Study: Houston Real Estate And Inflation

What the historical data tells us about using real estate to hedge against inflation in Houston

Headlines these days are worrying. Inflation is at its highest in 40 years.

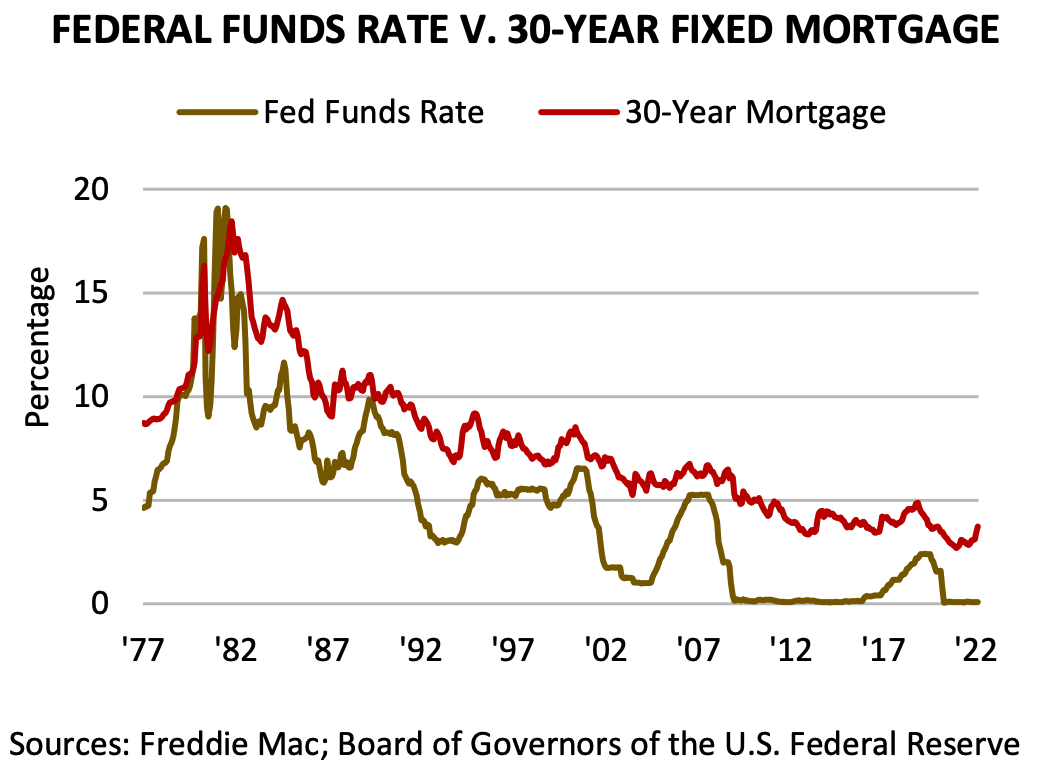

While the Fed has started raising interest rates, there's no sign of inflation slowing down soon. [See Salary Needed To Buy A Home In Houston].

This raises an important question: how do you protect yourself against it? One option is to include assets in your portfolio to hedge against inflation.

During periods of high inflation, history has observed some winners and losers:

- Winners: stocks (depending on starting valuations), real estate, and commodities

- Losers: loans, bonds, and any fixed income streams

In this analysis, we've specifically focused on the benefits of owning Houston real estate.

Real estate can be an inflation hedge for three reasons:

- Real estate holds intrinsic value

- Fixed-rate mortgages are paid back in "cheaper dollars."

- For investors, rents typically follow the inflation rate

We'll get into more detail on these three reasons later on.

There's no underestimating how inflation can be frightening and powerful over time. In addition, we've included information on why it's likely Houston should continue to benefit from population growth and a strong economy. The #1 predictor of future real estate prices is job growth.

If you have any questions about how this may impact your family, please contact Paige Martin, founder of the Houston Properties Team (Houston's #1 Boutique Real Estate Team).

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected]. Paige Martin is the #1 Individual Agent with Keller Williams in the State of Texas and team lead of The Houston Properties Team.

Table of Contents

- What Is So Scary About Inflation? Here Are Examples.

- Inflation Explained

- What Is Driving This Inflation?

- How Long Do Inflations Like This Last?

- Benefit #1: Real Estate Holds Intrinsic Value

- Benefit #2: Fixed Rate Mortgages Paid Back in “Cheaper Dollars”

- Benefit #3 (For Investors): Inflation Impacts Rental Rates

- Why Houston Real Estate Should Outperform Inflation

- Impact Of The Russia-Ukraine Conflict

- Data Sources and Disclaimers

- Paige Martin and The Houston Properties Team

What Is So Scary About Inflation? Here Are Examples.

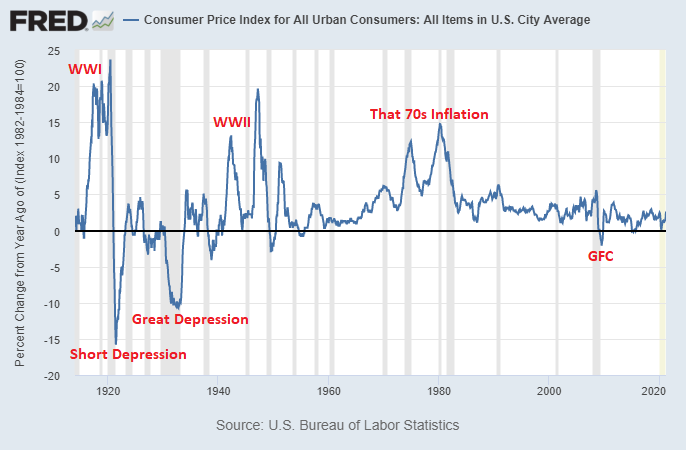

US inflation is at its highest since 1982. Most Gen X, Millennials, and Gen Zers have never had to “do the math” of the impacts of inflation.

