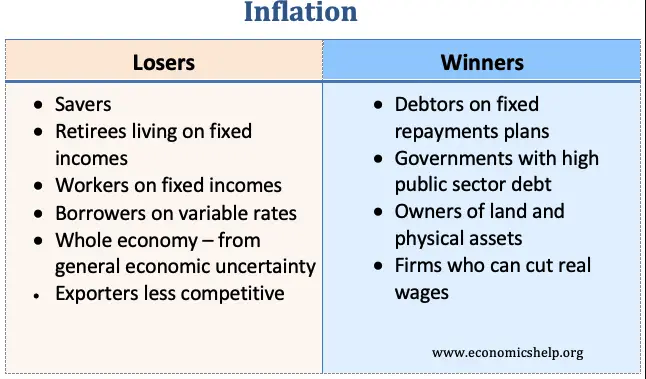

Inflation will also act as a tax on people’s assets. Those who buy a bond or a certificate of deposit expect a return of their purchasing power plus interest. However, in real estate, it should make the value of the assets larger in dollar terms. Real estate should be a good hedge for inflation.

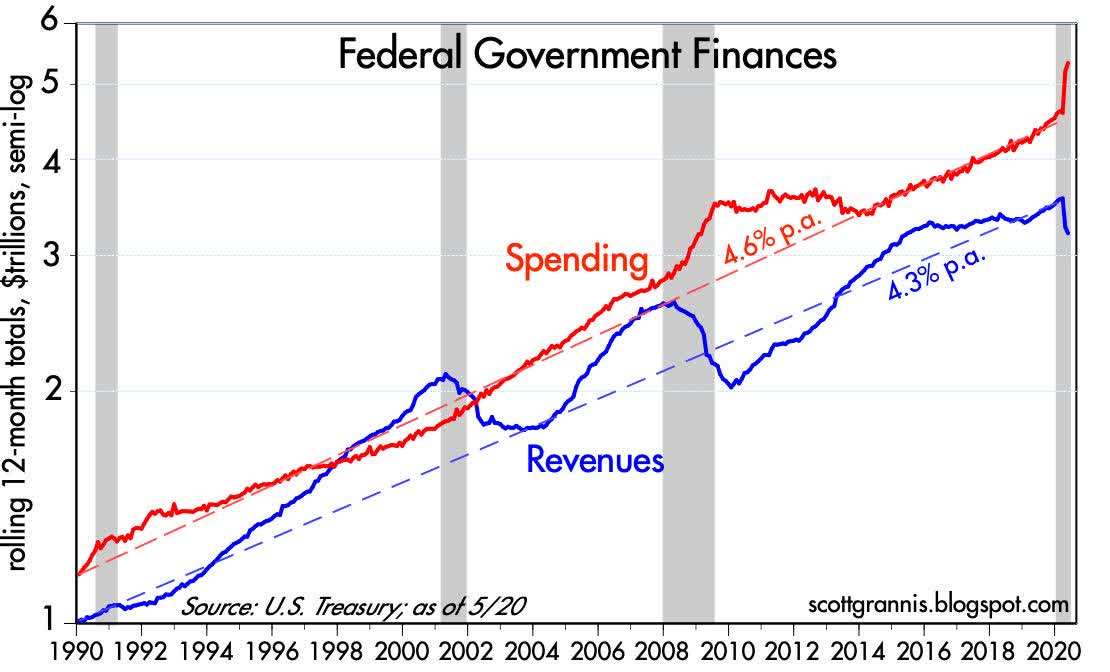

If the main growth in personal income came from the government, can’t they just do that every year?

If printing money was the answer to growing the economy, then Venezuela would be the richest country in the world.

