Get an Offer on Your Home With a Press of a Button? Real or Too Good To Be True?

Instant Buyer (Opendoor, Zillow Instant Offers, Perch, Knock) Reviews & What To Know In Advance

You may have been driving around and noticed signs (maybe stapled to telephone poles) promising to “buy houses fast!” or “pay cash for houses” or “buy your ugly home.”

Obviously, some of these signs are a bit sketchy, but they speak to a large and legitimate need – some people want or need to sell their homes fast, and may be willing to offer financial discounts to do so.

Enter the rise of the Instant Buyer (iBuyer) and lots of money from New York hedge funds and foreign investors.

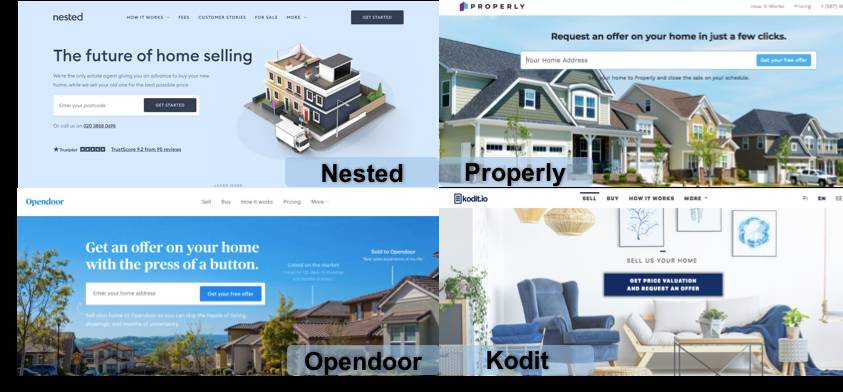

You may have seen the TV or Facebook ads, “Get an offer on your home in 24 hours. Guaranteed.” or “Sell your home now. Fast closing for cash.”

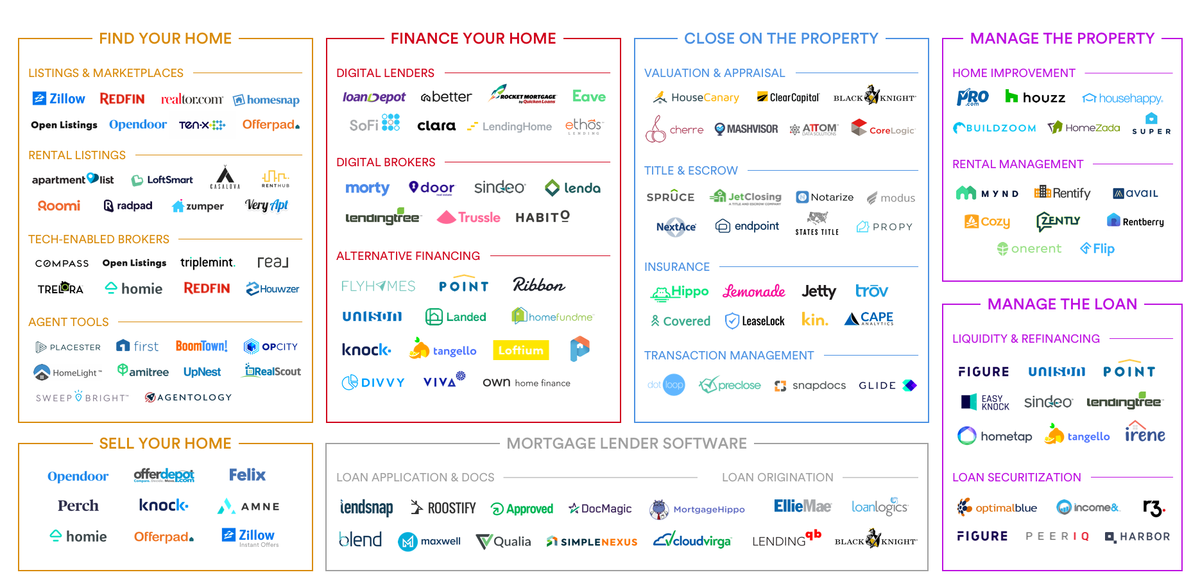

Some of the most prolific advertisers include OpenDoor, Zillow Instants Offers, Keller Offers, RedFin Now, OfferPad, Knock, and Perch. There are over 100 big players in total.