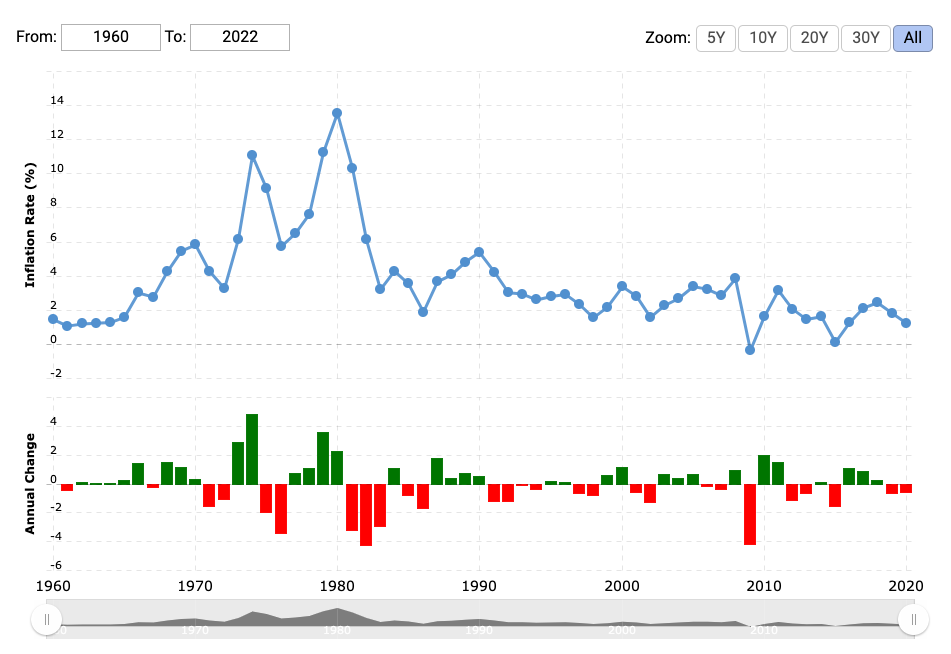

U.S. Inflation Rate 1960-2022

From the early 1990s through 2020, US inflation averaged about 2% per year.

Most Gen X, Millennials, and Gen Zers have never had to “do the compounding math” of the impact of longer-term high inflation rates on assets and liabilities. It’s enormous.

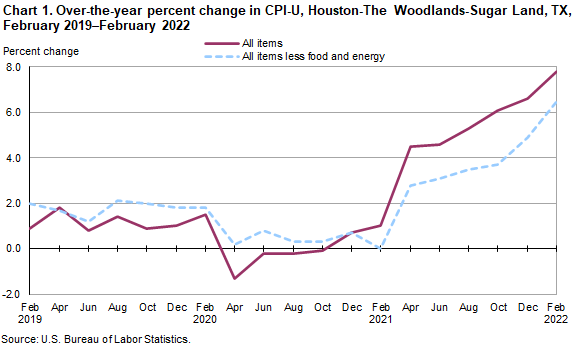

The annual inflation rate for the United States is 7.9% for the 12 months ending in February 2022—the highest since January 1982.

The last time inflation initially went over 6% in 1973, it took 10 years (until 1983) to bring it back under 5%. From 1973 to 1982, US inflation averaged 8.75%.

Benefit #1: Examples For Real Estate Holding Intrinsic Value

If inflation averaged 7.9%, and real estate had 0% appreciation above inflation: 2022 2027 (5 years) 2032 (10 years) Houston Home Price (Avg) $395,871 $578,976 $846,775 Houston Home Rental (Avg) $2,052 $3,001 $4,389

Benefit #2: Fixed Rate Mortgages Paid Back in “Cheaper Dollars”

Anyone with large, fixed-rate debts like mortgages benefits from higher inflation. These interest rates are locked for the life of the loan (meaning, they don’t change with inflation).

These mortgages are paid back with future “devalued dollars.”

If inflation averaged 7.9%: Today Value In 15 Years In “Today’s Dollars” Value In 30 Years In “Today’s Dollars” $350,000 $111,878 $35,762 $500,000 $159,826 $51,089

As the table above shows, the value of $350,000.00 will be reduced to $111,878 in today’s dollars in 15 years. That's assuming if the inflation rate averages at 7.9%.

This is an enormous benefit to debtors.

- You still have to pay back the loan in nominal terms (for example, the loan is $350,000).

- However, the “real terms” of paying back in 15 years have been reduced ($350,000 to $111,878).

If mortgages are devalued against inflation, and home prices stay consistent with inflation home equity, values go up quite a lot.

When you evaluate the possibility of this happening in the US, remember:

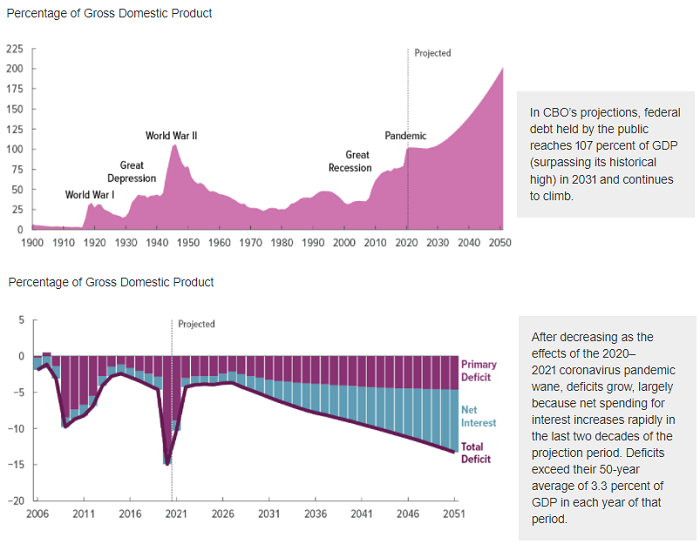

- The largest debtor is the US government has over $30 trillion in debt.