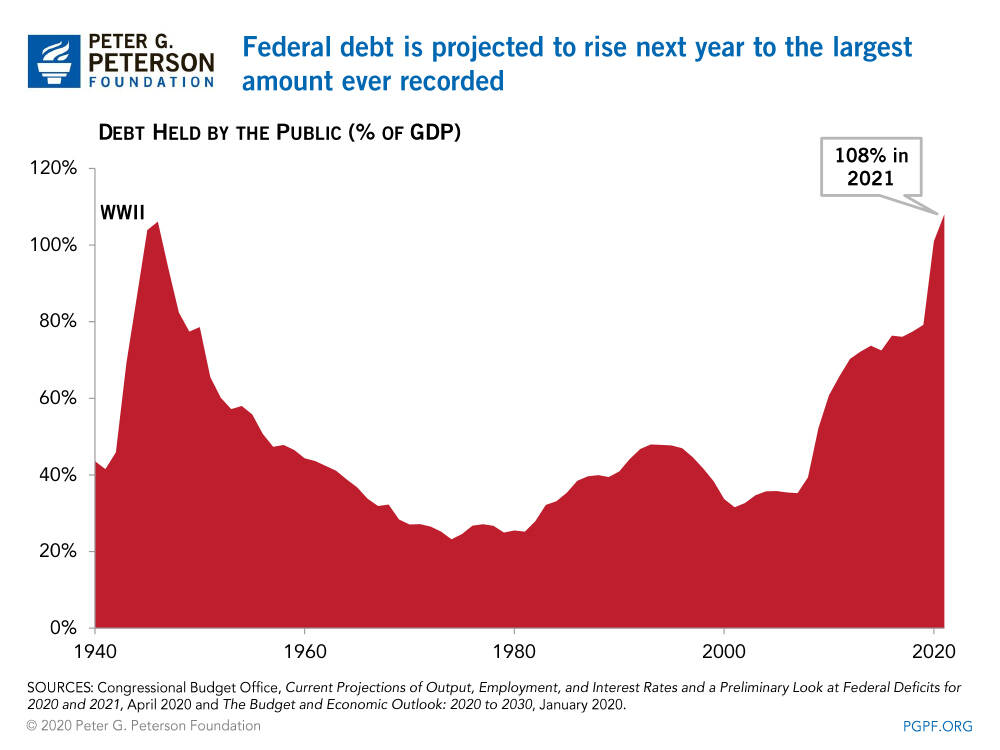

The debt level, both current and anticipated in 2021, is worrisome. However, we believe it’s not likely to trigger an immediate problem, as people and institutions are still buying US Treasuries.

The new spending raises the question: When will we see the rise of the problem from all of this money printing?

Economists are not very good at pinpointing the date of an upcoming crisis (and here at the Houston Properties Team, we don’t have a crystal ball either).

However, we can look to the past to guide us and teach us what to be wary of.

Historically, the US has enjoyed robust growth when debt was high. After World War II, debt held by the public reached 106% of GDP.

The worst possible result of too much borrowing is a debt crisis, which occurs when lenders won’t extend further credit to a country. The trigger point for a debt crisis is extremely difficult to pinpoint. For details, I’d suggest reading Ray Dalio’s Principles for Navigating Big Debt Crises.

In summary, borrowing rolls along just fine until, suddenly, nobody wants to buy the country’s bonds.

We believe that the US is a ways away from this as the US is the world reserve currency. However, it’s hard to be sure given that the threshold is very difficult to identify prospectively.

We believe the more likely problem from our growing national debt is that it converts into the money supply that fuels inflation.

Now, the US hasn’t suffered material inflation since the 1980s and much of the working population has never dealt with this problem in their lifetime.

Inflation will also act as a tax on people’s assets. Those who buy a bond or a certificate of deposit expect a return of their purchasing power plus interest.

In regards to real estate, on one hand, it should make the value of the assets larger in dollar terms (e.g. real estate should be a good hedge for inflation).

On the other hand, interest rates should rise, and since so much of real estate is financed, it would reduce the amount that buyers can afford to pay, thereby reducing demand for primarily financed properties.

The trillions of dollars of relief bills are not free. It will be paid back by the people of the country. We believe the bill won’t come due in 2021 and potentially not in 2022 either. However, eventually, we will have to pay the piper.