Have you wondered if these are legitimate or too good to be true?

We’ve created this Houston iBuyer Review Guide to help you.

The Houston Properties Team partners with over 100 pre-approved iBuyers (instant home buyers) to connect you with competitive cash offers in their market. Just fill out some information about your home and location and we’ll present you with the best price ranges available from a Simple Sale buyer.

“Paige demonstrated all qualities you want in a realtor – knowledgeable, attentive, responsive, patient. She put us into our first dream home, and due to that experience, we’ve returned to her time and again for our other real estate needs. You will quickly realize after working with Paige that while she focuses on completing your deal, her endgame is to ensure her clients’ needs are preserved and satisfied.” -Peter McGillivray & Jillian Jopling

Table of Contents

- What Are iBuyers And What Do They Look For?

- Is The iBuying Process Complicated?

- What Kind Of Clients & Situations Work Best With iBuyers?

- If I'm A Seller, Which Ones Should I Talk To & Which Are Scams?

- How Do I Enter My Home's Information To Get The Best Initial Price?

- How Do I Read The iBuyer Fee Structure?

- How Do I Negotiate With iBuyers Upfront?

- Common Reviews: "Bait & Switch." How Do I Handle This?

- Common Reviews: "Exaggerated & Overpriced Repairs." How Do I Handle This?

- Let The Houston Properties Team Manage The Process For You

- The Best Houston Realtor to Sell Your Home

What Are iBuyers And What Do They Look For?

“Paige and The Houston Properties Team is simply amazing! Paige is a customer service driven agent that doesn’t let any small details slip past her. She is meticulous with her offers, inspections, and knows how to effectively negotiate the right price for her buyers and sellers” – William Swallen

If you type “iBuyers” in Google, you’ll get about 150,000 results. Searching for “iBuyers reviews” yields about 45,000 results.

There’s a lot of fear and uncertainty circulating the industry. It’s partly the reason why almost a third of “iBuyer-related” searches are reviews about the product.

iBuyers theoretically make cash offers on your home within a few days.

This is attractive for sellers looking to make a fast close and avoid stagings, showings, and more. However, it comes with a handful of tradeoffs.

If it sounds great in theory, why is there a lot of confusion about iBuying? Primarily because:

• There are over 100 companies fighting over the iBuying space.

• Majority of iBuyers are backed by hedge funds and virtual capitalists who don’t have a lot of background in real estate, as a company (Opendoor, for instance, has recently raised $2B from investors, mostly New York hedge funds and foreign companies).

• Decision-makers behind the industry are driven by its revenue per transaction potential. iBuyers can make over $30k per sale from homeowners looking for an easy sell, a lot higher than what traditional agents earn.

• The business model thrives on “fast transactions”. To generate profit, iBuyers need to purchase homes at a discount and relist them at a higher price. Volume is key, so iBuyers need to move quickly, buying and selling homes in as little time as possible.

• Shortcuts are sometimes taken to facilitate faster transactions. Most iBuyers will bypass house inspections, valuing your home using a proprietary valuation model.

• Most of the process is automated. According to Offerpad, only 10% of home valuations are actually done by people while the rest are handled by machines.

• There is no single person that represents the seller. All decisions are made by the homeowner alone.

Is The iBuying Process Complicated?

“Please look into Opendoor before you consider their offers. Their initial offer is deceptive and their exclusive contract charges excessive fees back to the seller. Read the reviews online and do some research, they are misleading and taking advantage of people’s ignorance of real estate.” – Bryan Carlson, Facebook

To get started, a seller needs to fill up an online form with around 10 to 15 questions – for EACH iBuyer platform.

The form collects details about the size of your space, number of bedrooms and bathrooms, any major improvements, special features, and mechanical and structural issues.

Some platforms require photos, others will crunch figures solely based on what the seller is able to manually input.

The iBuyers then calculate your home features alongside comparable properties, tax rates, and other factors. These are crucial details crunched by computers to calculate your offer, all without having seen your house or its upgrades.