- Running inflation at 7.9% over 15 years would reduce that debt's “real value” to $9.59T.

Inflation Explained

Inflation has a “deflating effect” on debt. As home prices increase over time, it lowers the loan value of any mortgage debt. This acts as a buffer to price inflation (like a natural discount). So, in a sense, mortgages are paid in “cheaper dollars”.

Inflation is a loss of purchasing power over time—your dollar will not go as far tomorrow as it did today.

Let’s pretend that you have $5 in your pocket and you want to buy a loaf of bread. If you decide to buy it now, it will cost $2.50. You could buy two loaves of bread.

If you decide to save the $5 and use it to purchase bread later instead, there’s a chance that it won’t cost $2.50 anymore. It could cost $3. By then, you can only buy one loaf of bread. Your purchasing power has decreased because of inflation.

Consumer price inflation refers to basic consumer goods and services going up. Imagine paying $3 for a sandwich five years ago and $4 for the same sandwich this year. The price has inflated at 25%, with an average annual price inflation rate of 4.56%.

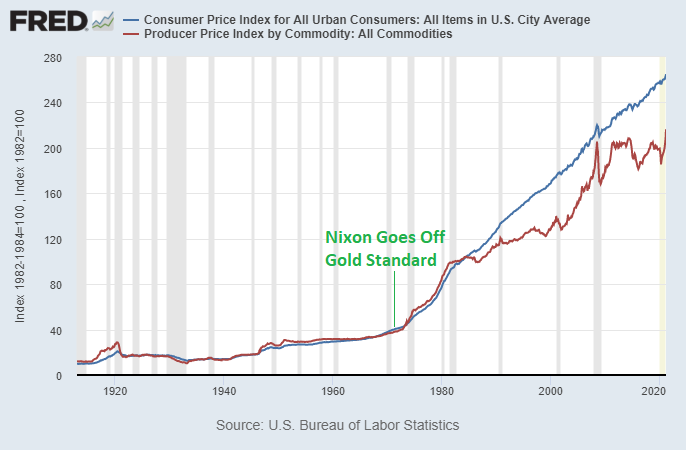

The table below lays out the consumer price index and the commodity producer price index since 1913, which is the founding year of the Federal Reserve.

Lyn Alden explains the table in layman's terms: "What that consumer price index chart shows, is that a basket of goods that would cost $100 in 1982, would cost $265 today, and would cost about $10 in 1913. The price of a basket of goods, in other words, has risen over 26x from 1913 to today in dollar terms."

What Is Driving This Inflation?

You can potentially beat inflation if you’re buying in areas with historically good land value appreciation. You get more value out of your money as the equity on the house rises, but your fixed-rate mortgage payments remain the same.

Inflation can come about from various sources: supply chain issues, surging demand, production cost increases, and government policy. If an economy is running hot—one where many people have extra cash or credit and want to spend—it can lead to inflation.

One of the common causes of inflation worldwide is when the government creates money.

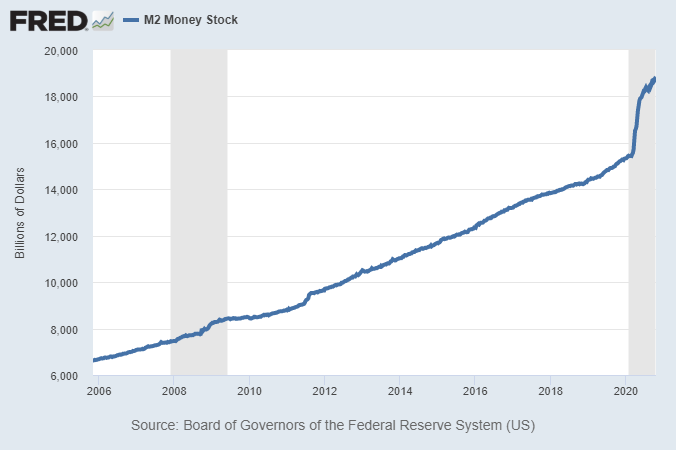

As you can see in the graph above, the US money supply (M2) was about $7 trillion going into the Great Recession.

After government policies brought about by the Great Recession and Covid-19 were implemented, the amount of money stock in the US is up to about $20 trillion.

That’s A LOT of new dollars.