The Tale of Two Cities

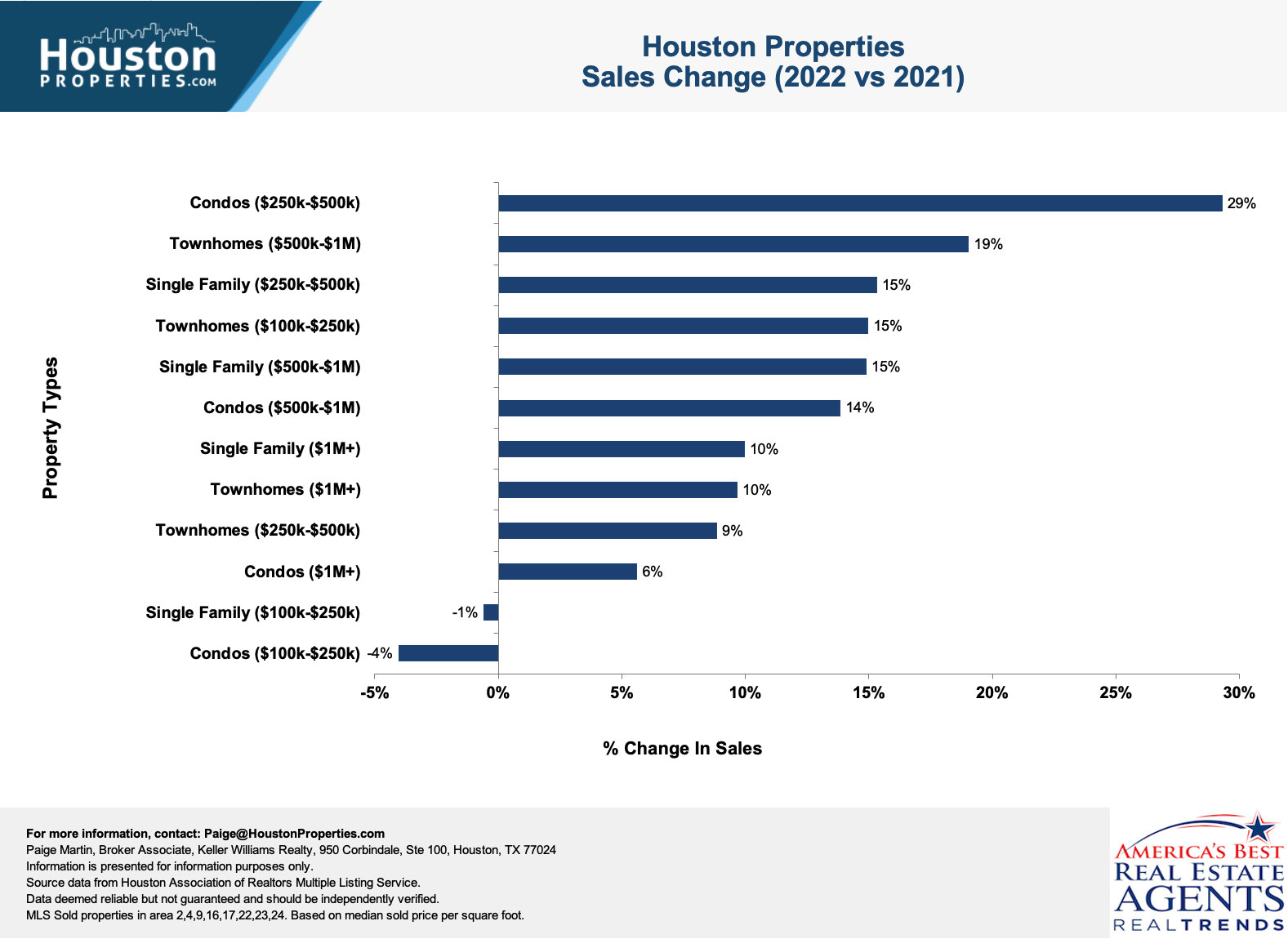

38% of homes bought and resold within 5 years in Houston have lost money for their owners on a net basis. We believe that we’re headed into another period of major macroeconomic instability, and it’ll have a big impact on different parts of Houston.

"Look, I just want to buy a house in Houston that’s not a bad investment. Why do I care about these economic policies?"

It’s a fair question.

In any recent period of economic turbulence (e.g. any five-year stretch in the last 25 years), there have been winners and losers.

38% of homes bought and resold within 5 years in Houston have lost money for their owners on a net basis. (See the worst mistakes here.)

**In addition, staying within five success themes would have allowed for 500%+ home appreciation over the average property over the past two decades (See the best investment themes here.) **

We believe that we’re headed into another period of major macroeconomic instability, and it’ll have a big impact on different parts of Houston.

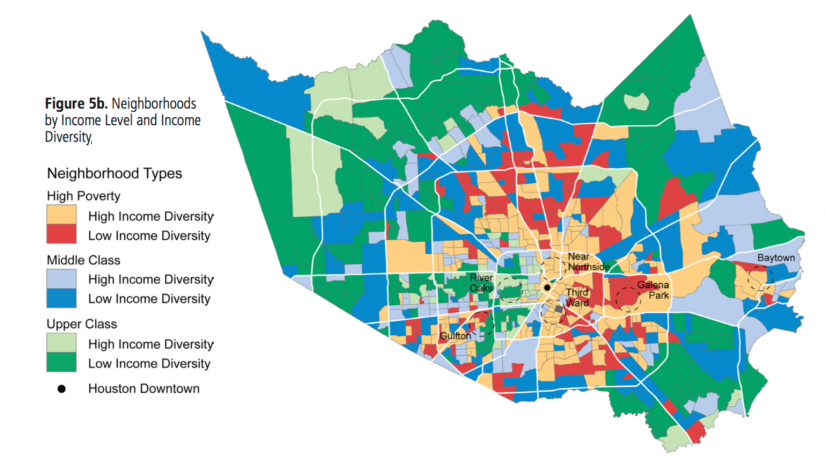

Notably, as you’ll see in the graphic above from the Kinder Institute, we live in one of the most economically segregated cities in the US.

Contact us for details and specific trends in your neighborhood.

So, when we look at all of the data above, here are our main predictions (legal disclaimers below: these are simply our opinions, and we don’t have a crystal ball):

- Specific neighborhoods with above average income, zoned to good schools that have historically been good stores of wealth will perform very well. This is because these buyers:

- Have liquidity (money to spend for down payments);

- Benefit from the lowest interest rates ever;

- Want real estate to serve as a hedge in their portfolio against inflation

- We are watching the “return to work” phenomenon closely. Notably (see the studies from Publicis Sapient and Cisco) nearly nine out of 10 workers want to be able to work from home “at least a few days a week.”

- Historically, proximity to one of the major job centers has been a big driver of land value.

- We believe that employers will be more flexible to “work at home” as it’s a way to offload costs to employees and try to find some balance between ‘together time” and “reduced commercial rents.”

- We think this trend benefits closer in suburbs zoned to good schools at the expense of congested inner loop neighborhoods with smaller lot sizes.

- We believe that specific close in neighborhoods characterized by “high poverty” with “high income diversity” (e.g. gentrification has started taking place) will appreciate greatly because:

- There is a plethora of investors with cash, looking to diversify out of the stock market and worried about inflation.

- They have access to down payments and cheap rates.

- These areas have many residents who don’t have access to down-payments or cheap credit, so they’ll continue to need to rent, further perpetuating a cycle of economic inequality.

- We believe a large part of the size of the appreciation here will be driven based on government action - both more stimulus and then also what new restrictions may be added regarding non-payment of rent.

- We also believe that there’s going to be strong appreciation for homes with the following characteristics:

- New / recently renovated to look “like HGTV;”

- Larger yards (equipped with pools, patios and outdoor grills);

- Open, first floor living plans integrating indoor / outdoor space;

- Larger properties with extra bedrooms and/or dedicated home offices

- Properties with a “flex room” (something that could be used for homeschooling, play room, home offices, media room, etc.)

- We also believe these trends will create limited appreciation for inner loop neighborhoods known for small lots, choppy floor plans, with lots of construction from the 1990’s - 2010, especially zoned to not-top-ranked schools.

How Is My Neighborhood Doing?