Within minutes or a few days, you get an instant offer via email. Should you accept, some iBuyers will send an agent to conduct inspections on your home, suggesting repairs that will further eat away at your initial offer.

If a seller wishes to compare offers from other iBuyers, he must go through the same process with more than a hundred other iBuyer platforms.

iBuyers differ in packages and not all of them will buy your home. While some zone in on purchasing tear-downs, others select homes in good condition. Some will issue decent offers, while others are infamous for lowballing.

The end result is often disappointment: offers that are ridiculously below market value. Opendoor reviews and Zillow Instant Offer reviews are rife with disgruntled clients who feel like they were low-balled by iBuyers who missed crucial details about their properties.

Other common complaints include:

• Bait and switch methods

• Hidden charges

• Poor customer service

• Companies taking advantage of sellers who know very little about selling their homes.

What Kind Of Clients & Situations Work Best With iBuyers?

“Every repair they identified was exaggerated and overpriced. The repairs we made on our own were typically 1/3 of what they said it would cost. We were asked to hold money in escrow in case of damage during a pier repair. They would not respond to emails or requests for the money, then miraculously produced an invoice in exactly the amount held in escrow. DO NOT DO BUSINESS WITH THIS COMPANY!!!” – Anonymous, Reviews.io

Since the business model relies on volume, iBuyers typically turn away from homes that need a lot of work. Their systems are set up to focus on properties that can sell fast on the open market anyway (i.e. sellers with good homes that need money fast).

Most iBuyers have very specific criteria that help weed out bad investments. These requirements vary from iBuyer to iBuyer, but here are a few criteria the typical iBuyer system will use to classify “not so good deals”:

• Your home is too old or dated

• Your home is too unique (“strange” homes, including those that are too artsy or rural, are difficult to appraise from the computer)

• Your home is either too cheap or expensive

• You live in a condo (a majority of iBuyers do not purchase condos)

• You live in a gated community, master-planned community, or an exclusive subdivision (it is hard to factor in “security” when the appraisal system is focused on the property)

iBuyers are attractive to customers who value the certainty of a sell over offer price. A lot of sellers who use iBuyers are:

• NOT ACQUAINTED WITH REAL ESTATE: Some iBuyers do not require selling agents to represent sellers, leaving them vulnerable and lacking leverage. Without the guidance of an agent, sellers perform poorly in negotiations, taking whatever is on the table.

• HAVE A SENSITIVE TIMELINE: For some sellers, a solid closing date is much more important than how much they get in return. Selling to Redfin Now, Opendoor, or one of about 40 iBuyers may allow the seller to pick a specific closing date (assuming there are no hiccups during the closing process).

• VALUING CERTAINTY OVER OFFER PRICE: iBuyers target sellers who want to avoid buyer contingencies or financing falling through.

• WANTING TO SKIP THE LEGWORK: Selling to an iBuyer allows you to bypass staging, repairs, and marketing.

It is highly recommended for sellers to seek representation when coordinating with an iBuyer. iBuyers are not realtors, hence, they are not bound by the fiduciary duty to get you the most money for your home.

If I'm A Seller, Which Ones Should I Talk To & Which Are Scams?

“This is a business with a strategy to send mass low ball offers hoping to find that desperate person. If you are not a desperate person, hire a realtor and sell your home for 35-60% more than their joke offer.” – John, Reviews.io

We’ve handpicked reviews to highlight common issues customers experience with iBuyers to help you make an informed judgment.

A forewarning: Yelp was accused of hiding reviews for Opendoor and OfferPad, making it difficult for sellers to compare iBuying programs with traditional brokerages.

However, we’ve done our best to scour the web for iBuyer reviews, and we’ve collected quite a handful.