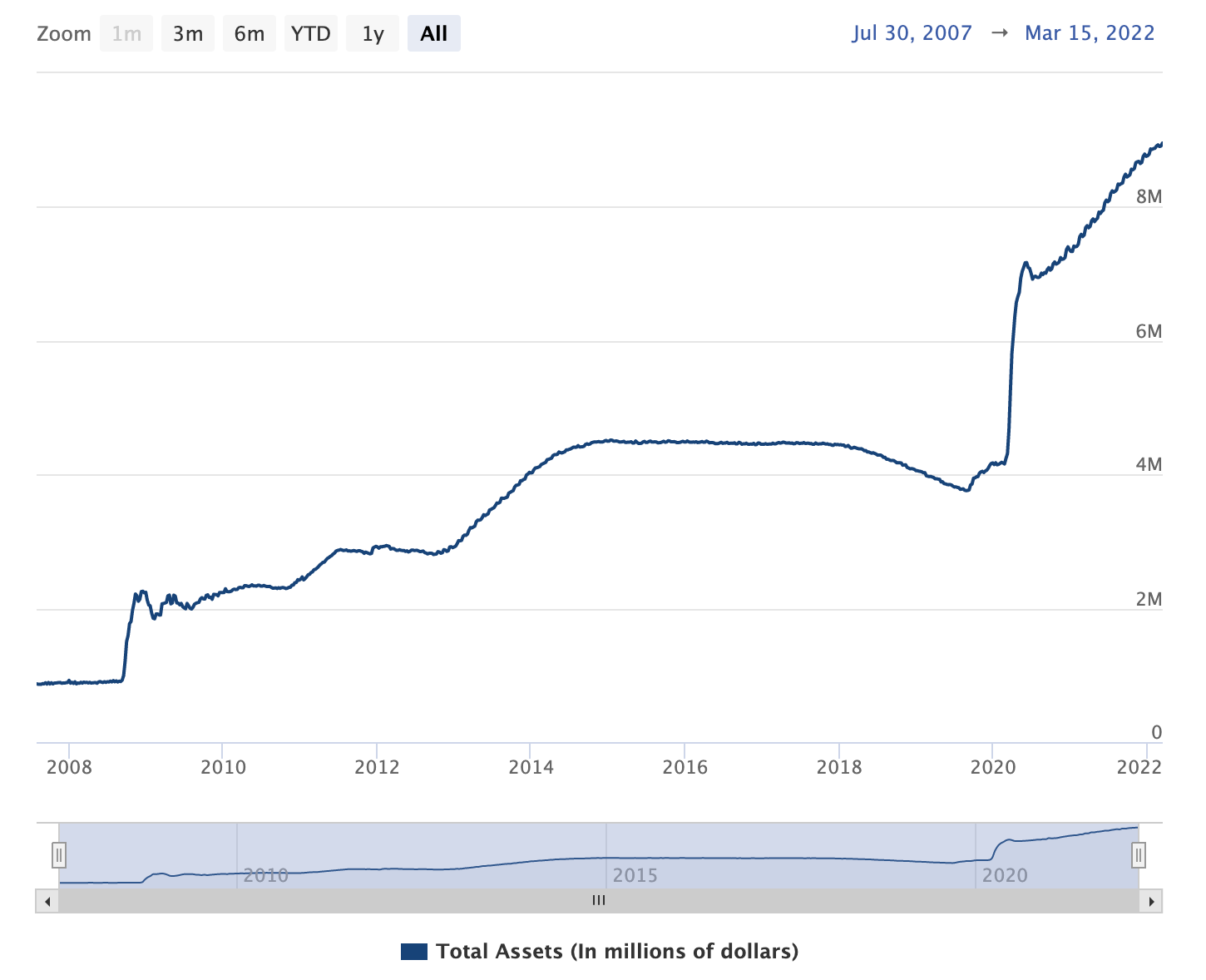

The Fed alone has created about $4 trillion in new dollars since January 2020.

Here’s a simple model to help you visualize how big a trillion dollars is:

- Million dollars: $10 a second for 28 hours

- Billion dollars: $10 a second for 38 months

- Trillion dollars: $10 a second for more than 3,000 YEARS

The scale of a trillion dollars is almost incomprehensible.

How Long Do Inflations Like This Last?

Good properties (those with long-term value) will always be good protection against inflation because they will continue to appreciate in value. Historically, real estate keeps up with or exceeds the rate of inflation.

No one knows the answer to how long inflation will stay around. However, we can make predictions based on history.

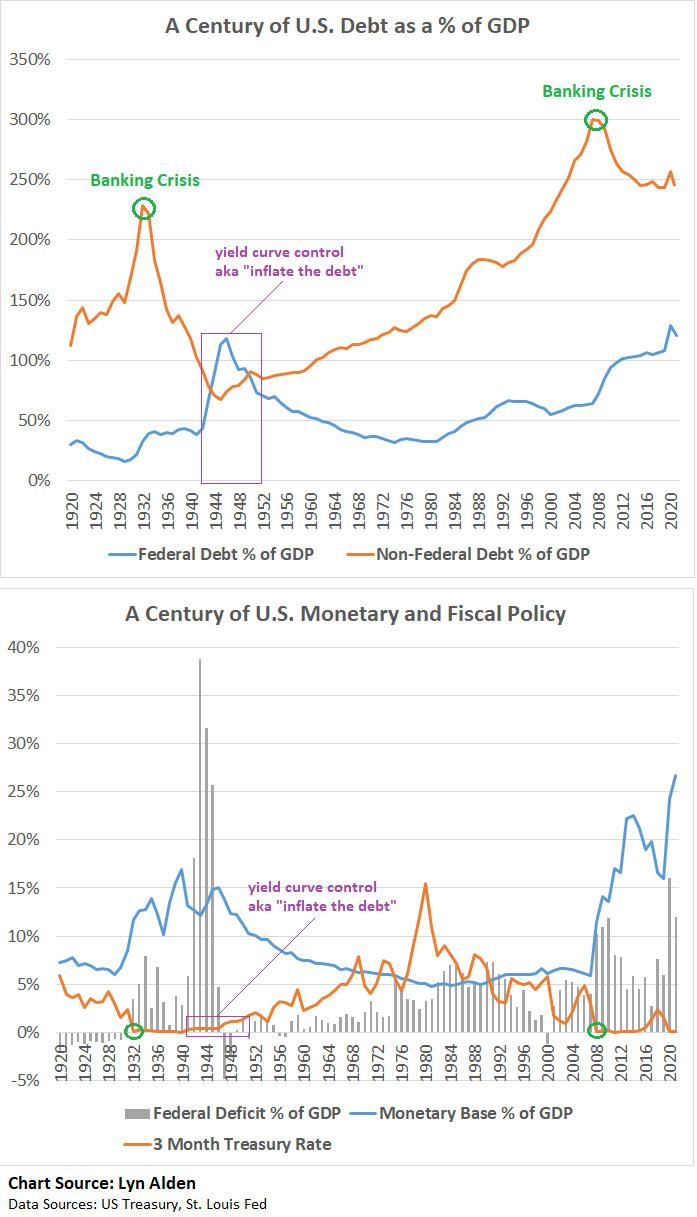

Historical data reveals that the last time the US debt was as high on a % of GDP basis was after WWII.

At the time, the US held interest rates below inflation rates for about a decade to reduce the total debt burden.

We can draw some correlations and projections here, but there are plenty of variables at play unique to our situation today. How does an economy bounce back from a pandemic? What happens while and after the ongoing Russia-Ukraine conflict?