High-quality homes sell in nearly every market. Disadvantaged homes sell more slowly or at larger discounts. The Houston real estate market is hyper-local — contact The Houston Properties Team for tips on how to navigate it.

"Which Houston neighborhoods are hit hard by COVID-19 and oil price crash?"

"Which areas in The Bayou City are doing well despite the pandemic and economic downturn?"

"How is my neighborhood doing? Should we expect sales to go up or down this year?"

We get these questions on a daily basis.

Houston real estate is hyper-local, some areas are doing better than others. Our response to these questions will be on a case-to-case basis.

Properties are still going under contract. We are still seeing listings receive multiple markets.

Based on last year's sales data, the number of homes that have gone under contract is still consistent with figures prior to the coronavirus and the oil price crash.

With that, regions tied heavily to oil and gas are areas of concern. Neighborhoods like Energy Corridor and The Woodlands still haven't recovered from 2015 (although the latter should benefit from the recent news about HP relocating to The Woodlands area).

Oil prices have crashed to levels not seen in decades, meaning gas companies are operating at a loss and will need to make sizable personnel cuts.

We’re already having conversations with our clients in the industry. Given the volatility of the situation, the urgency of the response is critical.

Regardless of the economic and political climate, our approach has been the same: Every situation is unique.

We use data to create custom solutions for our clients, present this to them, and have candid conversations on what they should do given the situation.

What To Do As A Homeowner?

Whether you buy or sell first depends on the current market and your unique situation. Our experience taught us to make the proper assessment out of the overall scenario every homeowner is in. Contact us to help you make the most viable decision.

While 2020 has been a record year, the Houston housing market is still facing a lot of uncertainties.

We expect a nationwide drop in home values as home inventory continues to shrink and we start to feel the economic impact of last year's mishaps.

Historically, the housing market has been able to bounce back strong from economic downturns (see graph below). As long as you don’t have to sell in a short time you should be able to ride this out.

As with any downturn, there's a flight to quality. Quality homes should rebound strong:

- Located in quality neighborhoods that have good proximity to major job centers;

- Large lots (the primary value is the land value);

- Not located on a busy thoroughfare, near a highway or near a railroad;

- A street location with some kind of premier feature (by a cul-de-sac, on a street with a tree-filled median, etc.); With a home that is liveable and rentable. Typically, new construction homes come with a higher purchase premium, and repair and maintenance require too much investment.

Buyers Beware?

With over $500 Million Houston residential home sales, the Houston Properties team can help you find the best property for you and your family. Contact us for a custom report on the Houston real estate outlook for this year.

Not at all, but tread with caution.

In general, buyers should still be in a good position to get great deals... If they know where to look and are getting good advice.

Buyers still have two big advantages:

- Interest rates are at an all-time low

- You're going to start seeing great deals in good locations in the next 3-6 months

However, we also expect to see a lot of fake deals. There will be plenty of buyers who will think they got a good deal, only to find out it's a disaster later.

The market will see an influx of price drops and hikes due to low inventory and high demand. On the other hand, properties that have been sitting on the market for a while even BEFORE coronavirus and the current energy crisis will be slashing prices left and right.

Buyers should be wary of "seemingly good deals on paper". We typically guide our clients to watch out for the 9 Kisses Of Death For Resale when shopping for a home.

I May Need To Sell. How Does This Affect Me?

The Houston Properties Team ran a study of past shocks (Hurricane Harvey, 2008 Crash, 2015 Oil Crash) and how it reshaped the market. For a copy of this research plus current trends in your neighborhood, email [email protected].

2020 ended favoring sellers. We saw historically low home inventory buoyed by low-interest rates.

This year should start following the same trends, but we expect the market to slow down considerably as the year progresses.

The market should be soon flooded with sellers and builders looking to take advantage of last year's trends. Our advice for those who need to sell: Sell now and move fast, before the market turns.

What we see from past experiences is that people who sell in the short term, while they may not make as much as they want, do much better than those who sell in 18-24 months down the road.

This is because people who got on the market first, reset the comps lower.

The typical real estate purchase process takes about 4-6 months (including being under contract for ~30-45 days). Any data showing any market impact won’t begin to show up for at least 3 months.

Historically, it has taken 18 months before there is a material impact on the real estate market (e.g. after the 2008 crash, average home prices still increased for ~12 months).

This means home sellers who can get on the market early has a distinct advantage over those who will opt to wait. Homeowners who absolutely need to sell, NEED TO GET OUT EARLY.