There are over 100 different iBuyers which have raised upwards of $10 billion in investment (mostly from hedge funds and international investors). The following firms have raised the most money so far:

• Opendoor

• OfferPad

• Knock

• Redfin Now

• Zillow Instant Offers

• Keller Offers

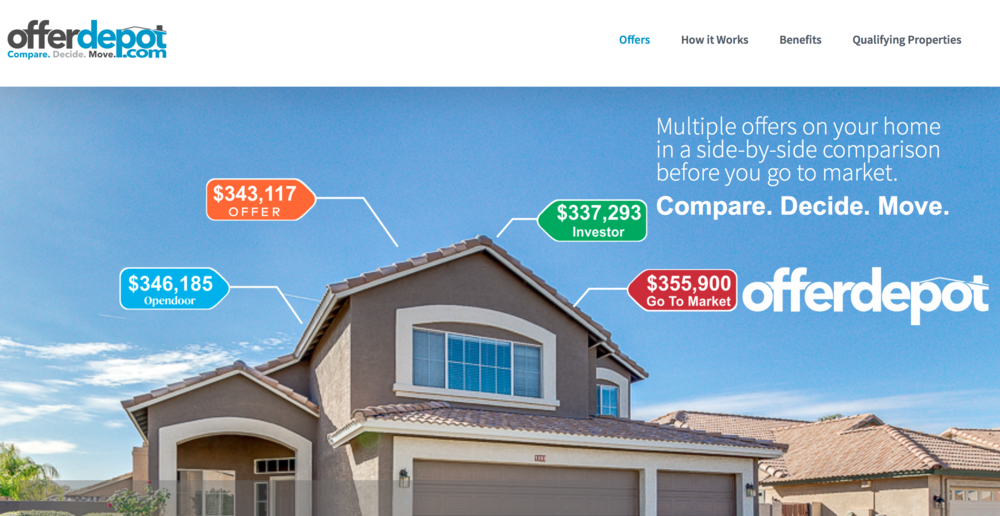

• Offer Depot

• Perch

• Knock

• Anme

• Homie

• Felix

• Coldwell Banker Offers

In Addition To These Firms Above, Other Spin-offs, Joint Ventures, Investment Groups, And Family Offices Have Started Companies Like The Following:

• Kensaq

• Smarter

• Pronto

• Houston Home Buyer

• Houston iBuyer

• Houston Buy Homes For Cash

• Texas Home Buyers

• Gulf Coast Home Buyers

Many of these firms specialize in different types of homes, ages of homes, and/or neighborhoods. Also, if you google things like “Offerpad reviews” or “Opendoor reviews” you’ll find that feedback is usually fairly similar.

How Do I Enter My Home's Information To Get The Best Initial Price?

“Offerpad backed out of the deal “due to market conditions” after taking a full 10 business days after the home inspection where nothing was noted wrong with house. Beware! They will offer you a market rate, but will just waste your time. Oh, then call you back and offer $20K less to add to the experience! Not worth your time.” – Ron Faulkner, Google Reviews

You’ll be asked to answer around 10-15 questions about but not limited to:

• Number of bedrooms and bathrooms

• Flooding history

• Major improvements

• Type of flooring and countertop material

• Special features such as garages, carports, pools, hot tubs, fences, or basement, among others

• Appliances that need repairs/replacements

• Structural or mechanical issues

Some iBuyers require you to take photos of your home to aid in valuation.

This is a good opportunity to showcase special features or details you feel they were unable to cover in their initial rundown of questions.

If you’re planning to do it yourself versus hiring a professional (like we do), here are some tips:

iBuyers determine offer price based on a variety of factors, including but not limited to:

• The time you want to sell

• The sale price of similar homes

• The condition of your home

• These factors are crunched by computers using proprietary home valuation and predictive market analysis technologies to give you an offer in a few minutes to a few days.

We have found a few anomalies in the market that sellers can take advantage of currently:

• 90% of the valuation work is done by an algorithm

• Most firms let you submit photos and details about your home

• The typical home seller only enters less than 20 pieces of data

• iBuyers have different technology and processes to value homes

There’s one important skill to get the most out of iBuying: You Need To Fill Up Forms Diligently.

You need to have all of the details, upgrades, and issues you’ve had on your home by memory, or have all the documentation that supports this on hand to avoid mistakes.

To get an offer, iBuyers need comprehensive information about your home. Before filling up valuation forms, it pays to know the nitty-gritty of your property so you can accurately describe its features.

• Good camera and lighting are essential. Snap photos in the afternoon with curtains drawn for natural lighting.