Benefit #1: Real Estate Holds Intrinsic Value

High-quality homes sell in nearly every market. Disadvantaged homes sell more slowly or at larger discounts. The Houston real estate market is hyper-local—contact the Houston Properties Team for tips on navigating it.

Good properties with long-term value will always be good protection against inflation because they will continue to appreciate. Real estate keeps up or exceeds the rate of inflation. In addition, long-term mortgages cost less because they're paid back in "future, less valuable dollars." Real estate does well mainly because the leverage attached to it gets melted away from inflation.

There may be a limited supply of properties in dense, urban neighborhoods and a lack of available land to build new structures on. Real estate holds intrinsic value because it is scarce and always in demand.

Assume that a made-up country has $1 million of total currency and that there are 50 properties with no other goods or services available. Each house would be worth $20,000, assuming they are all identical.

Now, pretend that that country's central bank printed an additional $1 million in one day. That economy will now have a total of $2 million. Each home doubles in value at $40,000. Money printing is one of the factors that create inflation. It can also cause real estate prices to rise.

This is good news for current property owners, as demand for real estate does not generally decrease, even when inflation rises. In fact, property values might increase, given the rising cost of materials and labor to build a comparable structure. Building material prices have increased by over 19% during the past 12 months and 13% year-to-date, according to the National Association of Home Builders (NAHB).

Benefit #2: Fixed Rate Mortgages Paid Back in “Cheaper Dollars”

Long-term mortgages “cost less” because they’re paid back in “future, less valuable dollars.” Real estate does well, mainly because leverage attached to it gets melted away from inflation.

Inflation has a “deflating effect” on debt. As home prices increase over time, it lowers the loan value of any mortgage debt.

This acts as a buffer to price inflation (like a natural discount). So, in a sense, mortgages are paid in “cheaper dollars.”

This is especially the case if you’re buying in areas with historically good land value appreciation as the equity on the house rises, but your fixed-rate mortgage payments remain the same.

The average homebuyer’s mortgage payments do not change over time. Inflation spikes mean that the value of money paid back in the future is worth less. When you have a fixed-rate loan, you pay the same amount each period throughout the life of the loan, regardless of inflation. As equity grows, fixed-rate payments stay the same.

Whenever we go through periods of inflation, the fixed interest rate you took out when you bought your house costs you less than when you took out the loan since the dollar has lost some of its value. You’re essentially paying the lender back money that has a lower value.

There’s also a correlation between wage and revenue increases and periods of high inflation. If you’re making more money, but your monthly payments for your financing stay the same, the payments take up a smaller percentage of your working capital.

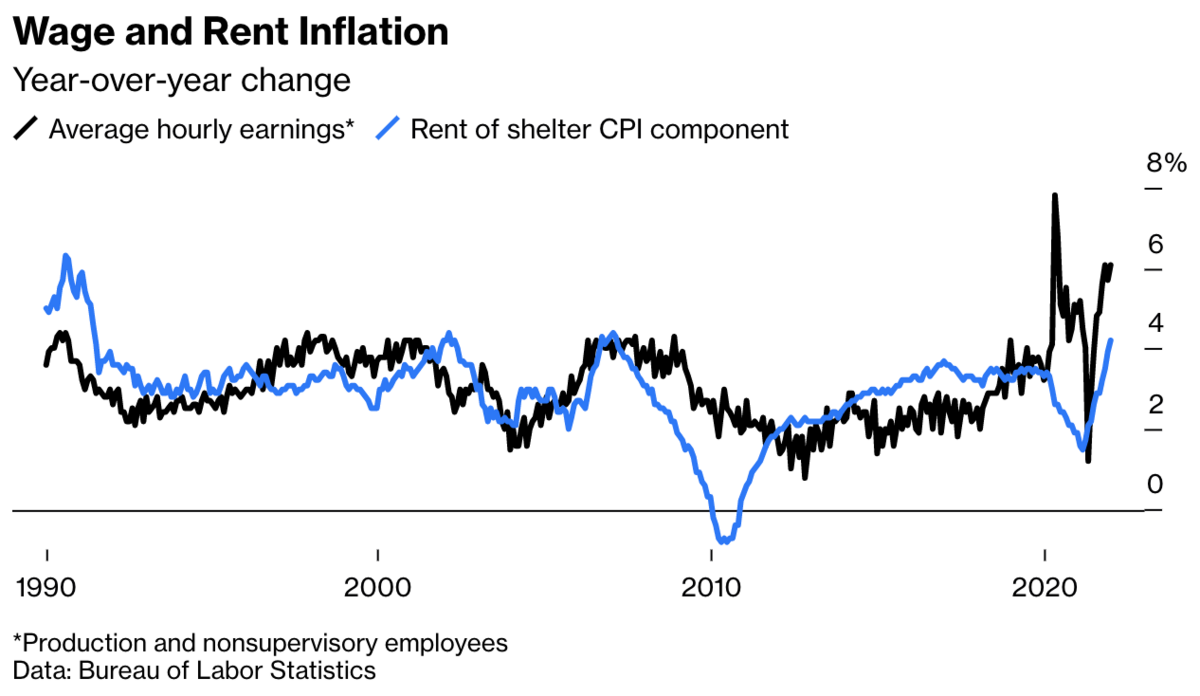

Benefit #3 (For Investors): Inflation Impacts Rental Rates

Inflation benefits real estate investors who are earning money from rental properties. With higher home values come higher rental rates.

Inflation benefits real estate investors who are earning money from rental properties. With higher home values come higher rental rates.

Those who invest in rental properties can see increased revenue from higher leases. We constantly see investors inquiring about multi-family properties or rental-type houses with this in their minds. We expect 2022 to bring more of the same.