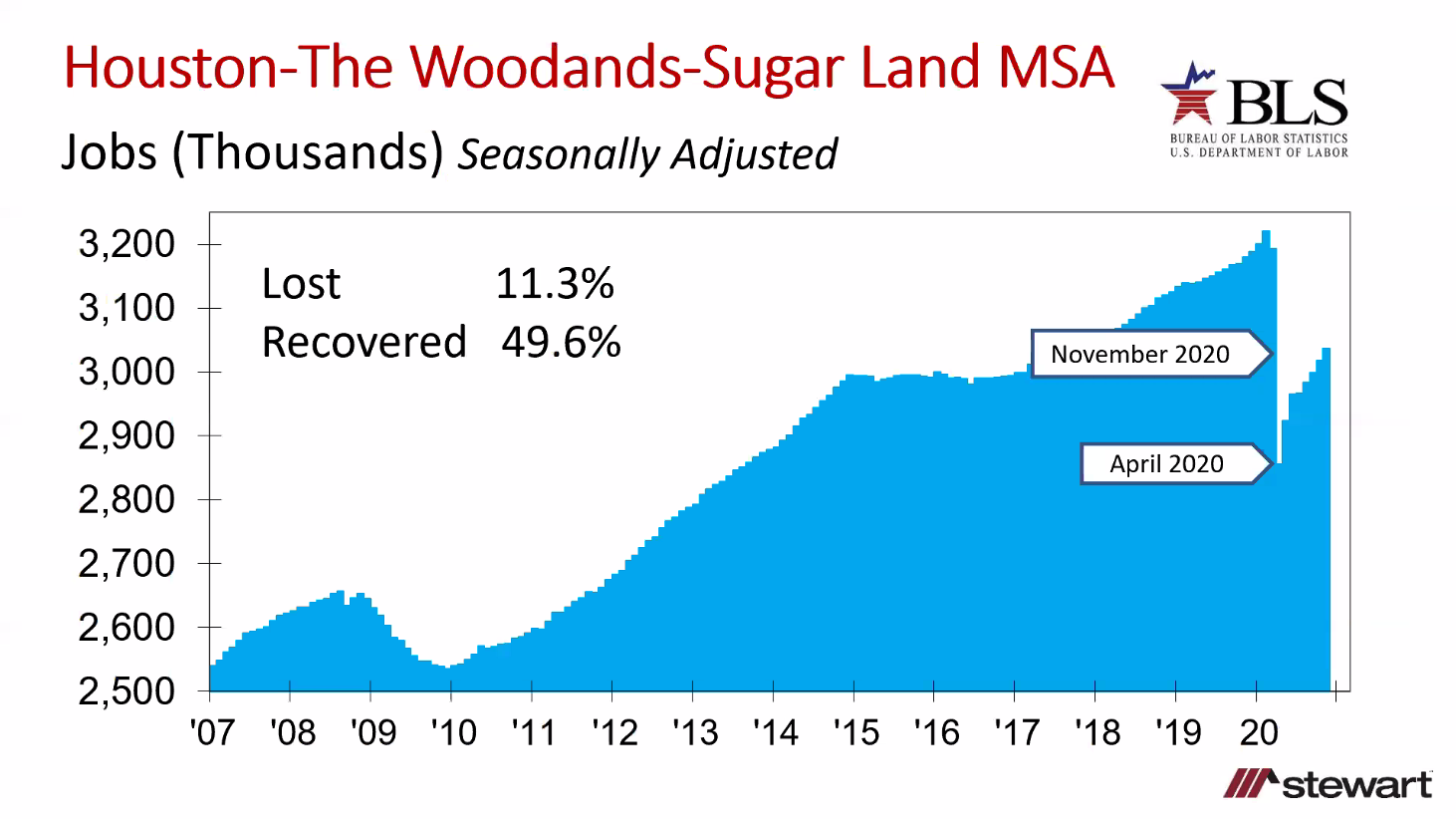

Job Losses In Houston: Areas And Industries At Risk

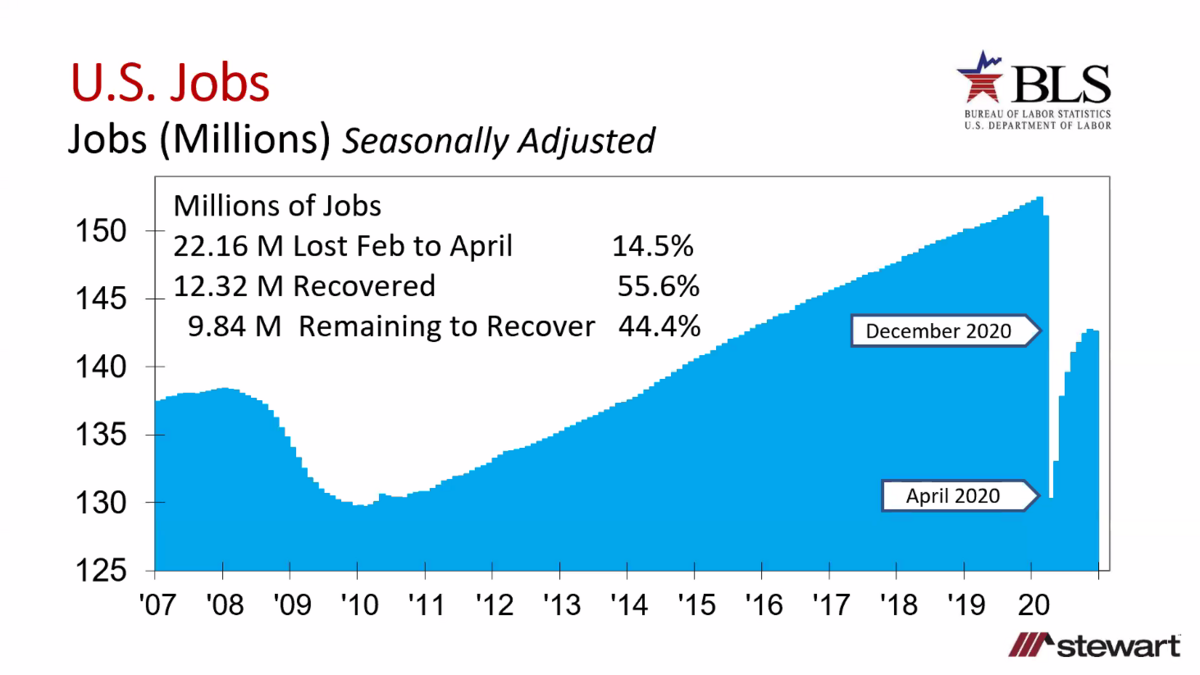

The #1 determining factor for the real estate market is job growth. In the 2nd quarter of 2020, the coronavirus global pandemic and the oil price crash has significantly reshaped all industries all over the city.