• Organize and de-clutter

• Focus on capturing special features, updates, and remodeling including pools, garages, carports, recreational rooms, basement, appliances, countertops, and flooring with high-end material, detailed moldings, etc.

To get the best initial price, it is best to compare offers with other iBuyers.

Note that some iBuyers are more partial to your type of home than others (e.g. while some specialize in condos, others focus on single-family homes).

As Realtors, we list and market homes every day. We know what buyers are looking for and how to highlight your property in the most favorable light. Our photography, attention to detail, and descriptions allow us to secure competitive offers.

Submit your home to the Guaranteed Purchase Partners that have shown the highest willingness to pay for properties like yours. To easily compare offers vs. a traditional listing, click here.

How Do I Read The iBuyer Fee Structure?

“Enormously unprofessional and quite simply dishonest. I was given an offer on my property subject to procuring a building permit for past work. After spending $2,300 for architectural drawings and a permit, they decided to not complete the transaction. they also never provided a copy of their inspection report or that they deposited earnest money. I did everything they asked of me, and they reneged. Complete dishonesty and did not live up to their agreement.” – Mark Nicotera, Google Reviews

It depends on the iBuyer platform. However, here’s an interesting case that we encountered while doing the research for this guide:

An Atlanta agent requested offers for his newly renovated home with Knock, Opendoor, and Offerpad to compare offer prices. His property was appraised at $495,000 but offers ranged from $265,000 on the low end to $373,000 on the high end.

This is just the initial offer he received, but since he has limited options, he’s starting the negotiation in a position of weakness. To get the best price from iBuyers, you need to get more offers. The only way to get more offers is to try as many iBuyer platforms as possible.

Once you agree on an offer, a number of deductibles come into play. iBuyers charge sellers transaction fees are as high as 7% to 13%. This fee depends on a number of factors, including but not limited to how long it takes to sell your home the risk of your home’s resale, and holding costs.

Other fees involved include repairs, title insurance, escrow fees, HOA transfer fees, taxes, document transfers, and other customary fees.

It is highly advised for sellers to compare offers from other iBuyers if she intends to get the best ROI.

How Do I Negotiate With iBuyers Upfront?

“I’ll be blunt. Zillow doesn’t care about home buyers’ and sellers’ best interests like agents do because they are not fiduciaries. They simply want to capitalize on consumer desire for instant gratification in buying or selling their largest, most valuable asset. They care far more about their stock price than you getting a fair deal. Don’t fall for it.” – Miguel Duque, Facebook.com

Some sellers allow you to negotiate their initial offer, while others have more of a “take it or leave it” approach. Typically, iBuyers issue offers 2-3% lower than what you would get if you sold traditionally with an agent.

In Opendoor reviews, Redfin Now Reviews, and Offerpad reviews, you’ll come across instances where sellers are offered a price that’s way lower than this standard. To get a better offer on your home, you must:

• Fill up your valuation forms diligently. Failing to detail critical house upgrades and improvements can significantly lower your initial offer.

• Submit to iBuyers who have the highest willingness to purchase your home. There are more than 100 iBuyers to choose from. We can direct you to Guaranteed Purchasing Partners who can give you the highest offers. Compare offers vs. a traditional listing right here.

• Seek the help of an expert realtor. Some iBuyers allow renegotiations when the seller feels their property has been valued wrongly. We can help you coordinate with the iBuyer and make sure that offers factor in all house upgrades and improvements.

Common Reviews: "Bait & Switch." How Do I Handle This?

“If a home does not need a lot of work and is “near market-ready,” those are the homes that sell the fastest and for top dollar! Also, with ‘every sale’ you have the ability to control and negotiate the timing and closing dates. Once again, this business model from Zillow Offers to Offerpad and the like is built on the premise that you ‘can’t sell quickly in the traditional market and that you ‘might consider taking less on your home’ not to show it or deal with the ‘trouble’ of being inconvenienced. For me, to be able to walk away with an additional 10%-15% on my home personally at closing, ‘trouble me all you like!’” – Hank Bailey, Good News For Sellers: Zillow Is Buying Homes. Is it good news though?