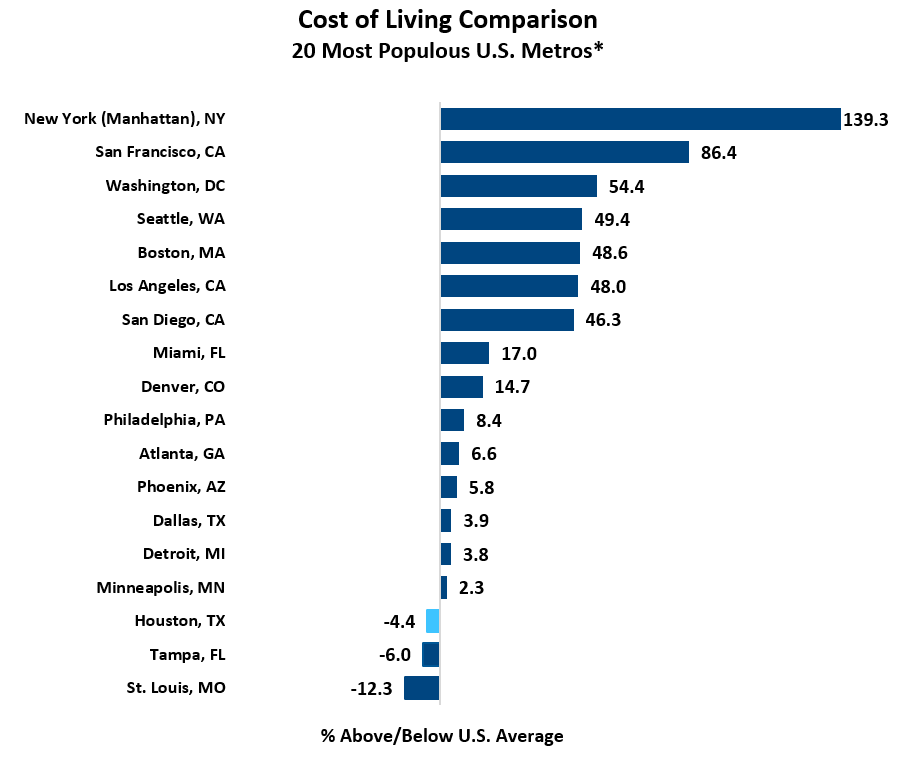

The other by-product of any type of economic imbalance like inflation is that people flock to cities with a lower cost of living. Houston has the third-lowest living costs among the most populous US metro areas. Living costs in Bayou City are 4.4% below the nationwide average and 26% below the nation’s most populous metropolitan areas.

US Postal Service change-of-address records suggest that people have been fleeing cities with high costs of living for relatively more affordable ones over the past two years, which helps explain why the latter has already seen rents surge.

Why Houston Real Estate Should Outperform Inflation

Houston has the third-lowest living costs among the most populous US metro areas. Texas has the 8th lowest tax rate in the US.

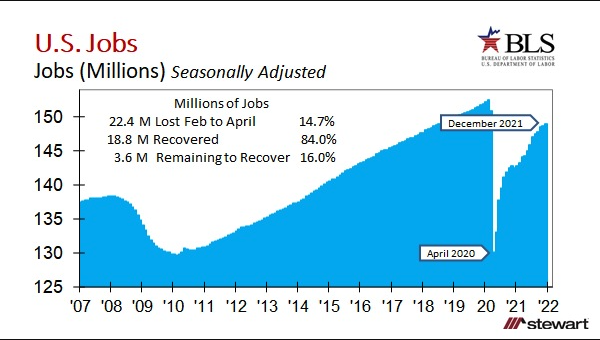

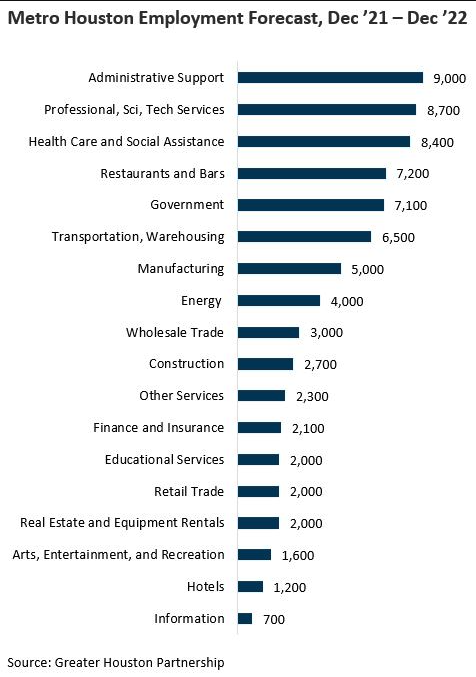

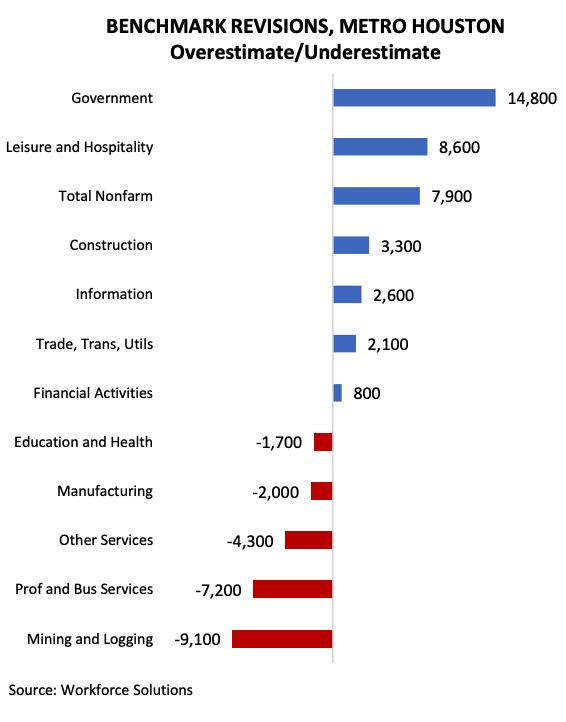

Houston Employment Outlook

Houston has recouped over 75% of the jobs lost during the early stages of the pandemic. Nine sectors have fully recovered their losses.