COVID-19 and the oil price crash obviously had a heavy impact on Houston employment rates.

Houston remains around 140,000 jobs short of its pre-pandemic employment levels.

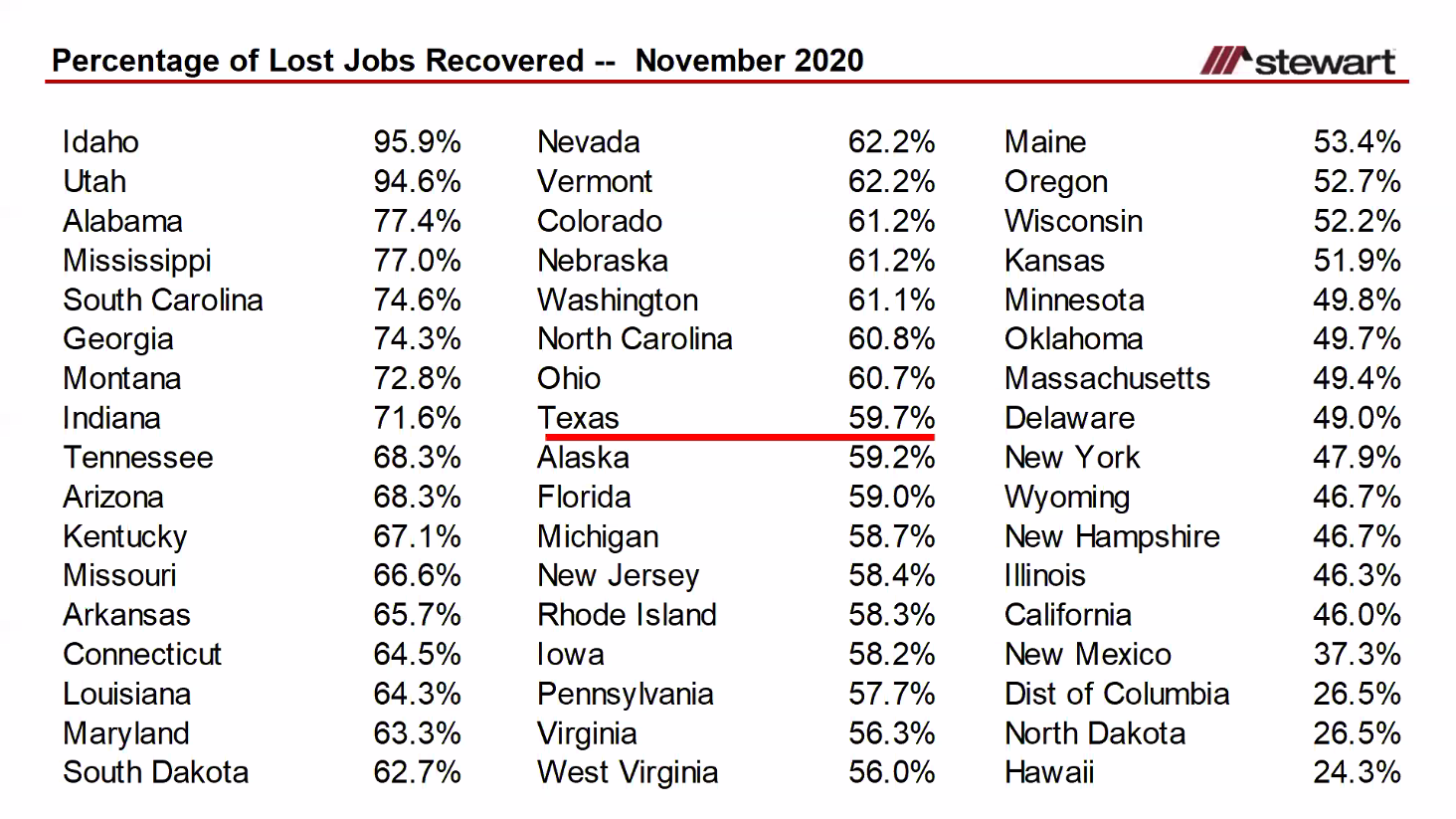

On the positive side, we have recovered around 50% of the total jobs lost last year.