Opendoor reviews, Offerpad reviews, and Redfin Now reviews are rife with customers who claim to have fallen for their “bait and switch” methods.

After being issued your initial offer, the company subtracts a number of deductibles from this starting amount, including repairs, title insurance, escrow fees, HOA transfer fees, taxes, document transfers, and other customary fees.

The resulting amount, according to iBuyer reviews, is often disappointing. Here’s how to deal:

Assume a Competitive Stance

An iBuyer that knows he’s being shopped or traded for an open market is more likely to offer you solid prices for your property.

Hire a Realtor for Leverage

A lot of Opendoor reviews complain about unnecessary and overpriced repairs that eat away from their initial offer. Seeking the help of a realtor to coordinate with an iBuyer at this point grants him leverage and security.

Collect Multiple Offers

There are more than 100 iBuyers and not all of them employ bait and switch tactics. As experts in real estate, we can help you select the legitimate ones with the highest willingness to pay for your property. Compare cash offers vs. traditional listings here.

Common Reviews: "Exaggerated & Overpriced Repairs." How Do I Handle This?

“Terrible service. They are NOT able to communicate with potential buyers and sellers are losing customers because of it. There is not customer service phone number for realtors to use to represent their clients. Homie does not have the seller’s best interest in mind. Our realtor tried sending an addendum to the sellers after the inspection, to renegotiate, based on the problems. 2 days later . . . homie had NOT given that addendum to the sellers. This company is TERRIBLE for buying or selling a home.” -Sarah D., Yelp

Complaints about overpriced and unnecessary repairs are all too common in Opendoor Reviews, Offerpad reviews, and RedFin Now reviews.

All of these repairs are deducted from the seller’s initial offer if the seller doesn’t volunteer to do them herself.

Sellers who are not certain if they’re being issued fair repair requests will benefit from an expert realtor who can ascertain that repairs suggested are well-grounded and fairly priced.

We can guide you through the entire iBuying process while showing you all of the offers available in the market vs. a traditional listing.

Let The Houston Properties Team Manage The Process For You

“Very difficult to work with if you are a buyer and not utilizing Homie yourself. Does not communicate with our agent, very difficult to get ahold of anyone to schedule showings, poor communication overall. They do not have the sellers best interest at heart and do not get to know their clients, you are just another number to them. They promote saving you money, but ask yourself the question, is something as big as buying or selling your home really something you want to bargain on? From what I can tell you get what you pay for, and the discount is far from worth the lack of service. We have now walked away from two homes represented by Homie despite loving the home, being pre-qualified, and offering a quick close, all because they were too difficult to work with. Get an agent that gets to know you and your needs, looks out for your best interests, and works hard to sell your home.” -Ronald L., Yelp

“When iBuyers compete, you win.” We can help get you 4-5 offers so you can select the best one. If you don’t like any of the offers, we can still help you list in the open market.

As Realtors, our job (and our fiduciary duty) is to help you get the most money for your home. We Can Assist You In The iBuying Process In Three Ways:

Finding the Right Buyer for Your Home

Currently, we are aware of over 27 different iBuyer platforms (firms like OpenDoor and Zillow are investing the most in marketing, but many others are similar). Some specialize in condos, others in single-family homes. Some want to buy properties in the Inner Loop, while others look for properties in the suburbs.

We can submit your home to the Guaranteed Purchase Partners that have shown the highest willingness to pay for properties like yours.

Optimizing Your Submission

Valuation forms are around 10-15 questions long, with some iBuyers requiring you to snap photos of your property. To get the best offers, it pays to be precise with descriptions, taking into account house features that are likely to bump up the offer price.

Our flair for photography, attention to detail, and mastery of real estate language will allow us to present your home in the best possible light.

Providing Leverage

The largest complaints against iBuyers come after sellers are under contract with them “close to closing”. This is when iBuyers try and re-negotiate the price based on repairs and other closing costs. When we submit your information, these iBuyers will know that you have other options and their “take it or leave it” style won’t be effective.

The Best Houston Realtor to Sell Your Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Recent awards include:

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtors in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtors in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, and civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find the team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent expert in your area

- competitive advantage by simply having more resources, more ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.