The latest economic forecasts predict that Houston will create nearly 80,000 jobs in 2022. We can expect the biggest gains in administrative support, government, healthcare, and social assistance, professional, scientific, and technical services, and restaurants and bars.

Houston Cost Of Living

Accounting for migration trends, Houston is still one of the top destinations for relocation. We can attribute this to the fact that Texas has no state income tax. Employment is also a main driver. Moreover, Houston is less dependent on the oil and gas industry.

Here are some advantages to Houston living, in numbers:

- Texas has the 8th lowest tax rate in the US

- Houston is #3 in areas with the lowest living costs

- 1 in 3 manufacturers in Texas is located in Houston

- We're ranked as the #1 seaport in North America

- Houston is home to over 500 tech companies

- Our city has the largest medical facility, with over 360,000 healthcare professionals

- Houston has the 4th highest # of Fortune 500 companies

- 35% of publicly traded oil and gas companies are located in Houston

Houston also has the third-lowest living costs among the most populous US metro areas. Houston's living costs are 4.4% below the nationwide average and 26% below the average of the nation's most populous metropolitan areas.

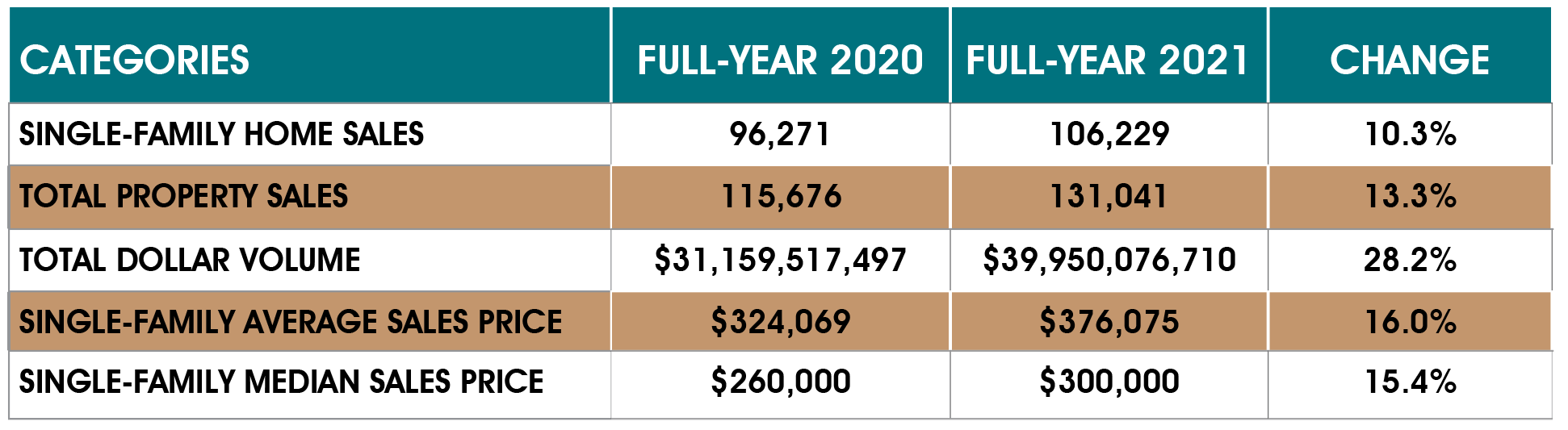

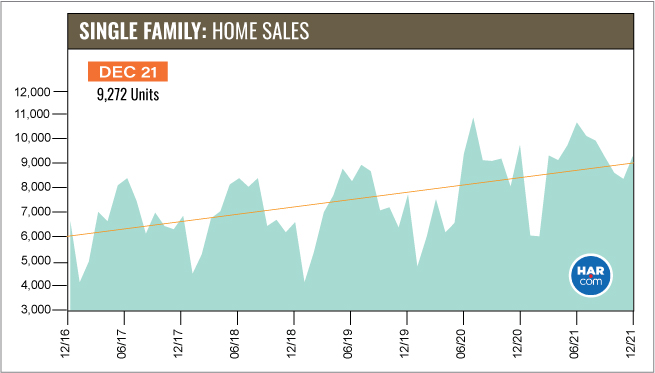

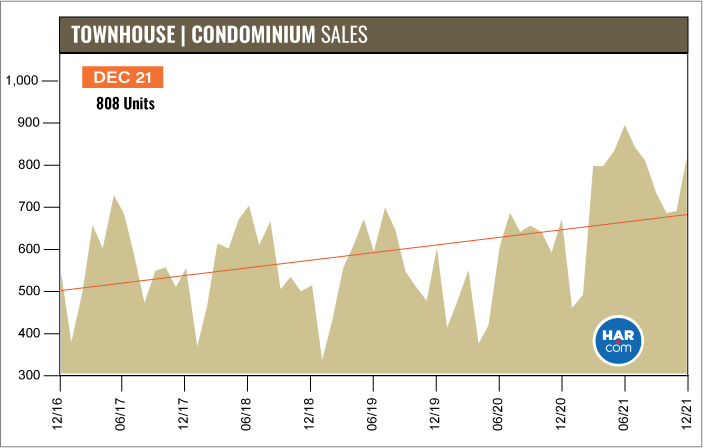

Recent Real Estate Growth

2021 is one of Houston's best years in terms of real estate growth. On a year-to-date basis, Houston home sales are 13% ahead of 2020's record pace. Total dollar volume is also up 28% to a record-breaking $40 billion.