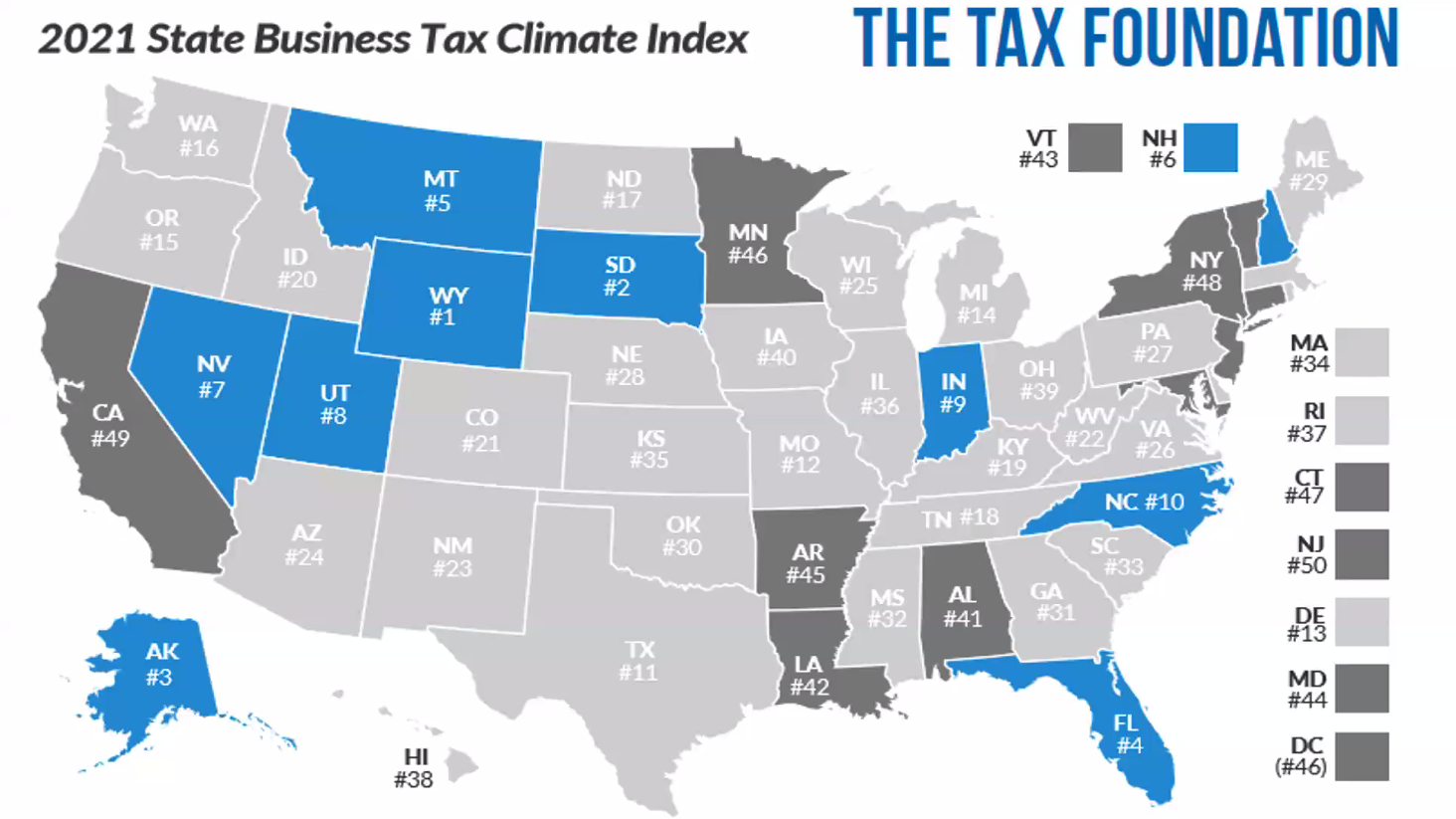

Looking at migration trends, Houston is still one of the top destinations for relocation. Employment was one of the main drivers, and it shows Houston is now less dependent on the oil and gas industry:

- 1 in 3 manufacturers in Texas are located in Houston

- We’re ranked as the #1 seaport in North America

- Houston is home to over 500 tech companies

- Our city has the largest medical facility with over 360,000 healthcare professionals

- Houston has the 4th highest # of Fortune 500 companies

- 35% of publicly traded oil and gas companies are located in Houston

Texas is still among the tax-friendly states and it's also spurring relocation.