To summarize, we see:

- 10.3% increase in single-family home sales

- 13% jump on all property types

- $500k-$999k homes are up the most at 41% in terms of sales volume

- Median price increased by 17.2%

- 1.4 months of supply

- BUT December was down 4.5%

Inflation's Impact On Houston Real Estate

| Neighborhood | Median Home Price | Home Price / Sq Ft | 10-Yr Apprec. % |

|---|---|---|---|

| River Oaks Area | $2,950,000 | $583 | 34% |

| Piney Point | $3,250,000 | $613 | 31% |

| Hunters Creek | $3,375,000 | $567 | 71% |

| The Woodlands: Carlton Woods | $0 | $0 | |

| Crestwood | $2,662,500 | $515 | 69% |

| Memorial Close In | $2,349,000 | $410 | -4% |

| Southside Place | $2,239,590 | $432 | 49% |

| Bunker Hill | $2,638,650 | $536 | 65% |

| Memorial Villages | $2,492,000 | $498 | 78% |

| Tanglewood Area | $1,750,000 | $366 | 5% |

| Hedwig Village | $3,680,000 | $593 | 105% |

| Memorial Park | $1,338,500 | $381 | 17% |

| West University/Southside Area | $1,837,500 | $514 | 46% |

| Southampton | $1,610,000 | $537 | 21% |

| Boulevard Oaks | $1,485,000 | $474 | 48% |

| Highland Village / Midlane | $1,225,000 | $414 | 64% |

| Rice / Museum District | $1,151,000 | $402 | 35% |

| The Woodlands: East Shore | $1,069,000 | $410 | 43% |

| Braeswood Place | $1,449,768 | $355 | 75% |

| Bellaire Area | $1,255,000 | $329 | 26% |

| Briargrove | $1,300,500 | $452 | 55% |

| River Oaks Shopping Area | $890,000 | $288 | 34% |

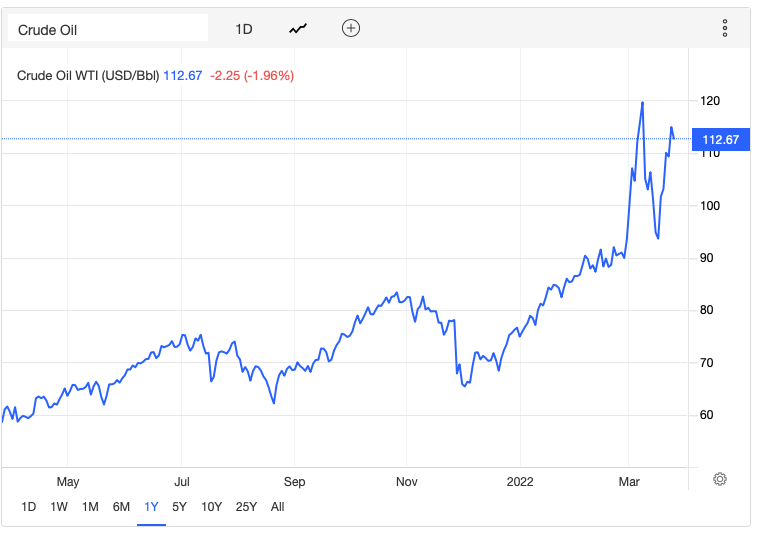

Impact Of The Russia-Ukraine Conflict

For Houston, the impact of the Russia-Ukraine conflict has mostly been about rising commodity prices.

About one-third of the Houston economy still is tied to oil and gas.

As you can see from the price of crude oil (WTI) in the graph above, the Russian-Ukraine conflict has had a big impact on oil and gas prices.

First, it increased prices by about 20-30%. Second, it dramatically increased the volatility of the price swings.

For oil and gas producers and their service companies, the increase in commodity prices boosts their cash flow and earnings.

We saw prices in this range last in 2014, before the oil and gas crash.

The additional profits from higher oil prices (and the correlated increase in energy company stock prices) helped create record Houston real estate prices in 2012, 2013, and 2014.

How About Houston Oil/Energy? Can We Expect A Boom?

The US has implemented a ban on the import of crude and refined products from Russia. In Houston, the embargo will directly affect two refineries that import crude from Russia: ExxonMobil and Valero. The indirect impact will be higher gas prices for all Houstonians.

We initially saw a hike in the oil price (as much as 25% per barrel). However, prices have since started slipping but remain well above where they stood before the conflict.

This won't likely lead to an immediate boom. Over the years, local oil companies have developed ways to be more efficient. Today, oil production doesn't need as many employees as it once did in the past.

The oil price surge will lead to profits in the short term, but the conflict and ongoing embargo will impact major oil producers for years.

What helps paint a rosier picture though is the "better than projected" employment numbers for the first quarter of 2022. New data place the job recovery (post-pandemic) at 95.8% as of December 2021.

Data Sources and Disclaimers

Houston real estate is hyper-local. For homebuying or selling advice, contact Paige Martin, the #1 Keller Williams Realtor in Houston and #1 Realtor in the state of Texas.

- Calculator.net

- Federal Reserve

- HAR Newsroom

- Intuit MintLife Blog

- Lyn Alden

- Macrotrends

- Vertex42

- US Bureau Of Labor Statistics

All Houston home value information was sourced from the HAR MLS database.

Paige Martin and The Houston Properties Team

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role—which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked amongst the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Her recent awards include:

– 2021 Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtor in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtor in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent expert in your area

- competitive advantage by simply having more resources, ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.

Best Houston Real Estate Resources

- Houston Texas Zip Code Map | HoustonProperties

- The Ultimate Houston Neighborhood Guide

- Houston Home Sellers Guide | Essential Tips To Sell Your Home Fast For The Most Money

- Tremont Tower Condo Houston | 3311 Yupon Street

- Houston 77023 With Garage Apartment Homes For Sale

Paige Martin, Broker Associate, Real Broker, LLC

5718 Westheimer, Ste 1000, Houston, TX 77057

Texas Real Estate Commission Consumer Protection Notice

Texas Real Estate Commission Information About Brokerage Services

[email protected] © 2002 – 2026

Houston Properties Team

Discover Houston's Top Areas - Get Your FREE Guide Now!

Your FREE Houston Guide

Unlock Houston's top neighborhoods with our in-depth guide.

- Key insights into local markets

- Find communities that suit you

- Updated market trends & data

Join 1,000+ others who've unlocked Houston's property secrets