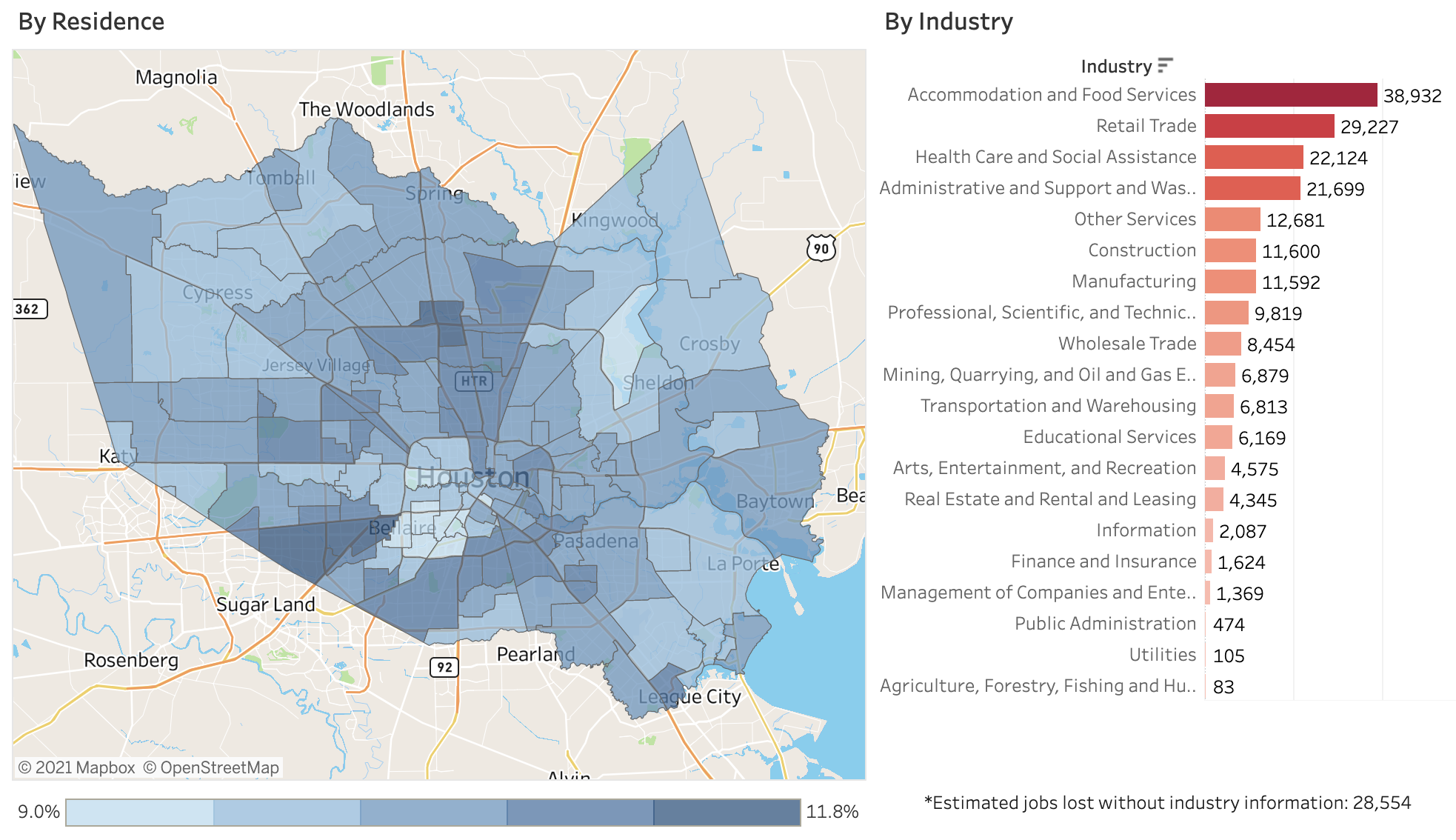

Kinder Institute's Houston Community Data Connections details the job-loss estimates across Harris County neighborhoods. Key takeaways include:

Estimated # of workers who lost jobs range between 8% to 11%

Accommodation and Food Services lost over 38,000 jobs; Retail dips by over 29,000

Areas (Sharpstown, Gulton, Greenspoint, etc) with a high number of people working in retail suffered significant job losses

Job losses in retail are quite even all across Harris County, except the west side of the Interstate 610 loop

Low-income renters are among the most vulnerable populations. In some regions, more than 60% of renters allot over 30% of their income on rent

Oil & Gas Having A Bigger Impact?

In a $20 oil environment over 500 US oil exploration and production companies will file for bankruptcy in two years. At $10, that number would more than double. That could fuel a recession.

The coronavirus pandemic has hit the "pause" button on the global economy, pushing oil demand to drop - we're literally running out of room to store barrels. Russia and Saudi Arabia flooded the world with excess supply.

This double whammy has put the American oil industry in a difficult position.

US crude turned negative at one point last year. This has never happened since NYMEX oil futures began trading in 1983.

The oil price crash is hitting Houston harder than most cities. While we are a lot less dependent on oil (compared to the '80s, about a third of the total jobs in Houston are tied to the industry.

Dirt-cheap oil could continue to unleash a wave of bankruptcies, furloughs, and layoffs.

A good number of oil companies took on too much debt during the good times. Quite a few of them won't be able to survive this historic downturn.

According to analysts, in a $20 oil environment over 500 US oil exploration and production companies will file for bankruptcy in two years. At $10, that number would more than double. That could fuel a recession.

Sources, Methodology & Disclosures

Houston real estate is hyper-local. For advice on the 2020 Houston housing market forecast, contact Paige Martin, the #1 Keller Williams Realtor in Houston and #1 Realtor in the state of Texas.

- All Houston home value information was sourced by the HAR MLS database.

- National Association of Houston Realtors Research Group: 2019 Home Buyers and Sellers Generational Trends Report

- The 3 R's Of Real Estate And The Economy (2021 Market Forecast) by Ted C. Jones, PhD

- Greater Houston Partnership

- Bureau of Economic Analysis

- New York Times

- Data is deemed accurate but is not guaranteed. Information is provided for informational purposes only.

- We don’t have a crystal ball. All predictions are our educated guesses. Caveat emptor.

Top Ranked Realtors: Paige Martin & The Houston Properties Team

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked amongst the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including: The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, and has completed over $500,000,000 in Houston residential real estate sales.

Recent awards include:

- 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

- 2020: #6 Individual Agent, Keller Williams, Worldwide

- 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

- 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtor in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtor in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

. . . in addition to over 318 additional awards.

Paige also serves a variety of non-profits, civic and community boards and was appointed by Houston’s Mayor to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our Team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses and showings. Each Houston Properties Team member is a specialist in their role – which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- ability to be in two or three places at one time: a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advise and marketing of agent expert in your area

- competitive advantage by simply having more resources, ideas, and more perspectives

- a “Checks and Balances” system. Selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster successful sale

- efficient multi-tasking: One agent takes care of inspections and/or repair work, while another agent is focused on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased Sphere of Influence and exposure to more potential buyers.

To meet all the award-winning members of The Houston Properties Team, please go here.